DecisionPoint July 29, 2021 at 05:50 PM

In this week's edition of Chartwise Women, Erin and Mary Ellen play "Never Have I Ever" with the markets, looking at stocks in the news based on these ‘revealing' questions... Read More

DecisionPoint July 26, 2021 at 07:33 PM

In this episode of DecisionPoint, Erin, flying solo, taked an in-depth view of the SPX and Swenlin Trading Oscillators (STOs) and covers the rally in Bitcoin, as well as a look at the prospects of Crude Oil moving forward... Read More

DecisionPoint July 26, 2021 at 06:43 PM

The market is continuing to see follow-through on the bounce that began last week. Charts and indicators that once looked very bearish are now turning around. Today both the SPX and NDX generated PMO crossover BUY signals... Read More

DecisionPoint July 19, 2021 at 07:52 PM

In this episode of DecisionPoint, Carl gives us his analysis of today's sell-off and discussed today's Downside Exhaustion Climax, showing us what to expect from this important signal and how to identify market climaxes... Read More

DecisionPoint July 16, 2021 at 06:08 PM

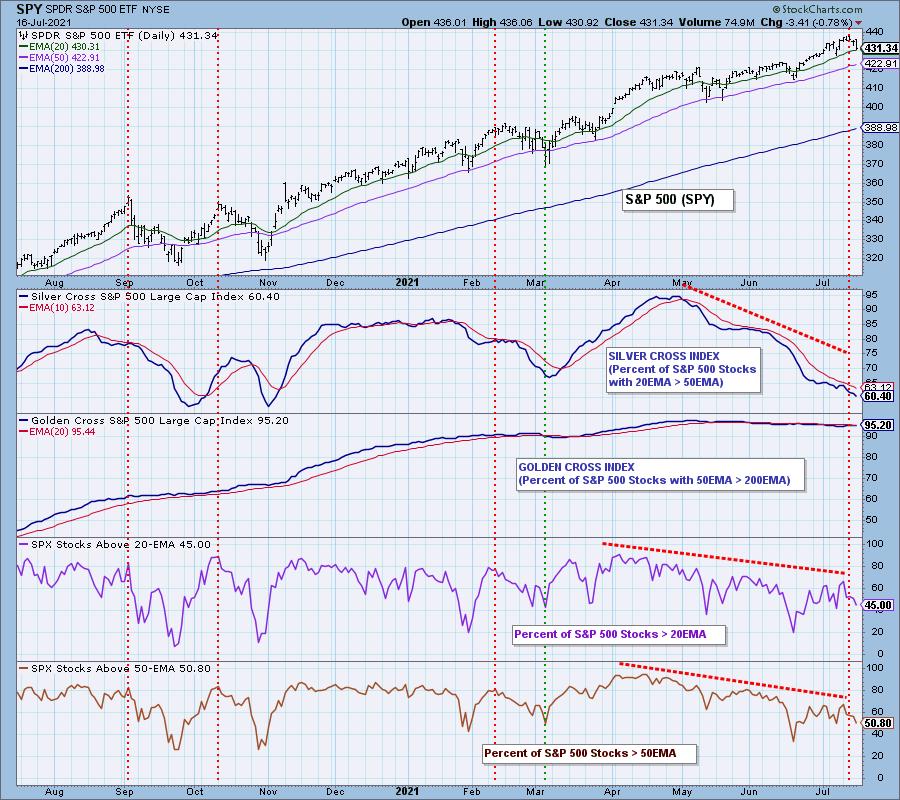

In spite of the market making new, all-time highs this week, participation continued to deteriorate. Our focus is usually on the S&P 500 Large-Cap Index, so we'll begin with that, but mid- and small-cap stocks are really looking bad as well... Read More

DecisionPoint July 15, 2021 at 06:09 PM

In this week's edition of Chartwise Women, Erin and Mary Ellen show us exactly how they find "pockets of strength" within the market. Regardless of market direction, there are almost always groups that are outperforming... Read More

DecisionPoint July 12, 2021 at 07:32 PM

In this episode of DecisionPoint, Carl covers the SPY and its associated indicators, paying particular attention to participation within the broad markets, as well as some observations on Disney (DIS) and Communications Services (XLC)... Read More

DecisionPoint July 06, 2021 at 09:41 PM

Technology (XLK) has clearly been leading the SPX higher, but it is now very overbought. The RSI has now entered shaded overbought territory. We haven't seen price this overbought since the crash at the beginning of September... Read More

DecisionPoint July 02, 2021 at 12:13 PM

The normal P/E range for the S&P 500 is 10 (undervalued) to 20 (overvalued), but the P/E spike in 2009 nearly pushed that range into oblivion. The current P/E of 33.85 is the third highest in history, but it is the highest ever reached during a market advance... Read More