On a day when the Dow was up +529.95 points, I thought it was odd that it's two giant components, Apple (AAPL) and Micrsoft (MSFT), finished the day at a loss and at the bottom of the list sorted by percent change. Maybe this is just a function of rotation, but, as I said, it is odd.

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY!

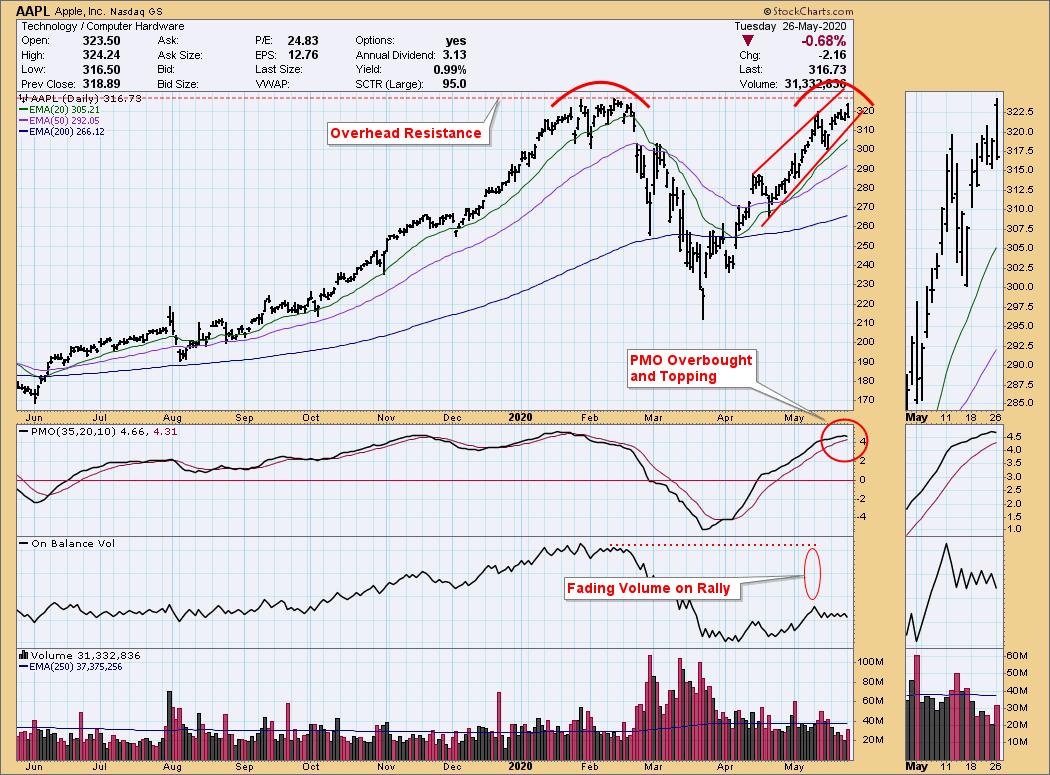

In my May 15 article I pointed out that AAPL was perhaps making a double top, but, of course, it went higher from there, and it made a new rally high today; however, AAPL reversed and closed on its low for the day. This caused the overbought PMO to top, which is bearish. Price is still within the rising trend channel, but the rising trend line is more likely to fail if price doesn't test the top of the channel again before it tests the rising trend line. Note how volume last week contracted as price was pushing higher.

MSFT had a similar day (opened higher, then reversed), although it didn't quite make new rally highs. The daily PMO, which generated a PMO crossover SELL signal about a week ago, is overbought and falling below the signal line. Also, similar to AAPL, volume for MSFT contracted last week.

It it interesting to see these two $1.39 trillion stocks so closely aligned in such a negative way. It's a pretty good setup for a double top on both stocks, but the double tops won't be in place until price breaks down below the rising trend line.

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)