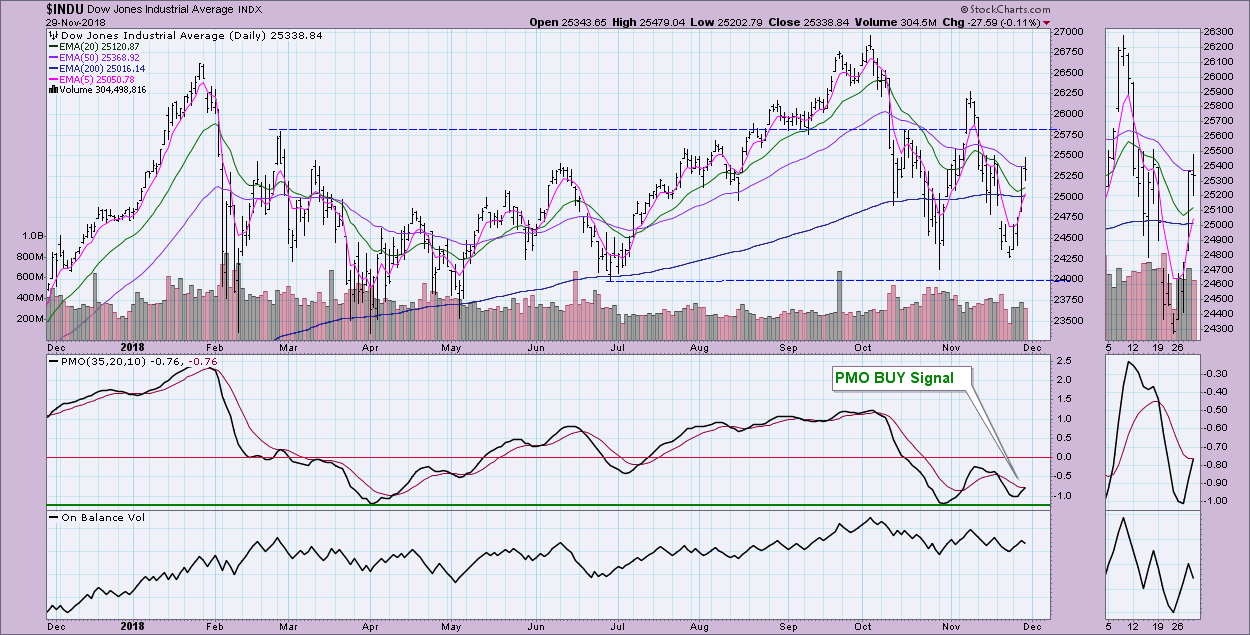

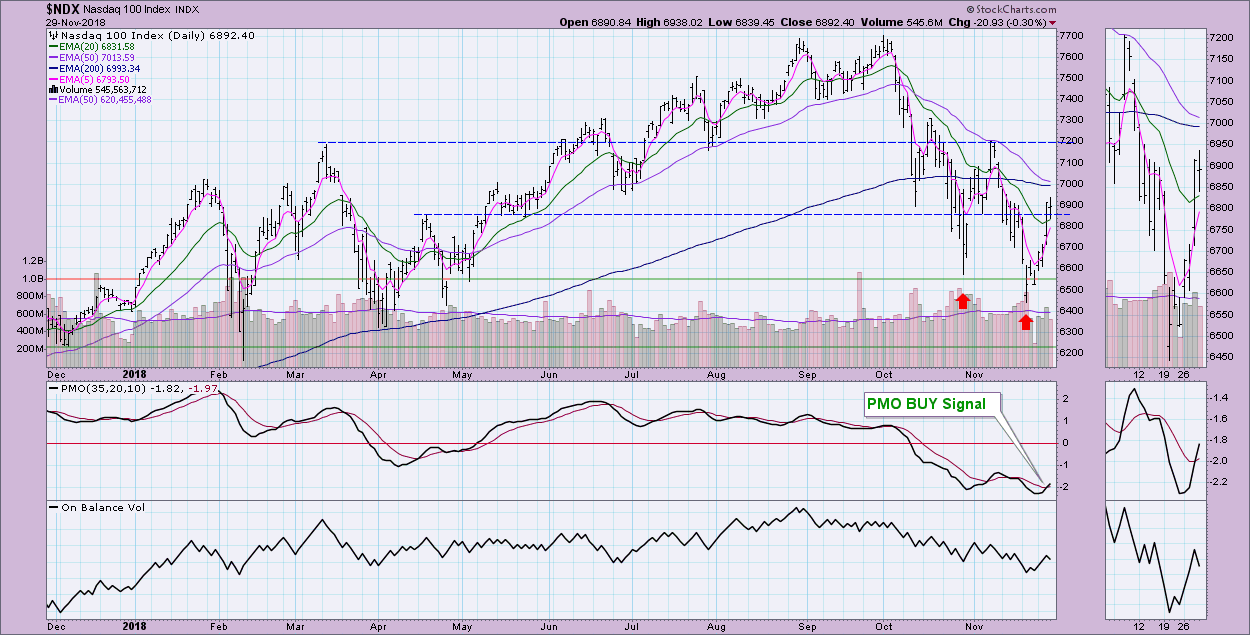

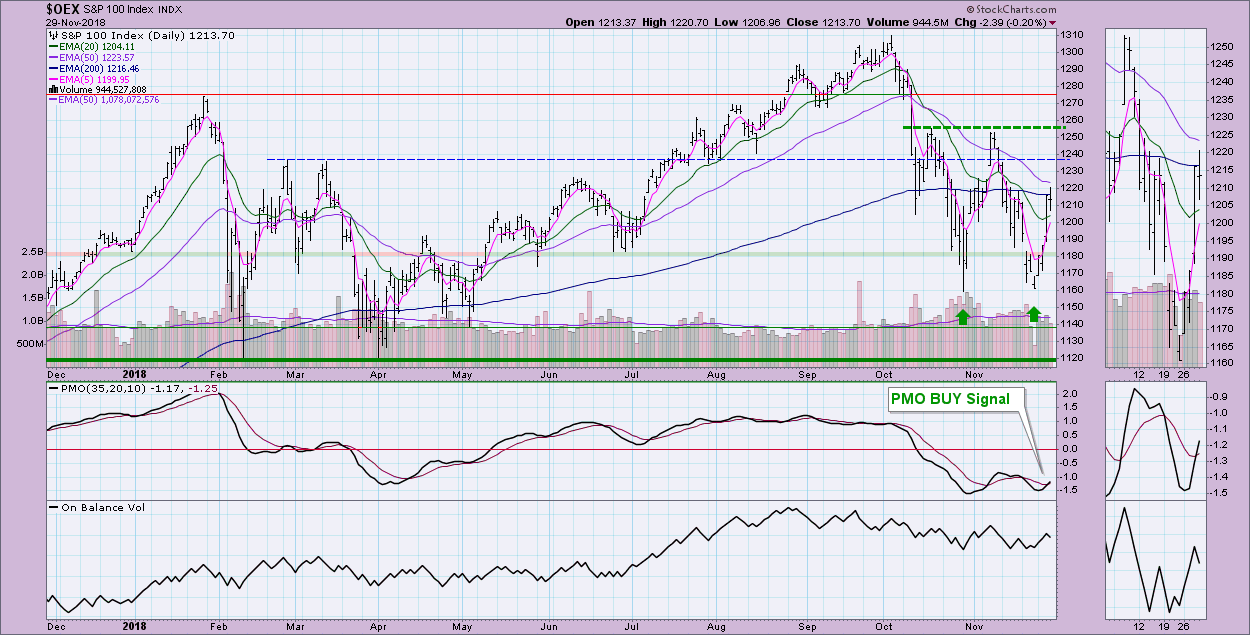

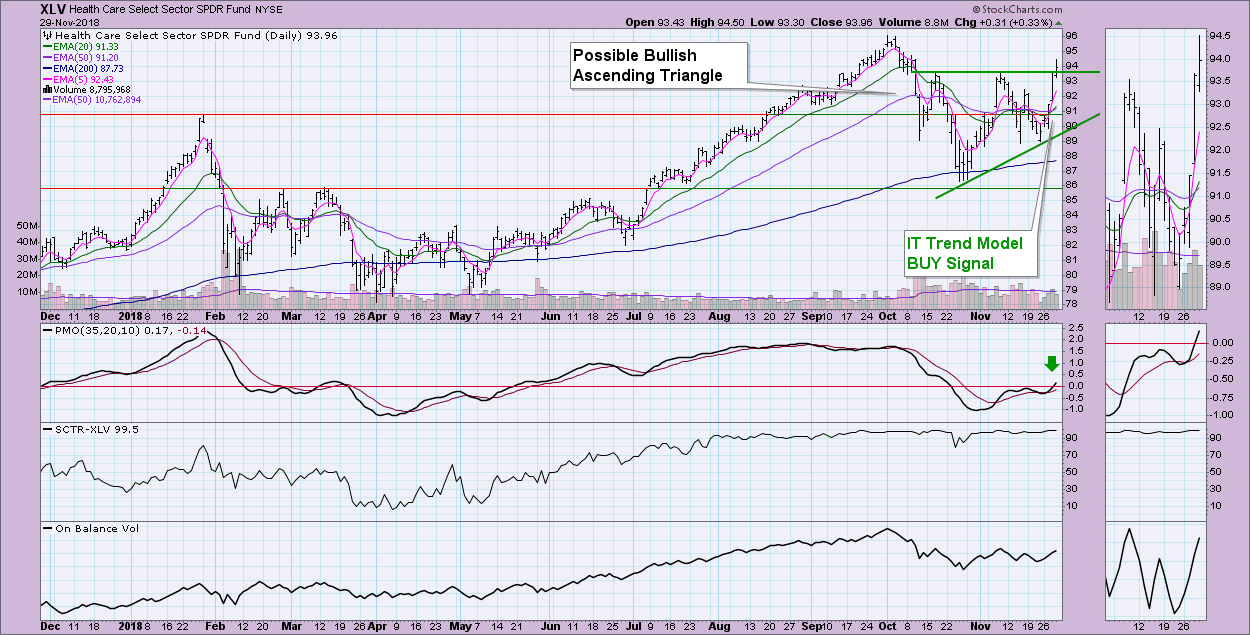

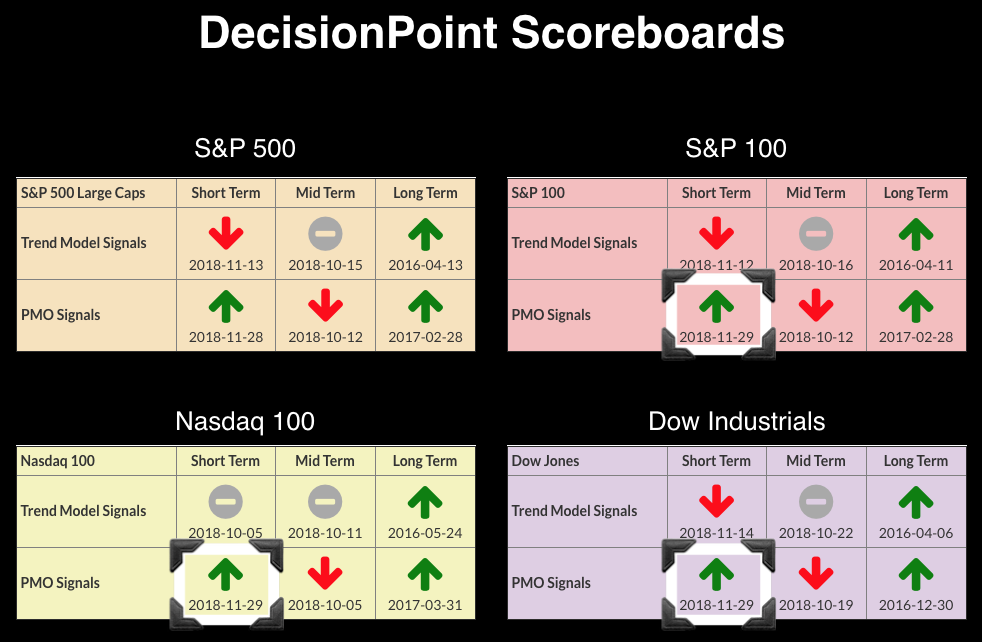

This is just a quick summary of the new DecisionPoint signals that came in. Yesterday, the SPX logged a new ST PMO BUY Signal on the "relief rally." Despite declines on the remaining indexes, they all managed to trigger new ST PMO BUY signals. I'm not looking at these new buy signals as the end of the correction; I suspect they will fail next week. Additionally, the Healthcare SPDR (XLV) triggered a new IT Trend Model BUY signal.

I've annotated the charts for the OEX, DOW and NDX below so you can see the new PMO BUY signals. An important note is that the Dow's PMO BUY signal only triggered by thousandths of a point and the margin between the others is extremely thin and, therefore, vulnerable to a whipsaw SELL signal.

As far as the Healthcare ETF (XLV), I am very bullish as we have a likely bullish ascending triangle pattern. The expectation is a breakout (which we got today to confirm the pattern) and a move the height of the back of the pattern. (The height is about $8.) Add that to the breakout point and the minimum upside target is $104. I don't trade off of chart patterns. The PMO looks great and I do trade off the PMO along with bullish Trend Model configurations. The PMO is rising and has now hit positive territory. It has plenty of room to run. Even volume is confirming this rally as it rose steadily throughout the rally until today. Interestingly, to boost the bullishness of XLV, Tom Bowley did his December seasonality report during MarketWatchers this morning and he said that, historically, the Healthcare sector performs best relative to the SPX in December.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**