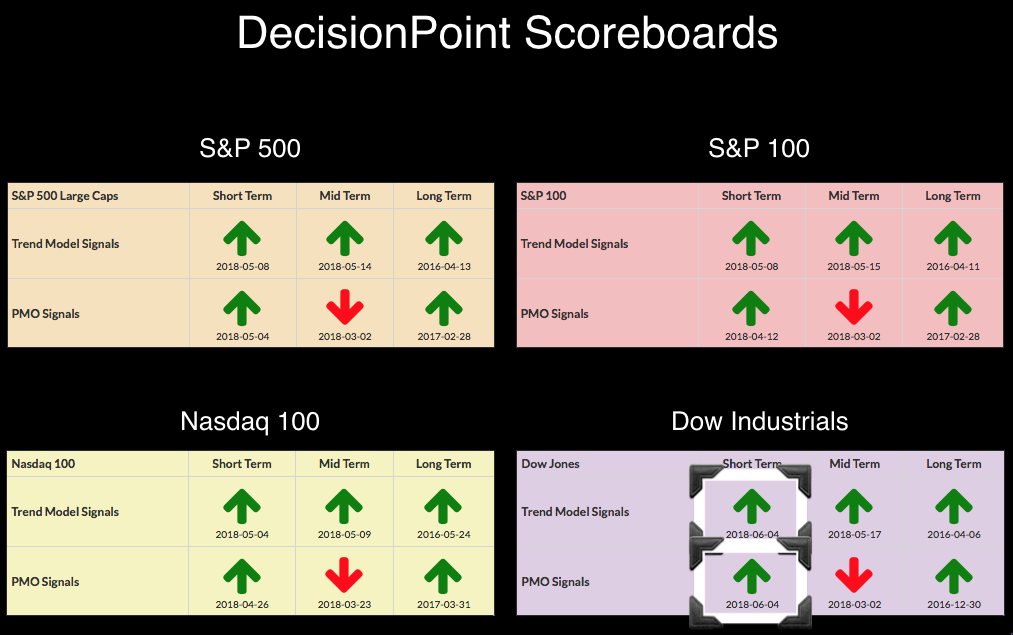

After yesterday's strong rally, the Dow managed to drop its bearish signals and collect two BUY signals in the short term. Today, the Dow was down slightly, but it didn't affect these signals which remained after the close. The indicators for the Dow are looking healthy now so I suspect these BUY signals will remain intact.

