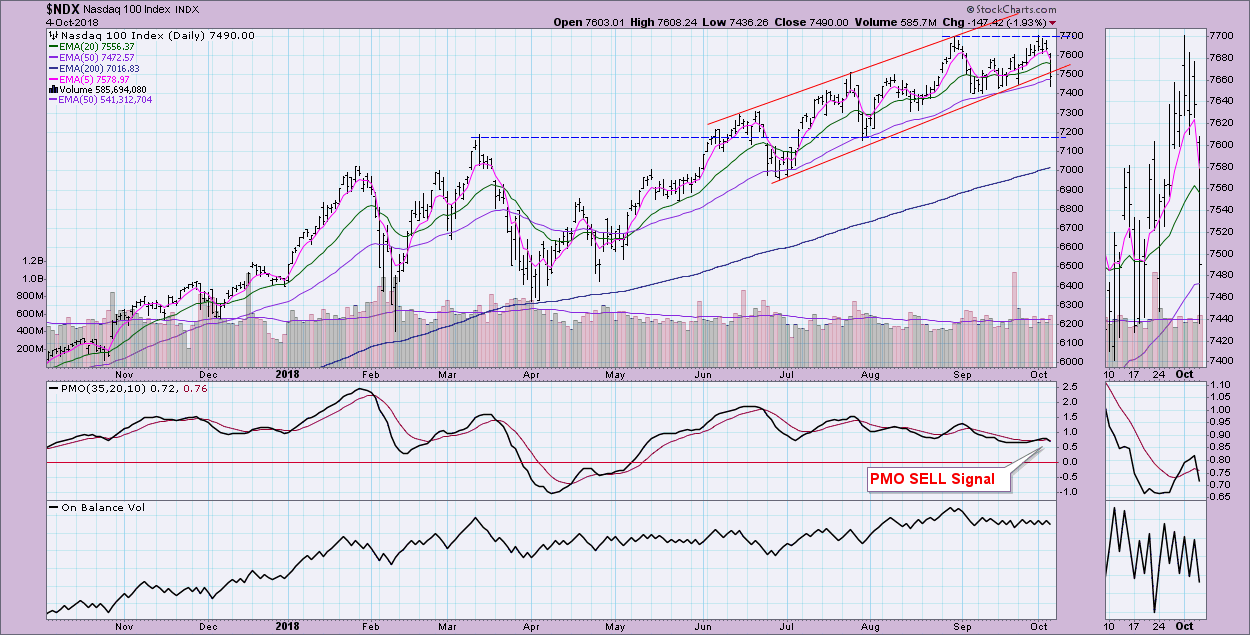

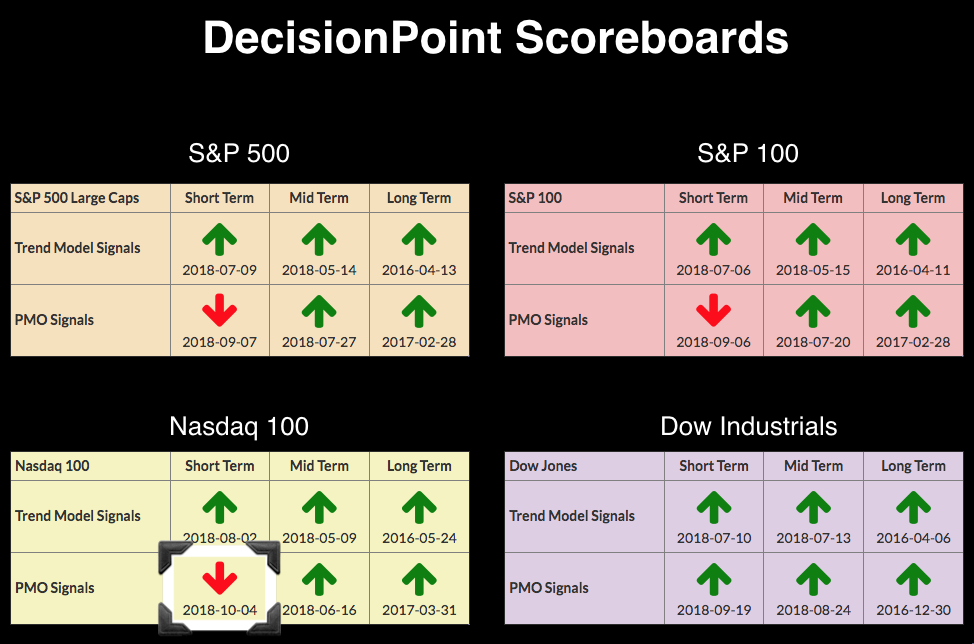

Well that didn't last long. The NDX had finally joined the Dow with a Scoreboard complete with BUY signals on Friday. Today's pullback erased that as the PMO was yanked downward and back under its signal line.

Interestingly, the NDX is the only Scoreboard index that I felt had a rising trend channel instead of a rising wedge, yet today that rising trend was broken. We can still see support around 7400, but this corrective move suggests more downside to me. The OBV is flat and indecisive. The only positive I can say is that volume didn't accompany this large decline. Volume was slightly above its 200-MA...not what I would call panic selling. This does leave room for follow-through on this decline, as we could see volume pile on another drop.

Conclusion: The SPX hasn't seen a rising PMO yet. Expectation is that Financials will begin to awaken with rising interest rates, but I'm still seeing most of the strength in Energy and Healthcare. In the sector rotation model, seeing these sectors lead suggests we are in a "late expansion". The next stage would be "early contraction" with Consumer Staples and Utilities leading. Watch MarketWatchers LIVE Mon-Fri 12:00p - 1:30p EST for more on sector rotation and leading/lagging industries.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**