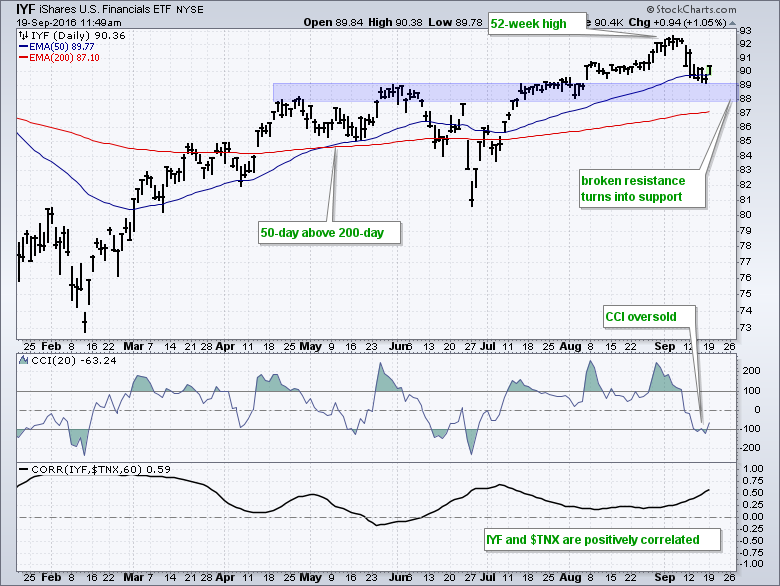

Chartists looking to track the finance sector can turn to the iShares Financials ETF (IYF). Note that the Finance SPDR (XLF) is in the midst of a metamorphosis this week so chartists can consider watching IYF for clues on the finance sector this week. IYF is in a long-term uptrend because the 50-day EMA is above the 200-day EMA and the ETF hit a new high in early September. Since hitting this new high, the ETF pulled back to broken resistance and this area turns into the first support level to watch for a bounce. Also notice that the 20-day Commodity Channel Index (CCI) became oversold last week and is starting to turn up. The Fed meets this week and Treasury yields will be in the spotlight when the FOMC makes its policy statement on Wednesday afternoon. Note that banking stocks and Treasury yields are positively correlated, which means banking stocks tend to rise and Treasury yields rise.

****************************************

Thanks for tuning in and have a great day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************