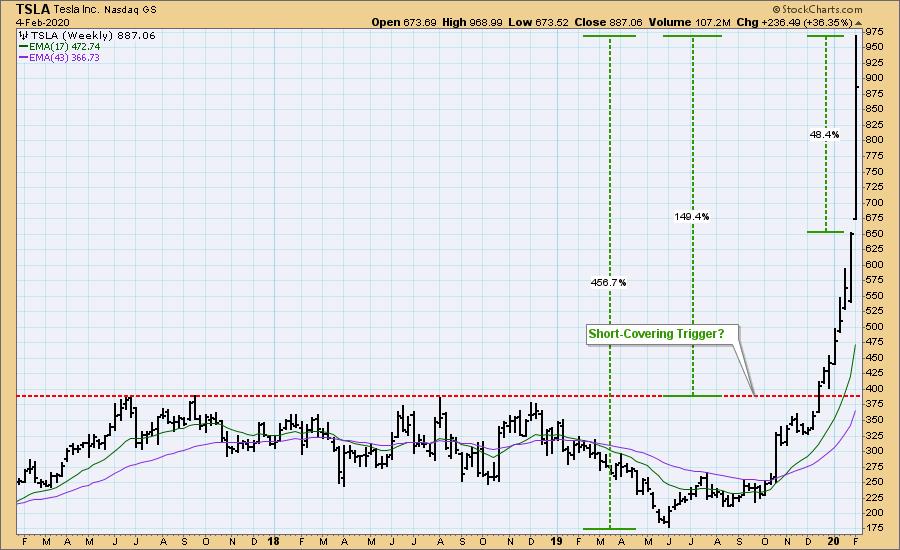

TSLA short-sellers no doubt feel that they have stuck their fingers into a light socket, or perhaps I should say they have been hot-wired to a charging station. Since last June's low, the value of TSLA stock has increased about four-and-a-half times. This week it advanced almost +50%, and today it hit another all-time high. It isn't hard to figure out where the short squeeze began -- 390 has held for about three years, and the pain must have started in earnest when price moved above that level.

As investors we want to accomplish two basic things: (1) Determine the trend and condition of the market, and (2) select stocks that will ride that tide. The DecisionPoint Alert helps with the first step, and DecisionPoint Diamonds helps with the second. Go to DecisionPoint.com and SUBSCRIBE TODAY! (Charter Subscriber Discounts Available!)

I'm not personally a TSLA fan. To me it is a "feel good" stock that is priced without any regard for solid fundamentals. That doesn't mean that there isn't some substance here, or that it can't eventually become a solid company, but it is reported that the current market cap is approaching the combined market cap of five major auto manufacturers. And from a technical point of view, price is worse than parabolic -- it is vertical! IMHO this will not end well, but don't ask me when it will crash -- it was reported the current shorts are about 20% of shares outstanding, so more squeezing could easily result in still higher prices. When it does finally start back down, technically, there is good horizontal support at 390, but at this point I can't make a case for anything higher than that.

Happy Charting! - Carl

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)