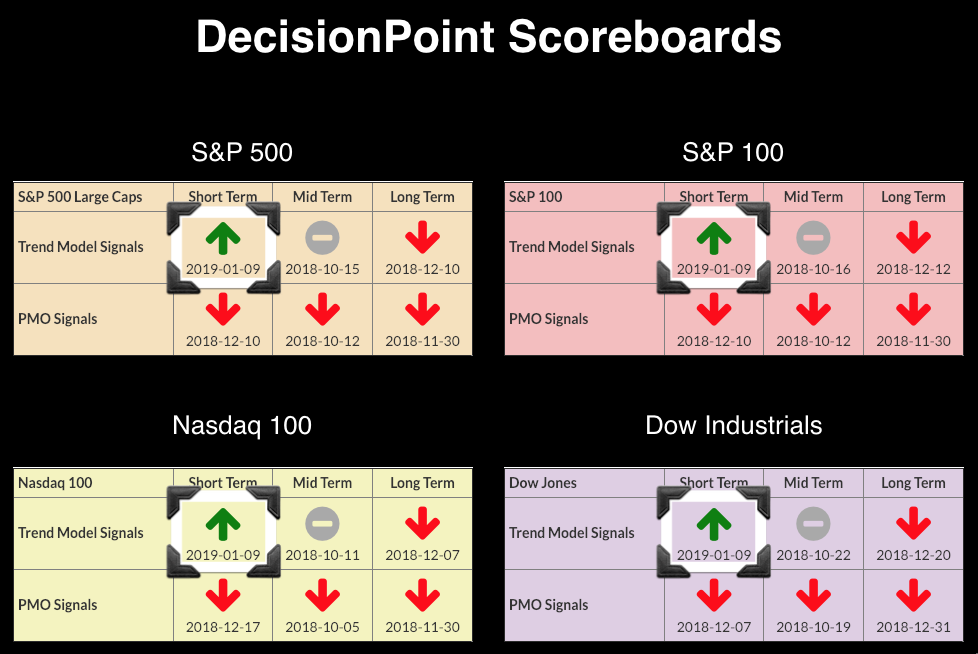

I took a peek at these new Short-Term Trend Model (STTM) BUY signals on the DP Scoreboards. After view the charts, I came to the conclusion that, as Pat Benatar once put it, "It's a little too little, it's a little too late." If you read my article from yesterday and have been listening to me on MarketWatchers LIVE this week, you'll know that I'm short-term bullish through the end of the week (unless breadth spikes or the VIX penetrates the upper Bollinger Band on an inverse scale). I recommend you go to the DecisionPoint Chart Gallery and review the price and indicator charts for the Dow, NDX and OEX. I'll cover the SPX below.

I took a peek at these new Short-Term Trend Model (STTM) BUY signals on the DP Scoreboards. After view the charts, I came to the conclusion that, as Pat Benatar once put it, "It's a little too little, it's a little too late." If you read my article from yesterday and have been listening to me on MarketWatchers LIVE this week, you'll know that I'm short-term bullish through the end of the week (unless breadth spikes or the VIX penetrates the upper Bollinger Band on an inverse scale). I recommend you go to the DecisionPoint Chart Gallery and review the price and indicator charts for the Dow, NDX and OEX. I'll cover the SPX below.

The DecisionPoint Alert presents a mid-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil and Bonds.

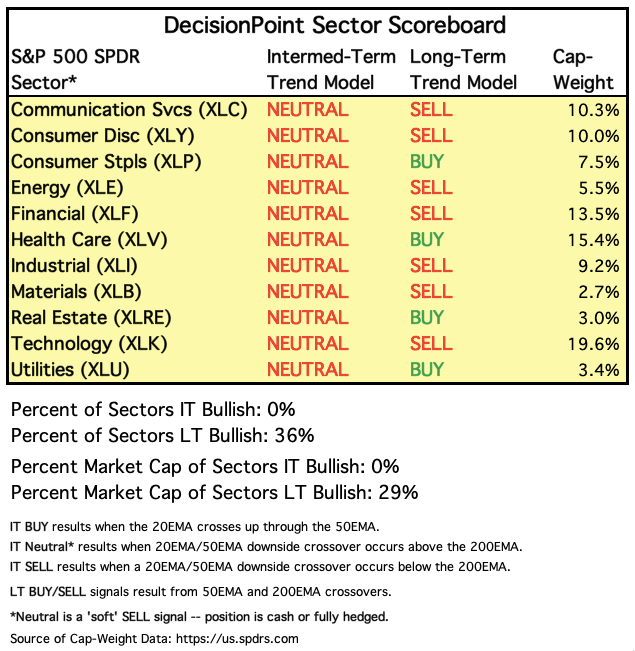

SECTORS

Each S&P 500 Index component stock is assigned to one and only one of 11 major sectors. This is a snapshot of the Intermediate-Term and Long-Term Trend Model signal status for those sectors.

