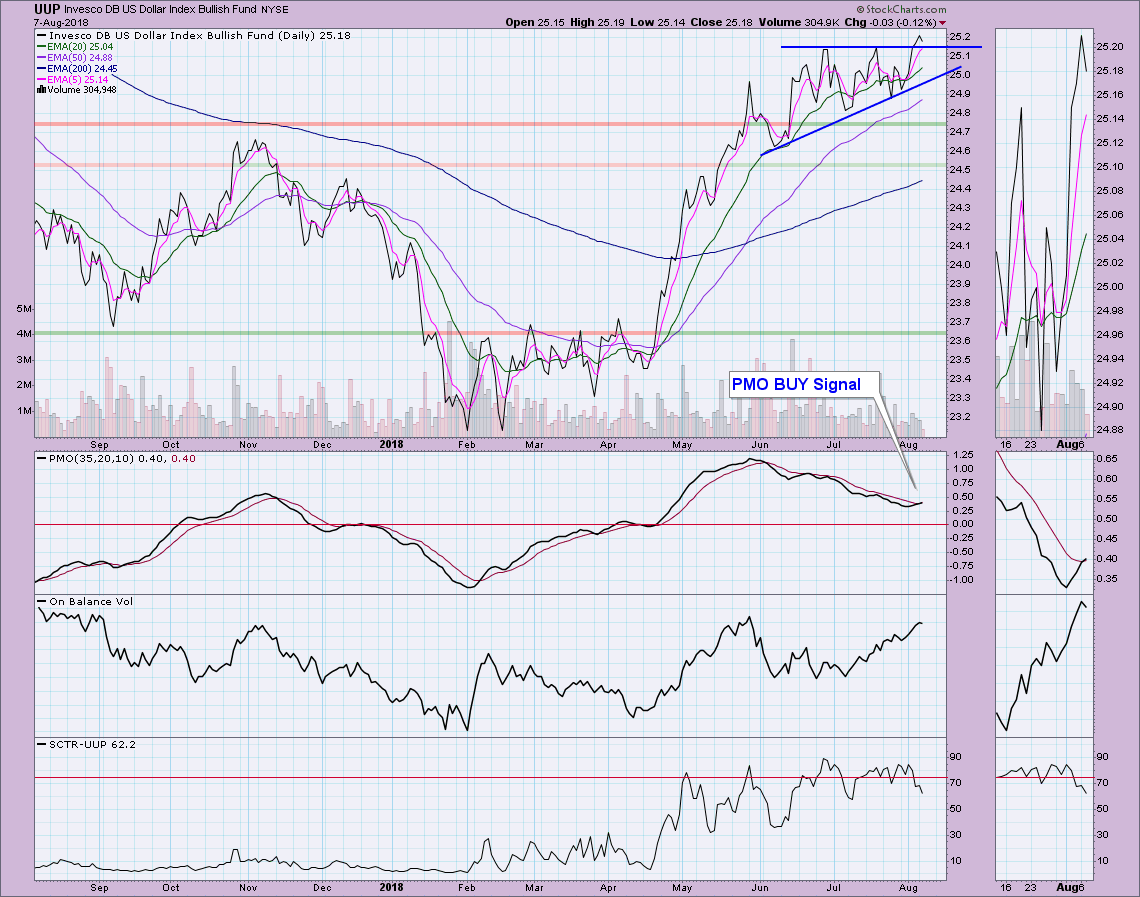

Yesterday's breakout on UUP was impressive and although the Dollar pulled back slightly today, it didn't matter to the Price Momentum Oscillator (PMO) as it crossed its signal line and triggered a BUY signal.

Yesterday's breakout on UUP was impressive and although the Dollar pulled back slightly today, it didn't matter to the Price Momentum Oscillator (PMO) as it crossed its signal line and triggered a BUY signal.

While studying the OHLC chart for UUP, I realized if I looked at the closing prices only, there is a clear ascending triangle and yesterday it executed with the breakout above overhead resistance. Today's pullback didn't sacrifice that breakout. If we did a measurement, the minimum upside potential target is $25.70.

Interestingly, when you look at the weekly chart, you can see that $25.75 is one of the next areas of overhead resistance, so that calculation of $25.70 is very close. Notice that the weekly PMO is still rising. It has started to decelerate somewhat, but that makes sense given the trading range of the last 4 or 5 weeks.

Conclusion: I'm bullish on the Dollar. I would look for a move to challenge overhead resistance at the 2010 top just above $25.75.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**