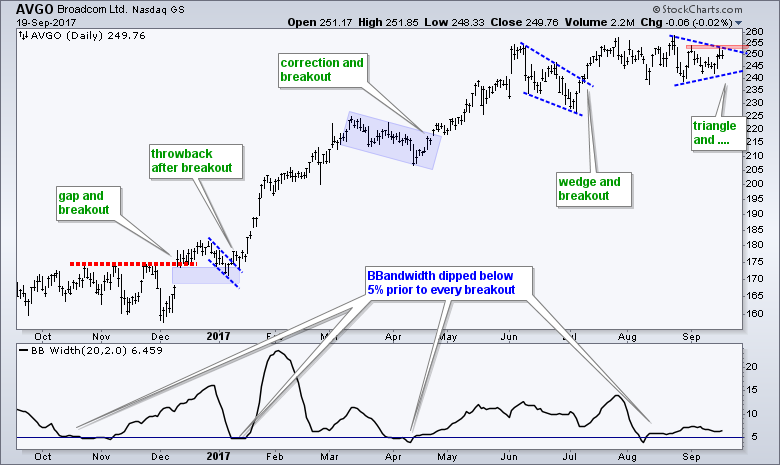

This is my third straight DITC posting with a semiconductor stock. The first featured Texas Instruments forming a cup-with-handle pattern and the second featured Intel with a surge towards long-term resistance. Today's chart focuses on Broadcom, which is actually lagging the S&P 500 SPDR over the last few weeks. Note that SPY hit a new high this week and AVGO remains within a consolidation. The long-term trend is clearly up and a consolidation within an uptrend is typically a bullish continuation pattern. This means an upside breakout at 255 would signal a continuation of the bigger uptrend and open the door to new highs.

Follow me on Twitter @arthurhill - Keep up with my 140 character commentaries.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************