STOCKS

IT Trend Model: Neutral as of 10/15/2018

LT Trend Model: SELL as of 12/14/2018

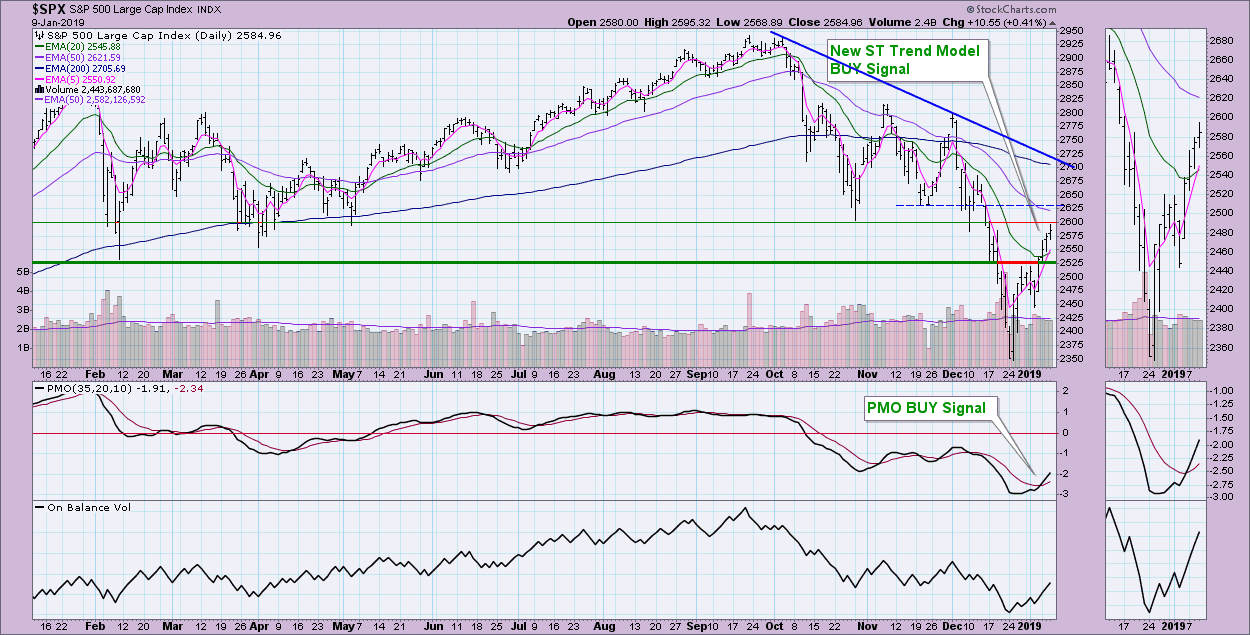

SPY Daily Chart: The market continues to rally this week and, as a consequence, the 5-EMA has crossed above the 20-EMA. This is how a STTM BUY signal is generated. The critical level of overhead resistance, in my opinion, is 2600. I suspect that is where price will fail.

If I knew nothing of the longer-term weekly and especially monthly charts, I could get excited by this rally. However, having seen these charts, I'm not convinced the bottom is 'in.' Personally, I am watching the declining tops trend line. If that is broken to the upside, it would imply that this declining trend has ended. However, like Carl, I'm using the monthly PMO as my guide. If I see a combination of the monthly PMO rising and a breakout above the declining tops trend line, I might reevaluate my bear market stance. Until then, use these rallies as an opportunity to sell positions or set up a short.

