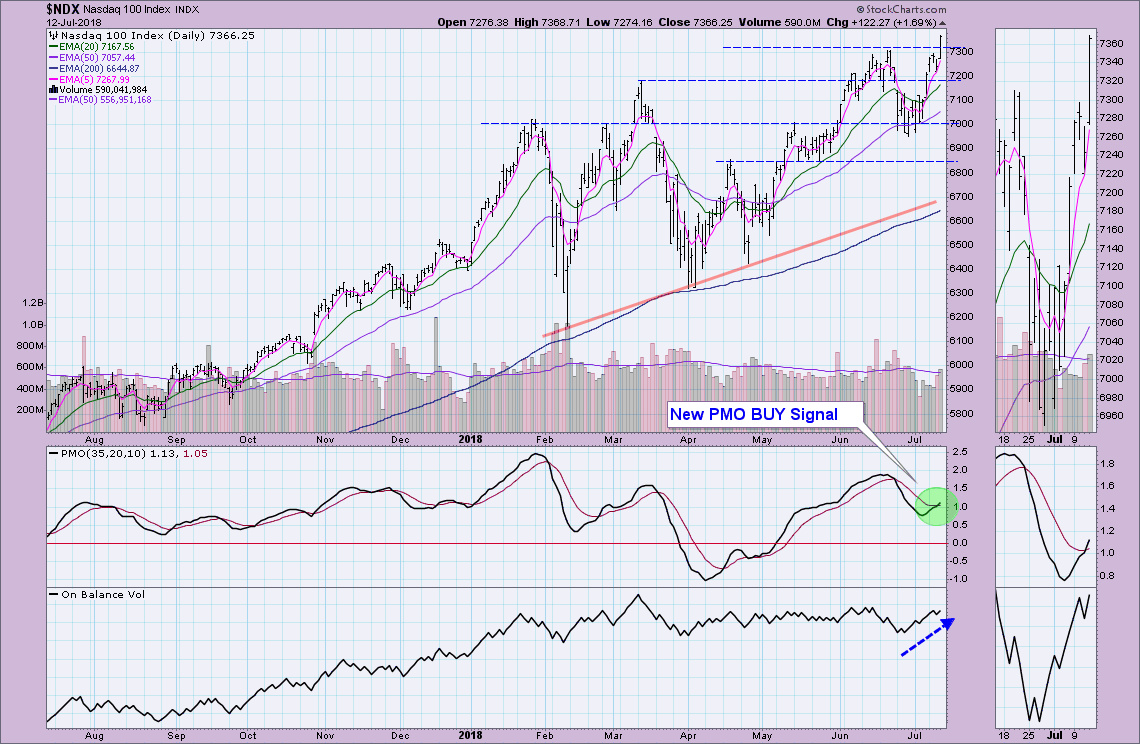

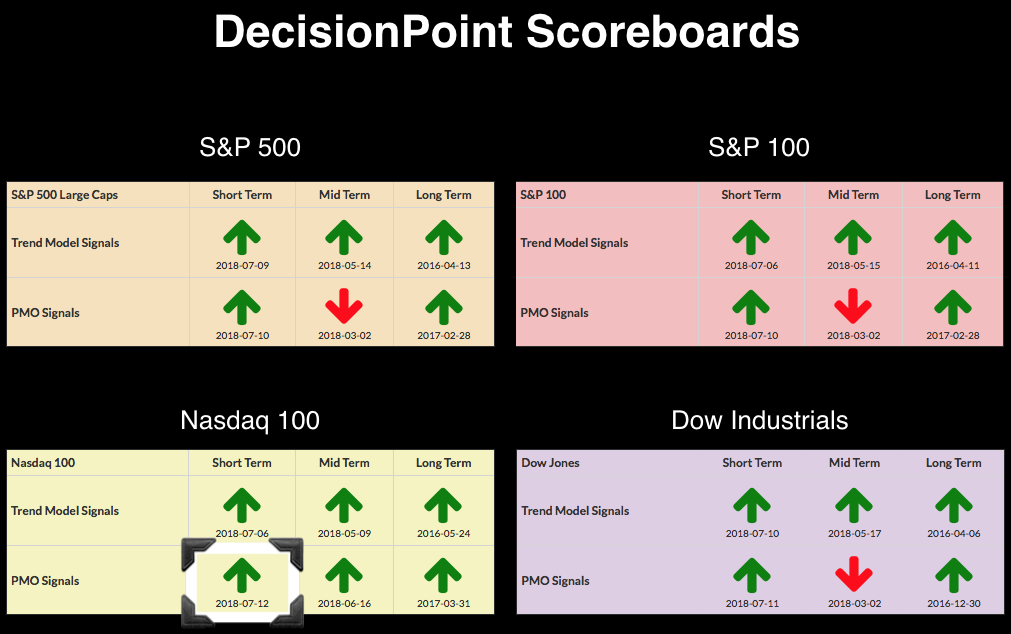

The NDX killed it today with a 1.69% move higher and logging a new all-time high. The other major Scoreboard indexes managed good numbers, but none above 1% or logging all-time highs. At issue with all of the Scoreboard indexes are extremely overbought short-term indicators. These conditions need to be relieved and this rally pop did nothing to help that cause. The good news is that overbought conditions in a bull market can be eased through consolidation. Additionally, oscillators must oscillate; so, even if we continue higher, these indicators could eventually pullback in mean reversion style. I just wouldn't count on it.

Today rally was very impressive on the daily chart and you can see that the PMO steepened on the price rise. The PMO is not particularly overbought and the OBV looks great.

It's the Swenlin Trading Oscillators (STOs) which are commanding my attention. They continue to rise into extremely overbought territory. They are beginning to decelerate and turn back down. I've annotated similar conditions and they generally finish with a pullback or consolidation. I'm looking for a pullback toward the breakout point sooner rather than later and likely consolidation to follow.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**