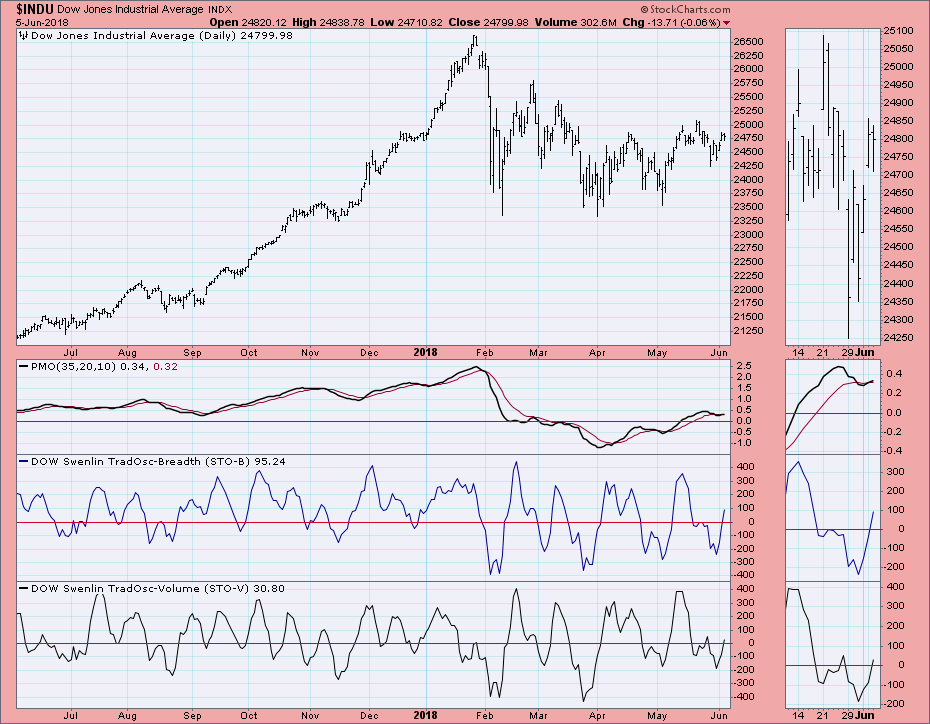

The Short-Term Trend Model BUY signal was triggered when the 5-EMA crossed above the 20-EMA. Yesterday's strong rally brought price well above both of those EMAs, so much so that unless price drops below the 20-EMA, that BUY signal will remain. The PMO has a very thin margin between it and its signal line, so it could be subject to whipsaw if we see a strong decline.

The short-term Swenlin Trading Oscillators (STOs) are rising strongly and sitting in neutral territory. They can certainly accommodate more upside.

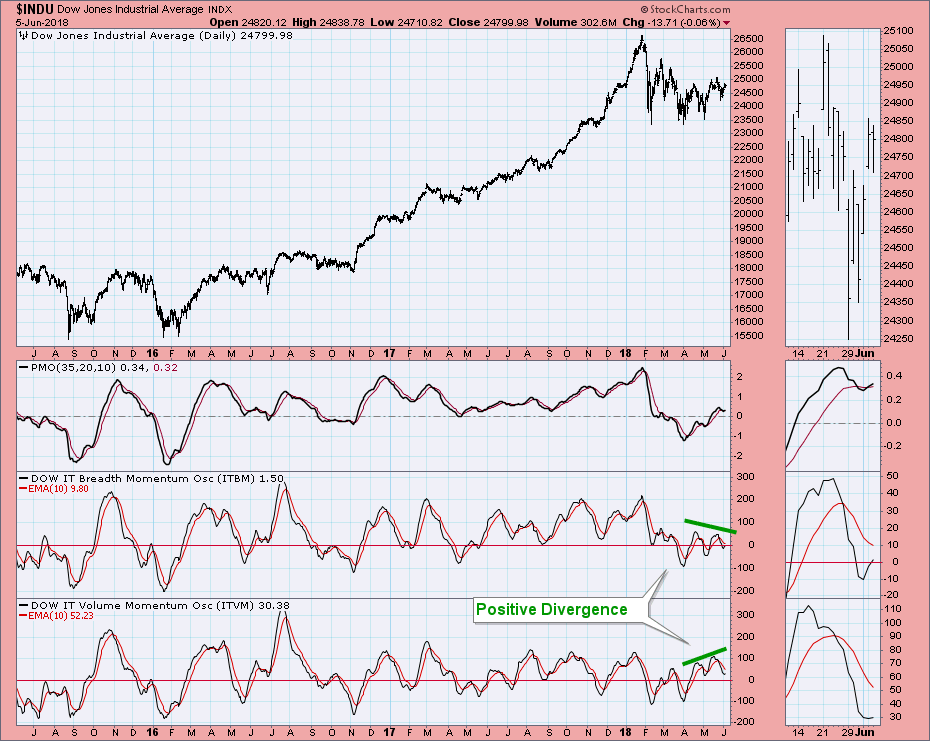

IT indicators are mostly bullish. They are rising back toward their signal lines for a positive crossover, all while preserving their rising trend. I noted a positive divergence in that we are seeing rising tops on volume indicators (as well as oscillation above the zero line), despite weakness in breadth which shows lower tops. I would like to see both have higher highs because technically, the declining tops line on the ITBM and rising tops on corresponding price peaks is a negative divergence. There's an adage that I believe is attributed to Joe Granville, "volume leads price". This is why I believe the rising tops on the ITVM confirm the rising tops on price. Yet, we can't completely discount the negative divergence between breadth and price. I still am looking for higher prices but I'm tempering bullish expectations in the intermediate term.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**