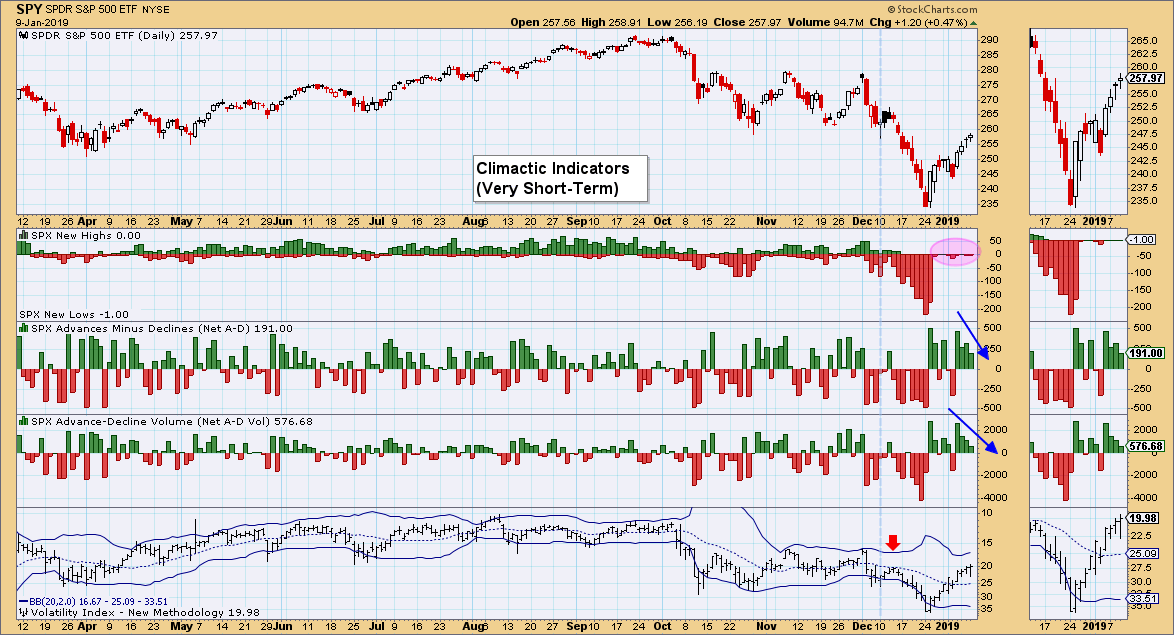

Climactic Market Indicators: The breadth indicators are beginning to exhaust. I don't like to see fewer net advances on a daily basis while price is rising. Also note that we aren't seeing anything climactic on new highs/new lows. This is likely a sign of a buying exhaustion lining up. The VIX hasn't reached the upper Bollinger Band, but back in mid-December we saw a VIX top well below the upper Bollinger Band that still resulted in continued lower prices.

Short-Term Market Indicators: These are quite overbought and are decelerating. This set-up is ripe for a new leg down.

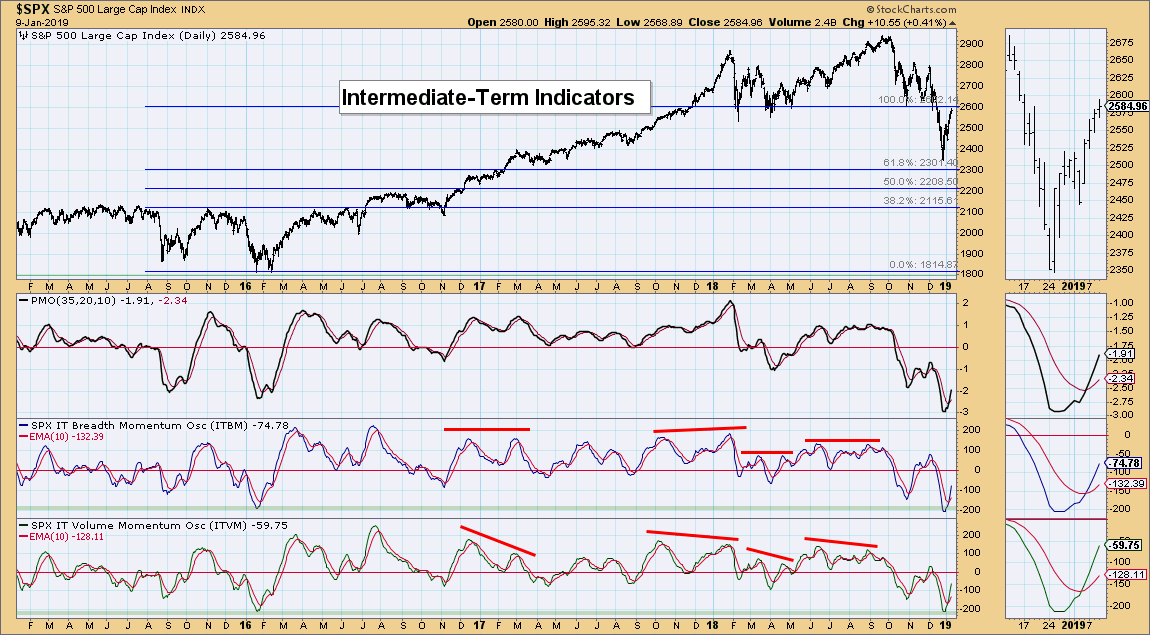

Intermediate-Term Market Indicators: When I used the Fibonacci annotation tool, I found that, having set 2600 as the upper bound and the 2016 lows as the lower bound, each level in between is significant, lining up with consolidation areas of support and resistance. While these indicators are very bullish in appearance, remember that oversold territory is 'thin ice' in a bear market and, additionally, oscillators must oscillate. Even in a bear market, you'll see oscillators making moves to the upside. Just be cautious; Carl wrote in last Friday's "Weekly Wrap" that he didn't expect to see these indicators continue to rise.

