As I reviewed my scans to write the "DecisionPoint Diamonds" report, I noticed a theme in Technology, particularly in the Semiconductor industry group (SOXX). I zeroed in on my favorites to present in today's DecisionPoint Diamonds report (if you'd like to see those charts, you can subscribe to the Diamonds report on DecisionPoint.com. For ONLY $25/mo you will get 60 stock picks a month!).

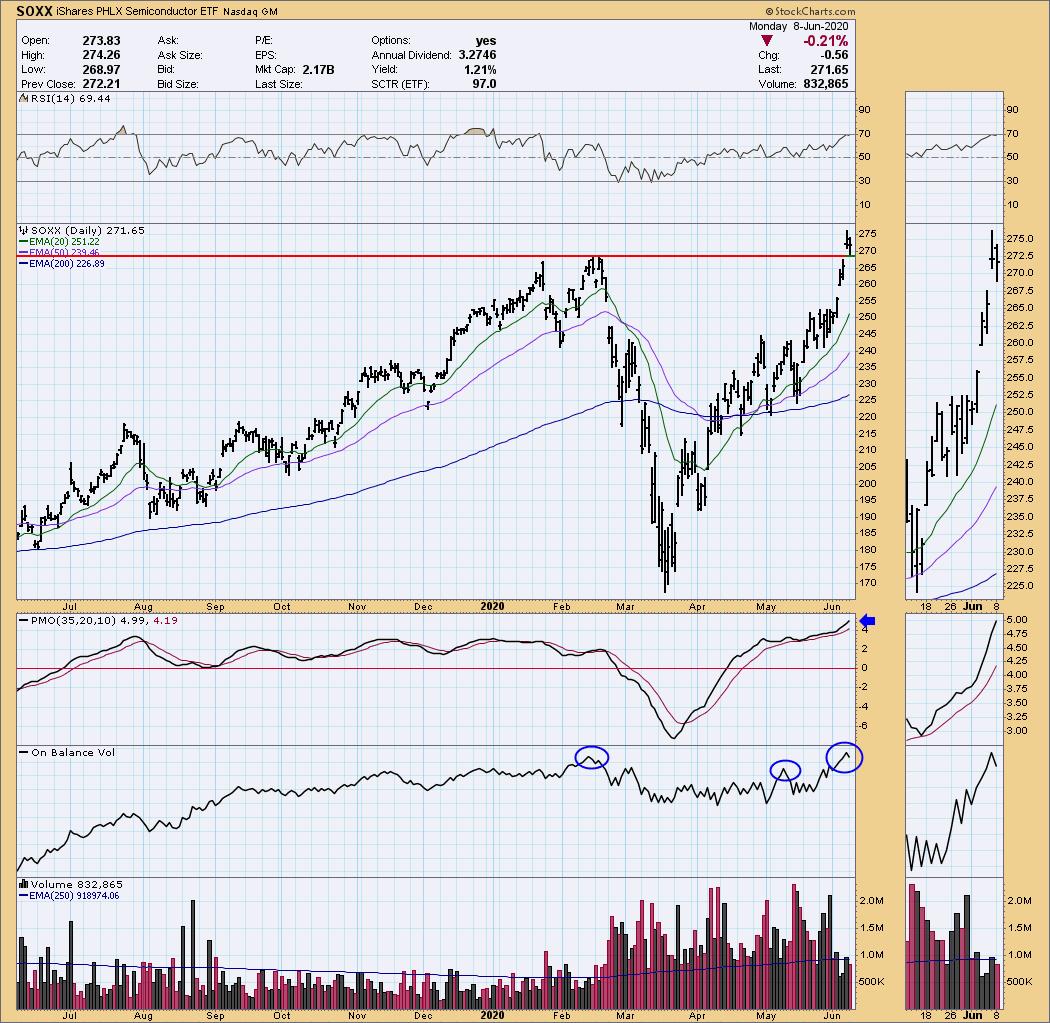

Let's look at the ETF that tracks to the Semiconductor industry group, SOXX. We can see a nice breakout to new highs and a pullback today that brought price right to the breakout point. As many of you know, I love finding the stocks that have broken out and then pulled back to support. It showed strength on the breakout, followed by profit taking. If there is internal strength and positive indicators, the stocks within this group could be excellent short-term investments. This ETF has rising momentum and the OBV is confirming, not only with rising bottoms, but also setting an OBV top that is above the prior two. This tells us that volume did come in on this breakout.

If you are interested in trying out DecisionPoint.com reports, you can use the coupon code "dptrial" when you sign up for the "BUNDLE" package and your first week will be free. Cancel before the week ends and you will not be charged. If nothing else, you should sign up for our free email list on the home page at DecisionPoint.com.

Happy Charting!

Erin

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY! (Charter Subscriber Discounts Available!)

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

f