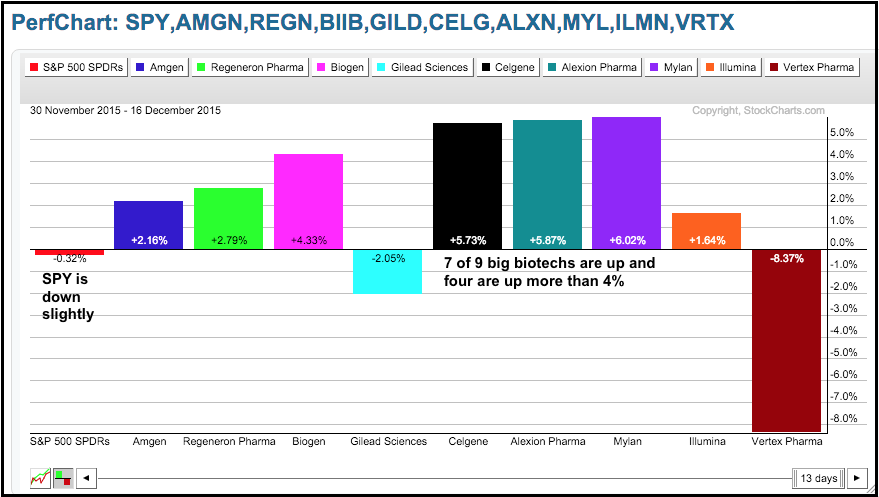

December got off to a rough start for the broader market, but several big biotechs bucked the selling pressure and moved higher. The Perfchart below shows December performance for SPY and the nine biggest biotechs in the Biotech iShares (IBB). SPY is down a fraction over this period and this reflects weakness in the broader market, especially large-caps. Among the biotech stocks, seven are up in December and only two are down. Vertex is down sharply with an 8+ percent decline and Gilead Sciences is down around 2%. Biogen (BIIB), Celgene (CELG), Alexion (ALXN) and Mylan (MYL) are the upside leaders with 4+ percent gains.

The next chart shows the Biotech iShares (IBB) holding support near the mid November low and bouncing with a gap on Tuesday. The ETF followed through on this gap with a 2.25% gain on Wednesday. I am impressed with IBB because it showed relative strength during the early December decline. The S&P 500 SPDR and many other ETFs broke their mid November lows, but IBB held above this level and did not break support. The price relative (IBB:SPY ratio) confirms recent relative strength because it has been rising since October 22nd.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************