DecisionPoint April 30, 2020 at 08:50 AM

In this episode of DecisionPoint, Carl and Erin reviewed everything from the Case-Schiller Home Price Index to SPX Earnings Estimates and Gilead Sciences (GILD). Erin covered brand new scan results that uncovered a few names you might want to consider... Read More

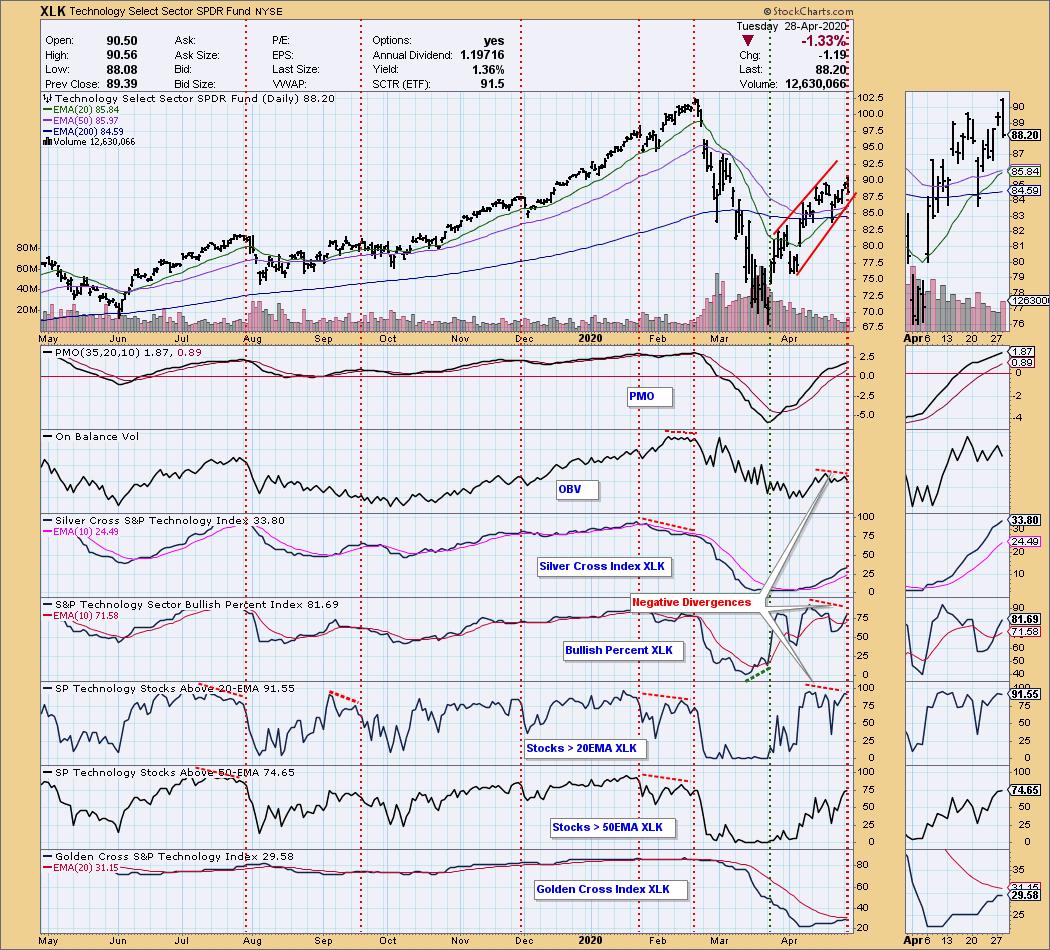

DecisionPoint April 28, 2020 at 08:06 PM

The Technology Sector (XLK) 20EMA is on the verge of crossing up through the 50EMA, a Silver Cross, which will generate an IT Trend Model BUY signal. Since price is well above the 20EMA, the crossover will probably take place tomorrow, or the day after... Read More

DecisionPoint April 23, 2020 at 10:55 AM

In this episode of DecisionPoint, Carl opens the show with a market overview looking particularly at short- and intermediate-term indicators. Carl and Erin comment on the bullish bias that seems to be prevalent in this rally off bear market lows... Read More

