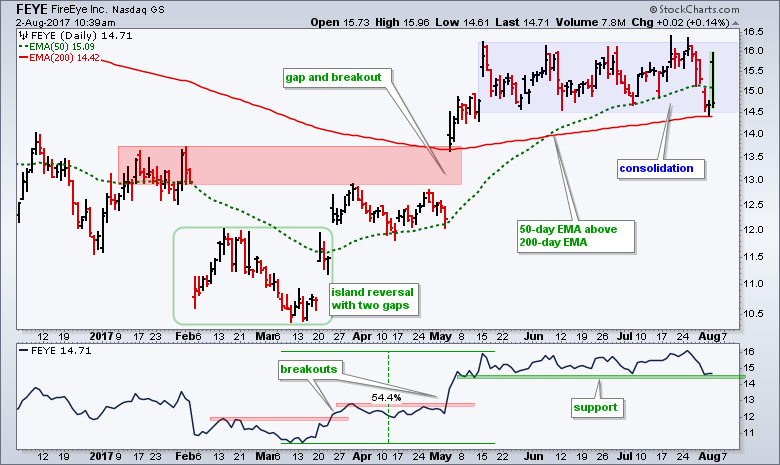

FireEye reported earnings on Tuesday and surged on Wednesday morning with a strong open. The stock is trading well below the open now, but I wanted to highlight the bigger patterns at work. First, the long-term trend is up because the stock is above the 200-day EMA and the 50-day EMA is above the 200-day EMA. The stock forged an island reversal with two gaps in March and broke a big resistance zone with another gap in May. After a 50+ percent advance from mid March to mid May, the stock moved into a trading range from mid May to now.

FireEye was clearly extended after the 50+ percent advance and entitled to a rest. The trading range is basically a consolidation, or rest, within an uptrend. Notice that the stock bounced off the 14.5 area in May, June and July to confirm support here. The indicator window shows a close-only chart to filter out the gaps and intraday price movements.

****************************************

Thanks for tuning in and have a great day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

****************************************