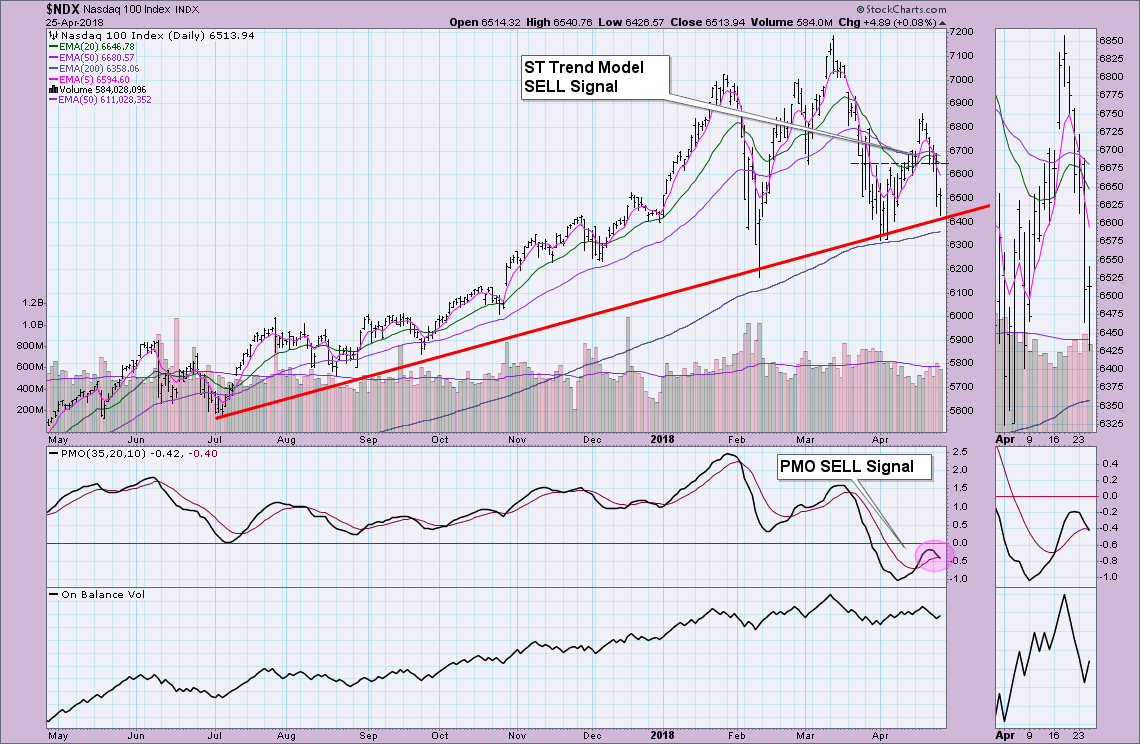

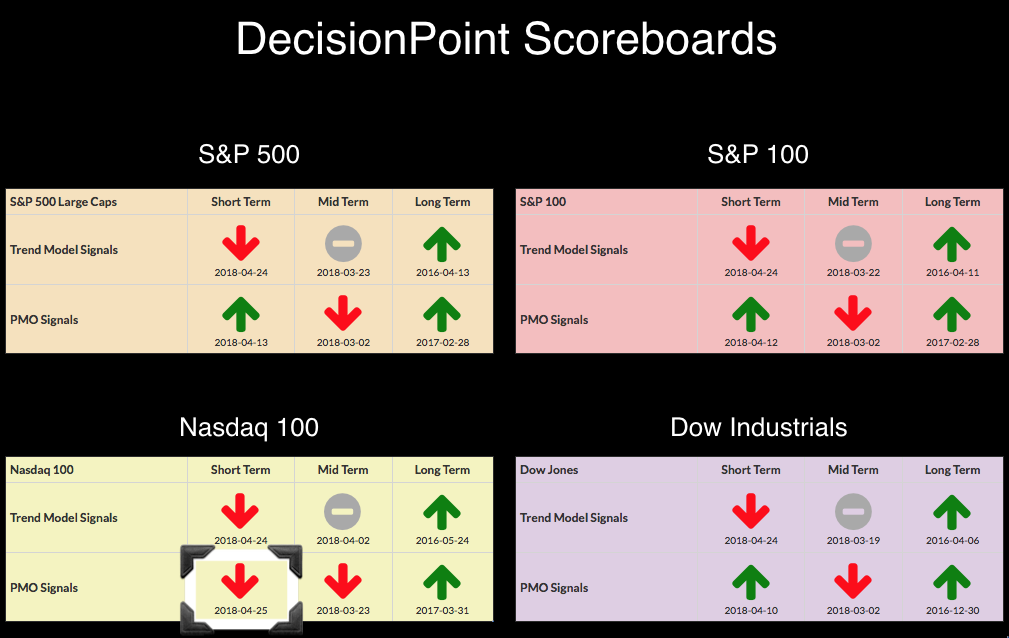

All four DecisionPoint Scoreboard indexes logged ST Trend Model SELL signals yesterday and now the NDX has added insult to injury with a new PMO SELL signal. This SELL signal was generated when the NDX Price Momentum Oscillator (PMO) crossed below its signal line.

Below is the daily chart for the NDX. I've pointed out both SELL signals. Looking from a distance at this chart, I think you could make a case for a head and shoulders pattern. The neckline would be considered sloping up, not down and shares with the longer-term rising bottoms line. The 200-EMA is critical support right now, but given the sell off and very negative short-term indicators, it could finally fail to hold above it. The other three indexes have some margin left between their PMOs and signal lines so I don't think we'll see anymore signals this week unless the sell off continues.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**