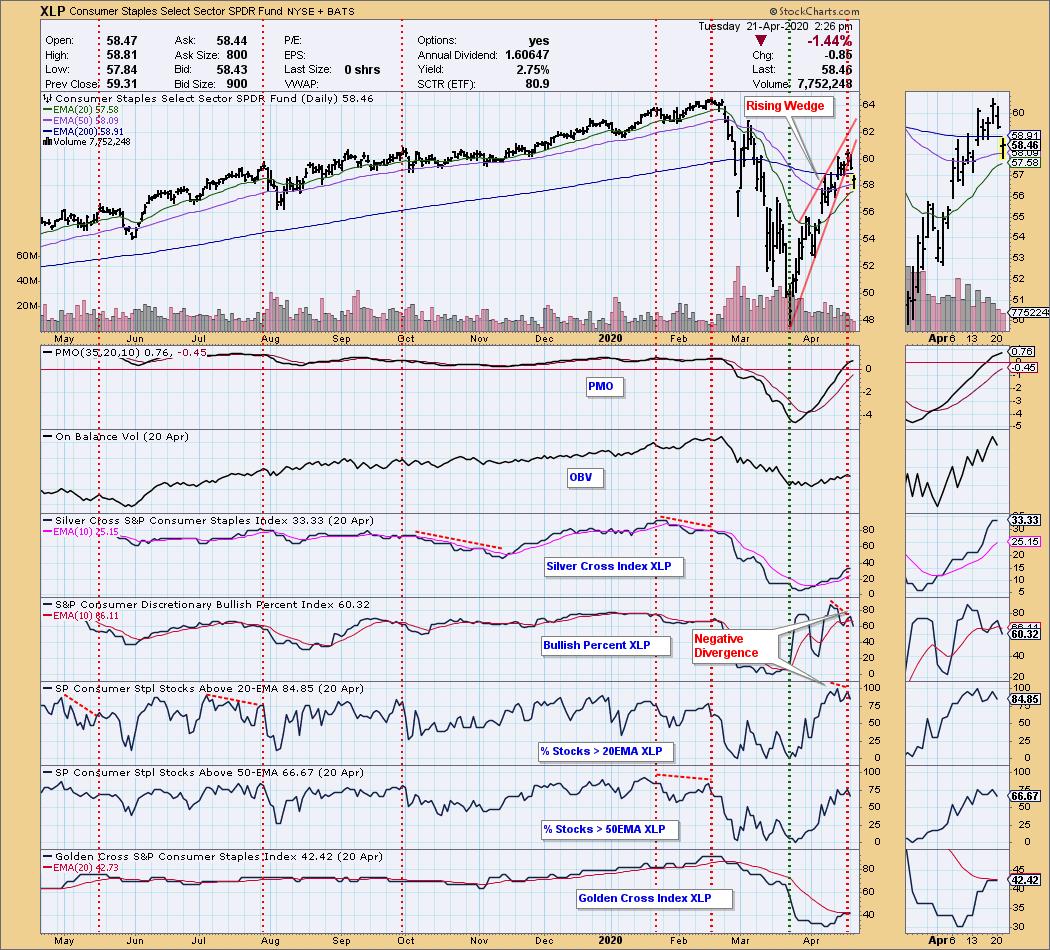

DecisionPoint April 21, 2020 at 03:29 PM

The S&P 500 component stocks are divided into eleven sectors, and five of them have rising wedges that have broken down. A rising wedge is a bearish formation, and, even in a bull market, it will resolve downward more often than not... Read More

