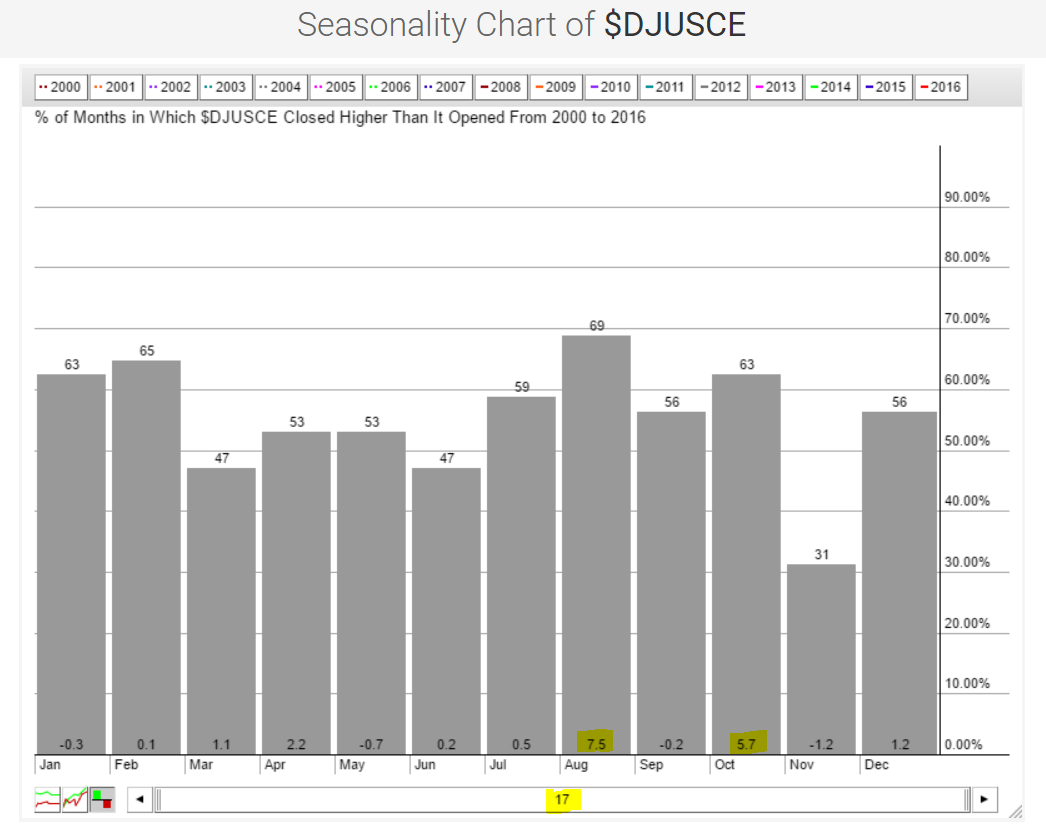

The summer months can be very difficult for U.S. equities, as history has proven over time. But there's always a bull market somewhere and the consumer electronics space seems to find a sweet spot in August. There are only two industry groups that average more than 5% monthly gains during August. One is the Dow Jones U.S. Consumer Electronics Index (+7.5% over the past 17 years) and the other is the Dow Jones U.S. Gold Mining Index (+6.3% over the past 17 years). However, seasonality patterns over the subsequent two months clearly favor the DJUSCE as September is typically flat while October is easily the second best calendar month of the year for the group. Take a look at the historical performance this century:

Those returns are significant and have occurred over many years so they're difficult to ignore. One of the primary players in this space is Harman Intl (HAR), which currently sports a positive divergence on its weekly chart and could be primed to continue this seasonal pattern in 2016.

Those returns are significant and have occurred over many years so they're difficult to ignore. One of the primary players in this space is Harman Intl (HAR), which currently sports a positive divergence on its weekly chart and could be primed to continue this seasonal pattern in 2016.

Happy trading!

Tom