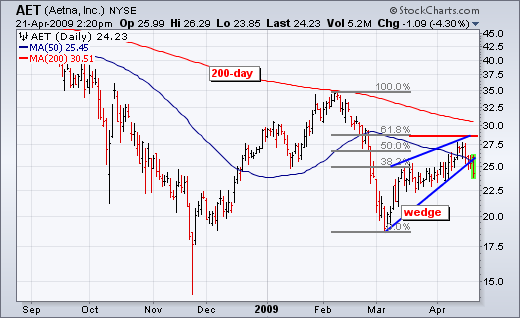

Aetna (AET) retraced 62% of the Feb-Mar decline with a rising wedge that peaked in mid April. Both the wedge and the retracement are typical for corrective rallies within bigger downtrends. Also notice that the 200-day moving average is falling and the 50-day moving average is below the 200-day moving average. Tuesday's trendline break looks quite ominous.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More