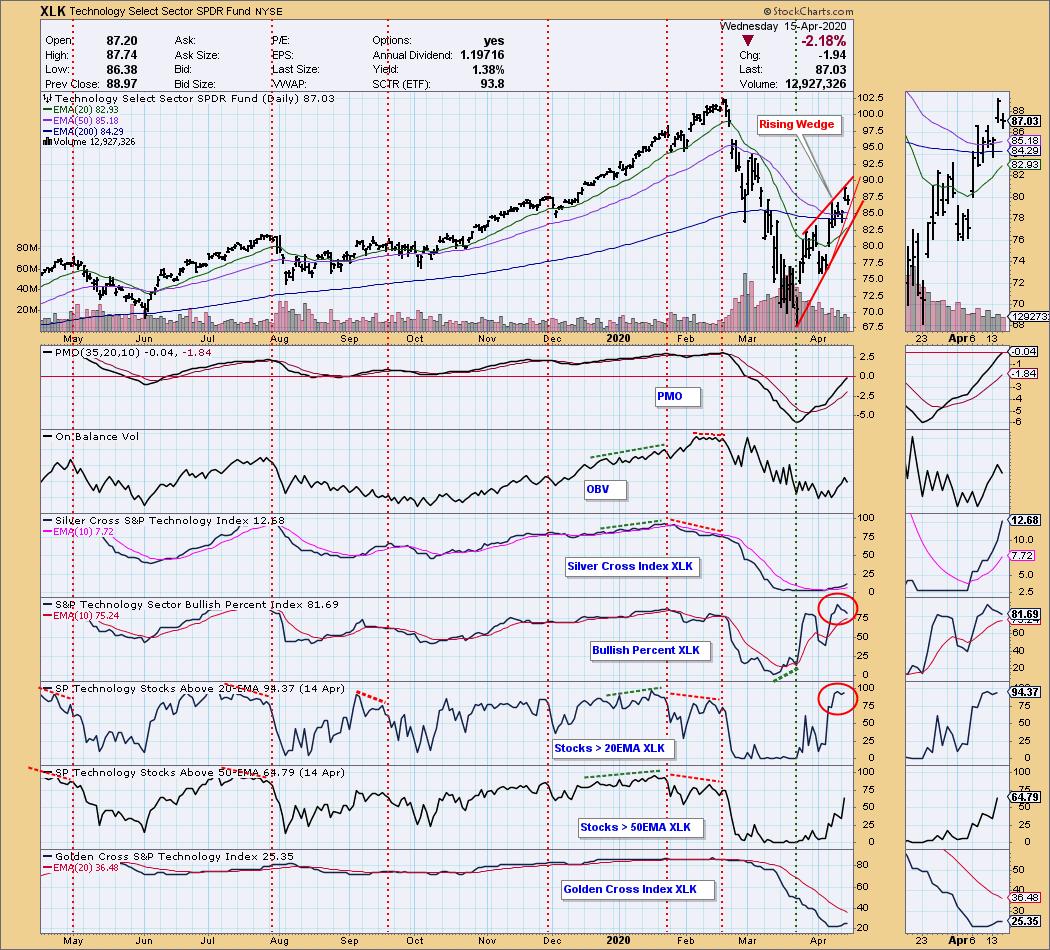

DecisionPoint April 15, 2020 at 05:30 PM

At DecisionPoint.com I maintain daily charts of the eleven S&P 500 sectors for our subscribers, and I can't help noticing two of the charts have bearish rising wedge formations, which developed after the market's March low... Read More

DecisionPoint April 13, 2020 at 07:59 PM

In this episode of DecisionPoint, Carl and Erin talk about some of the short-term technicals that are beginning to suggest weakness under the surface. Carl explains reverse divergences for On-Balance Volume (OBV) and price both with respect to Technology (XLK) and in general... Read More

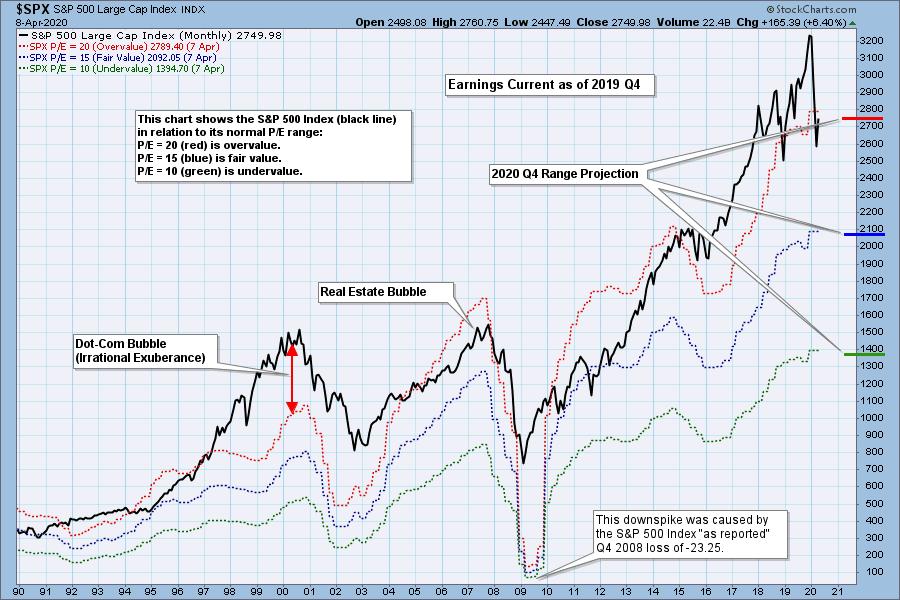

DecisionPoint April 08, 2020 at 04:48 PM

The S&P 500 final earnings for 2019 Q4 are out, and based upon GAAP (Generally Accepted Accounting Principals) earnings, the S&P 500 is finally back into the normal value range, but is still overvalued... Read More

DecisionPoint April 06, 2020 at 08:06 PM

In this episode of DecisionPoint, Carl and Erin look at the current market conditions and the bullish indicators that are appearing in the short- and intermediate-term timeframes... Read More

DecisionPoint April 01, 2020 at 03:29 PM

Murphy's Law says that if something can go wrong, it will. Bear Market Rules say that even bullish chart formations are more likely to resolve bearishly, and while reviewing the sector charts this morning, I saw many examples of this... Read More