DecisionPoint June 27, 2022 at 07:35 PM

In this episode of DecisionPoint, Erin, flying solo for the week, jumps right into an overview of the market and DecisionPoint indicators, with coverage of the woes of Bitcoin and encouraging news for Crude Oil... Read More

DecisionPoint June 24, 2022 at 05:32 PM

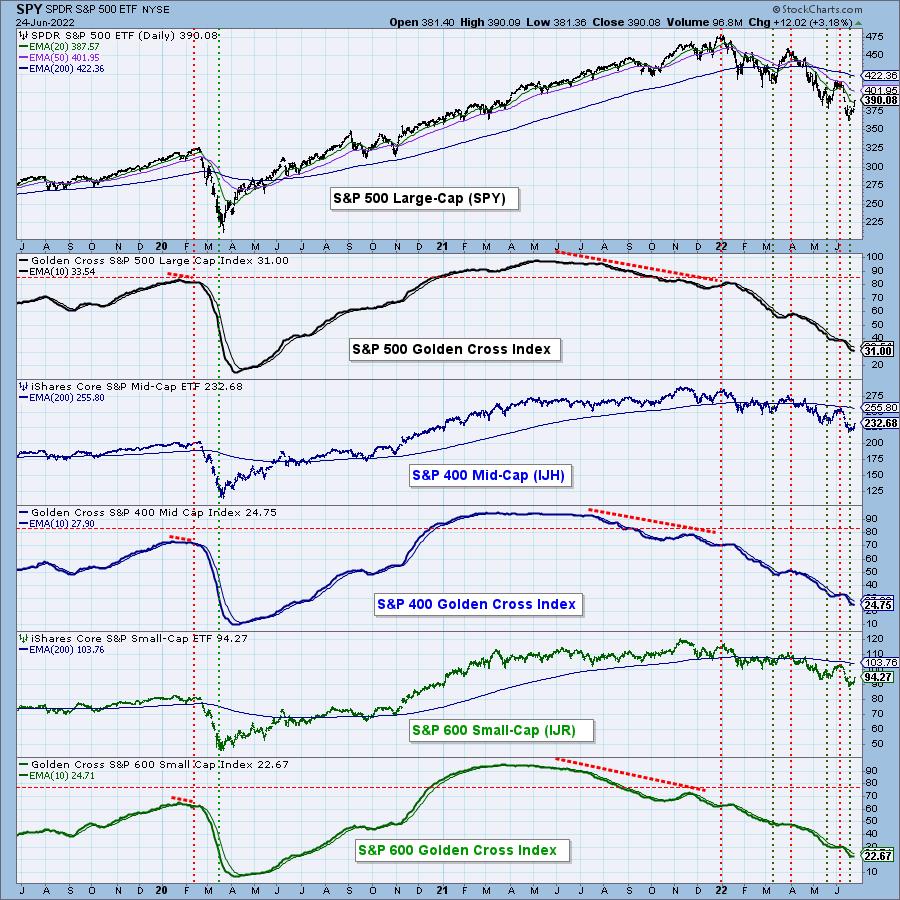

When the 50-EMA crosses up through the 200-EMA, it is commonly known as a Golden Cross, because it infers a positive long-term price trend. Our Golden Cross Index (GCI) shows the percentage of stocks in a given index with a golden cross condition... Read More

DecisionPoint June 17, 2022 at 07:30 PM

We know it is bad out there -- we don't have to tell you that. But the technicals are now proving to us how bad it really is... Read More

DecisionPoint June 16, 2022 at 07:32 PM

Yesterday I wrote an article about positive divergences on New Lows for the Nasdaq and NYSE... Read More

DecisionPoint June 15, 2022 at 08:15 PM

DecisionPoint has been on a roll -- or our indicators have been, anyway. Most notably, last Wednesday, we let DP Alert subscribers know that a downturn was likely. On Thursday the market fell out of bed... Read More

DecisionPoint June 14, 2022 at 02:51 PM

"The best laid schemes o' mice an' men. Gang aft a-gley". --Robert Burns Or as a Yiddish saying goes: "Man plans, God laughs." There is no better example of this than what has happened with natural gas this month... Read More

DecisionPoint June 13, 2022 at 09:08 PM

In this episode of DecisionPoint, Carl and Erin spend time discussing not only the current market chaos, but also looking at history as a guide. They give their perspectives on two prior bear markets and what it could mean for the markets now... Read More

DecisionPoint June 08, 2022 at 07:49 PM

It's been trending on social media that it is time for yields to top. One of the charts in the DPA ChartList (available to subscribers of DecisionPoint.com Blogs) is a long-term yield chart... Read More

DecisionPoint June 06, 2022 at 07:35 PM

In this episode of DecisionPoint, Carl and Erin discuss their short-term bullish expectations and whether they are still valid under current market conditions. Carl covers "breadth with depth" indicators for Nasdaq, NYSE and Mid- and Small-caps... Read More