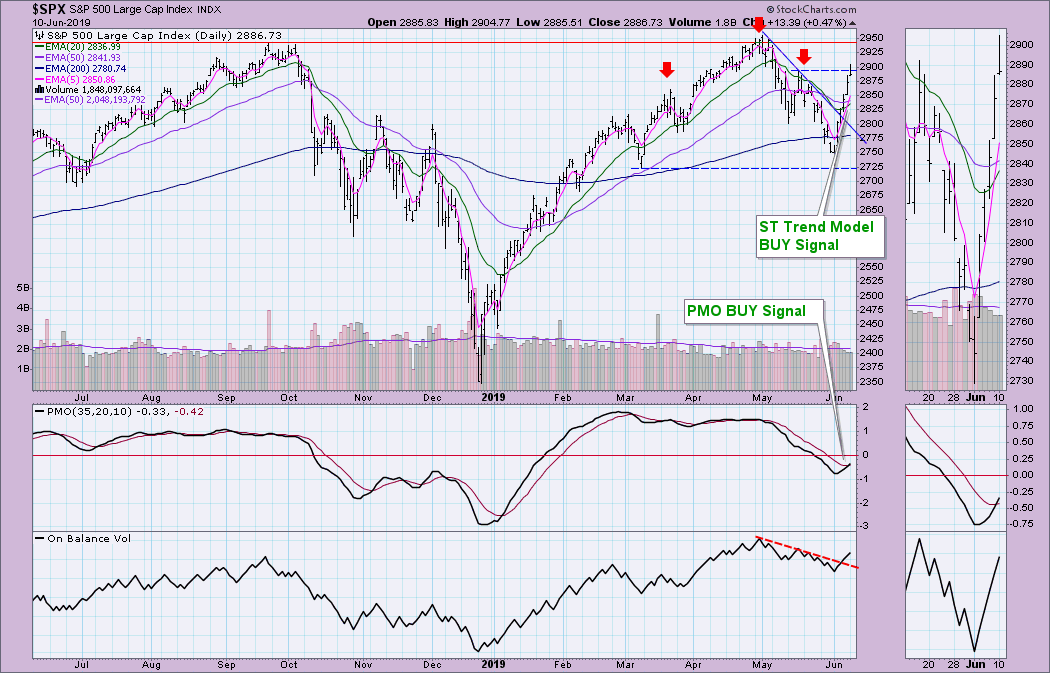

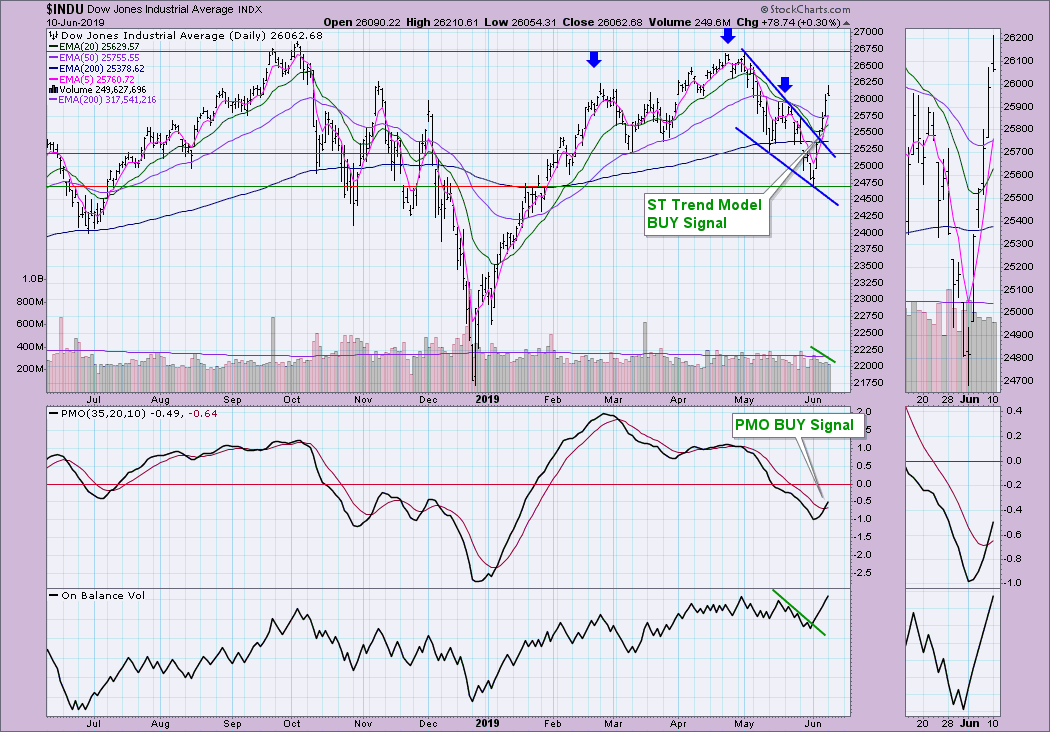

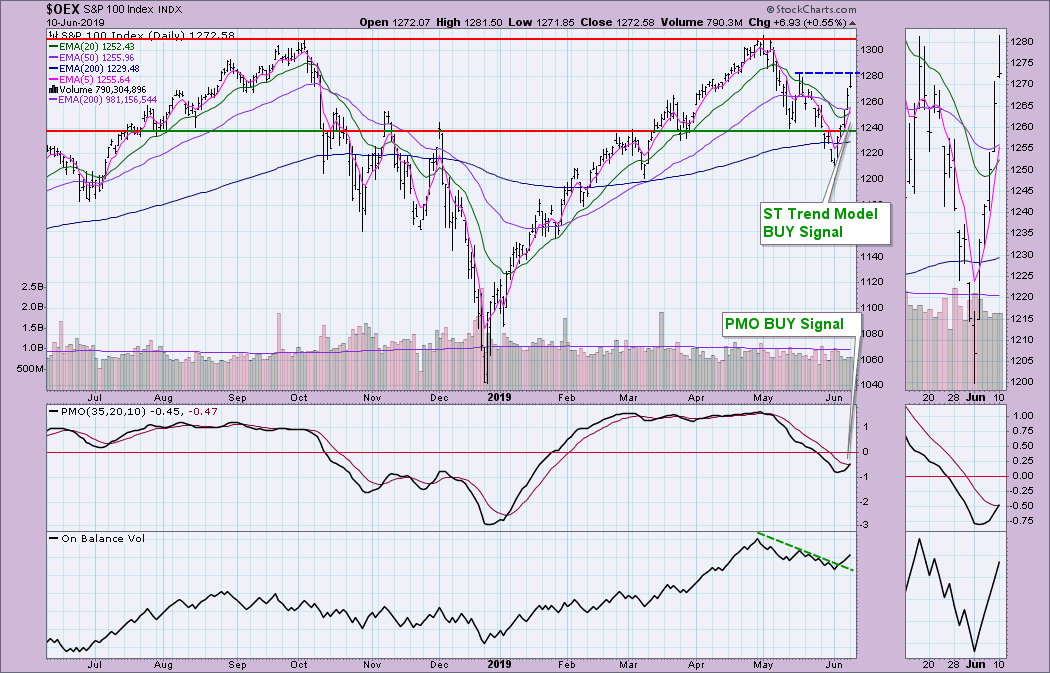

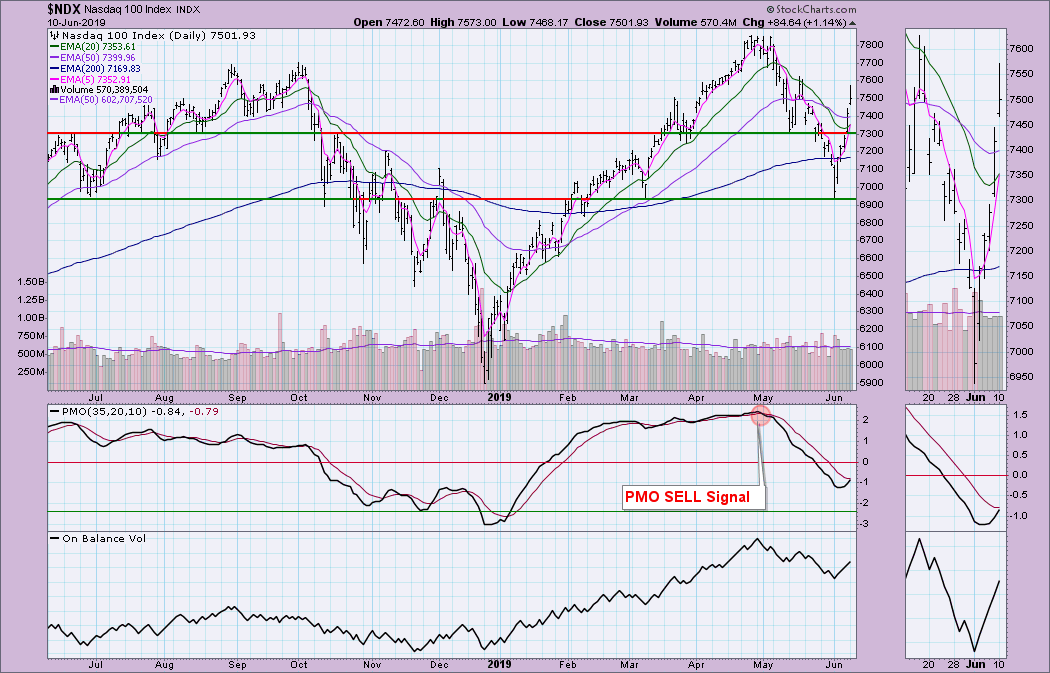

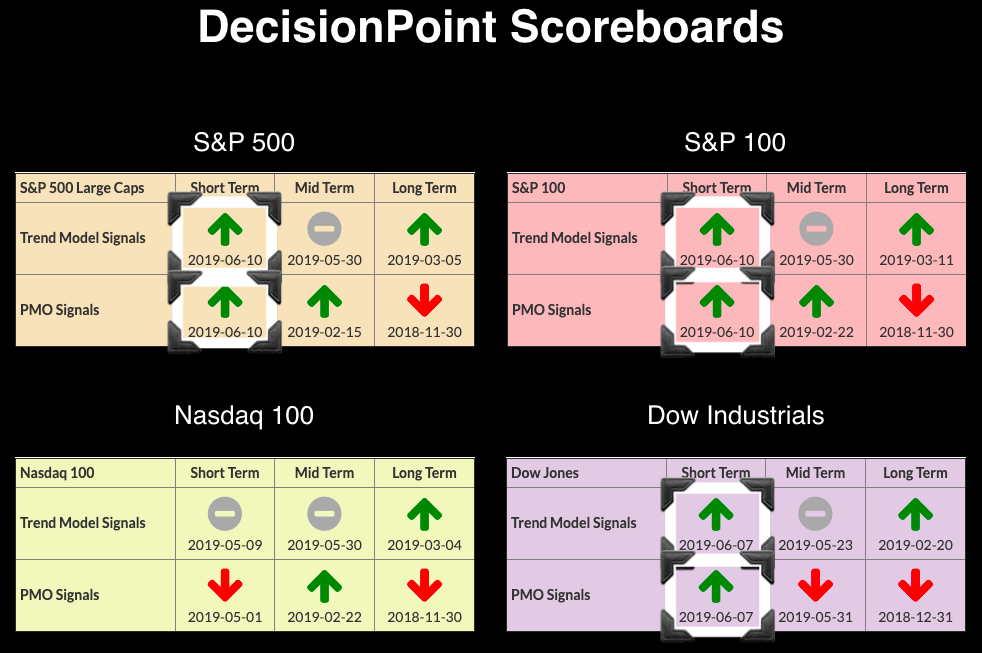

On Friday, $INDU logged both a Short-Term Trend Model BUY Signal and a Price Momentum Oscillator (PMO) BUY signal. Today, the SPX and OEX joined the party. The NDX is extraordinarily close to those same BUY signals and should switch tomorrow.

Notice that, on price, today's high pierced the resistance at the May top. However, we did see a close near the open for the day, which is generally a sign of exhaustion.

The OBV is beginning to form a reverse divergence. The next OBV top will be the highest of the past year, but price still won't be near price resistance. Despite heavy volume to the upside, the price has been unable to reach the April top.

The OEX failed at resistance today, too, and it isn't challenging the previous top in April. That's fine, but I'm unimpressed with the volume pattern overall. I added a 200-EMA of volume; you can see that, although the rally is steeply rising, volume is well below the average.

You can also see that the NDX is getting very close to the BUY signals. The 5-EMA hasn't quite crossed the 20-EMA for the STTM BUY signal, nor has the PMO passed above its signal line.

Overall, I see a buying exhaustion shaping up. Price is overbought and volume isn't rising like it should be if the rally were strengthening.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Fridays 4:30p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**