Conclusion: The market may be able to eke out slightly higher prices, but a buying exhaustion seems to have lined up with climactic indicators as well as short-term overbought indicators (Swenlin Trading Oscillators). Don't believe the bull market hype - another trip lower is around the corner.

DOLLAR (UUP)

IT Trend Model: BUY as of 4/24/2018

LT Trend Model: BUY as of 5/25/2018

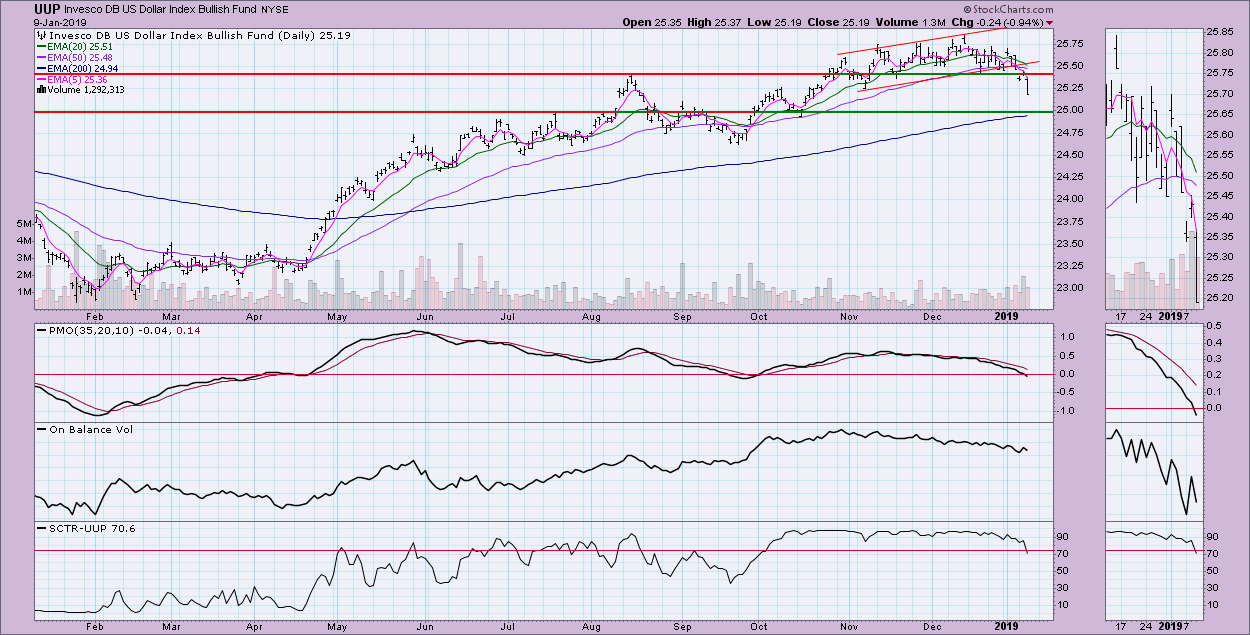

UUP Daily Chart: The rising trend for UUP has been broken. The next level of important support is $25.00. However, I'm looking for the Dollar to move even lower. The 200-EMA will likely be broken; if so, the $24.50 level will be next.

GOLD

IT Trend Model: BUY as of 10/19/2018

LT Trend Model: BUY as of 1/9/2019

GOLD Daily Chart: We received a new LT Trend Model BUY signal when the 50-EMA crossed above the 200-EMA. This puts Gold in a "bull market" configuration. I've pulled the trigger on moving into metals, so my portfolio is mostly cash with about 20% in metals. I'm taking full advantage of the recent consolidation/pullback in Gold. At first I wasn't going to do it, based on what looks to be a very overbought PMO.

However, when I pulled up a longer-term chart, I noticed that we've seen oscillation typically between +2 and -2 with readings reaching just under 4.

CRUDE OIL (USO)

IT Trend Model: Neutral as of 10/29/2018

LT Trend Model: SELL as of 11/23/2018

USO Daily Chart: USO is one I'm kicking myself about. The PMO bottoms are rising very slightly, but price bottoms declined sharply. This was an easy attention flag that Oil should see a resurgence. At this point, I'm leaving it alone as far as my portfolio, given strong resistance is lining up at $11.50. While that's still a decent return, I suspect there will be a pullback at resistance with a possible opportunity available then.

BONDS (TLT)

IT Trend Model: BUY as of 12/6/2018

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: Bonds are pulling back. The PMO is about to generate a SELL signal in overbought territory. While this should be an area of the market to find some safety, I don't like that support is not holding up at $121. There is support also at $120, where we can see the 20-EMA as well as tops in April and May. The PMO needs to decompress, so I do suspect we will see even more pullback past $120.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)