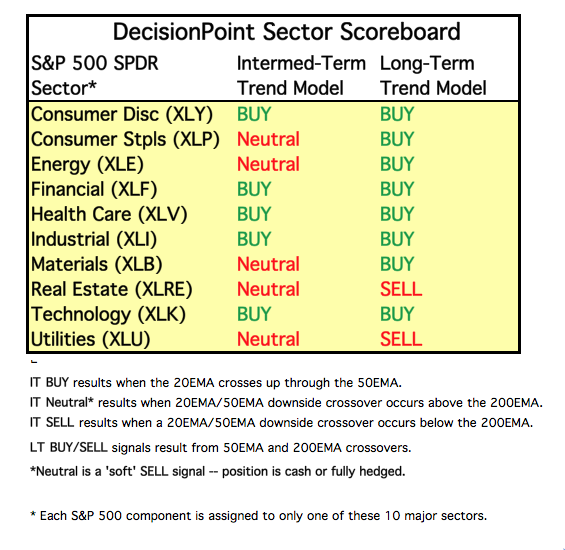

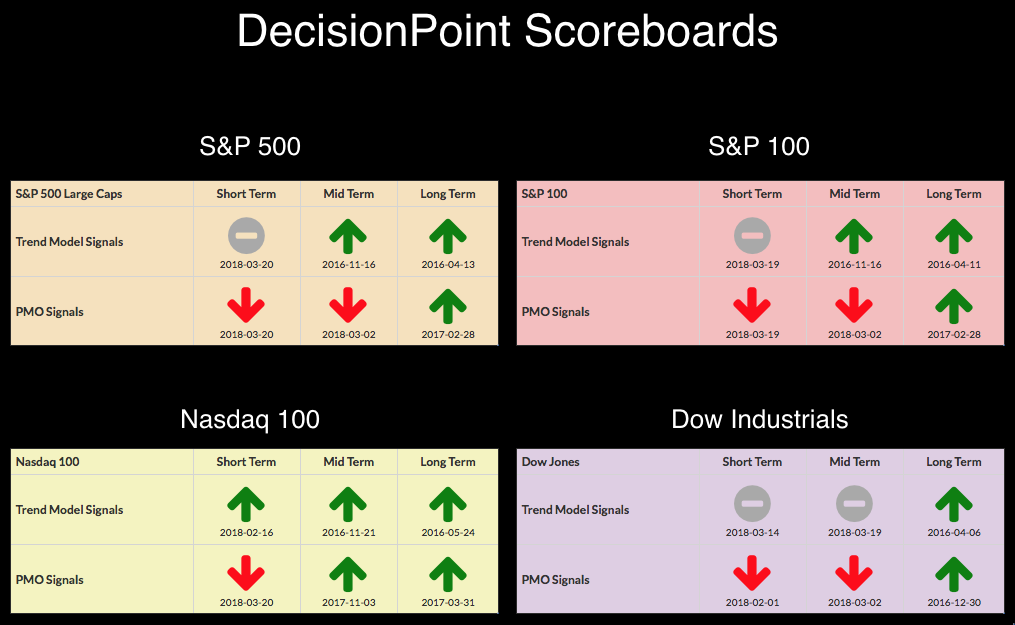

Below you'll find the latest DP Scoreboards. I've included a Sector Scoreboard that Carl and I will keep updated for analysis of sector rotation. The NDX is the only Scoreboard index holding its own. I don't think the NDX is out of the woods (see my article from yesterday) especially when we are seeing such weakness among the others.

The purpose of the DecisionPoint Alert Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine SPDR Sectors, the U.S. Dollar, Gold, Crude Oil, and Bonds. To ensure that using this daily reference will be quick and painless, we are as brief as possible, and sometimes we let a chart speak for itself.

As far as sector rotation, we are still seeing the aggressive sectors leading and the defensive sectors sitting in Neutral with Real Estate and Utilities faring the worst. If we start to see BUY signals appearing on those sectors in the neutral position right now, that means that investors are heading for the next best thing to an exit by moving into those sectors that tend to do better in a bear market.

STOCKS

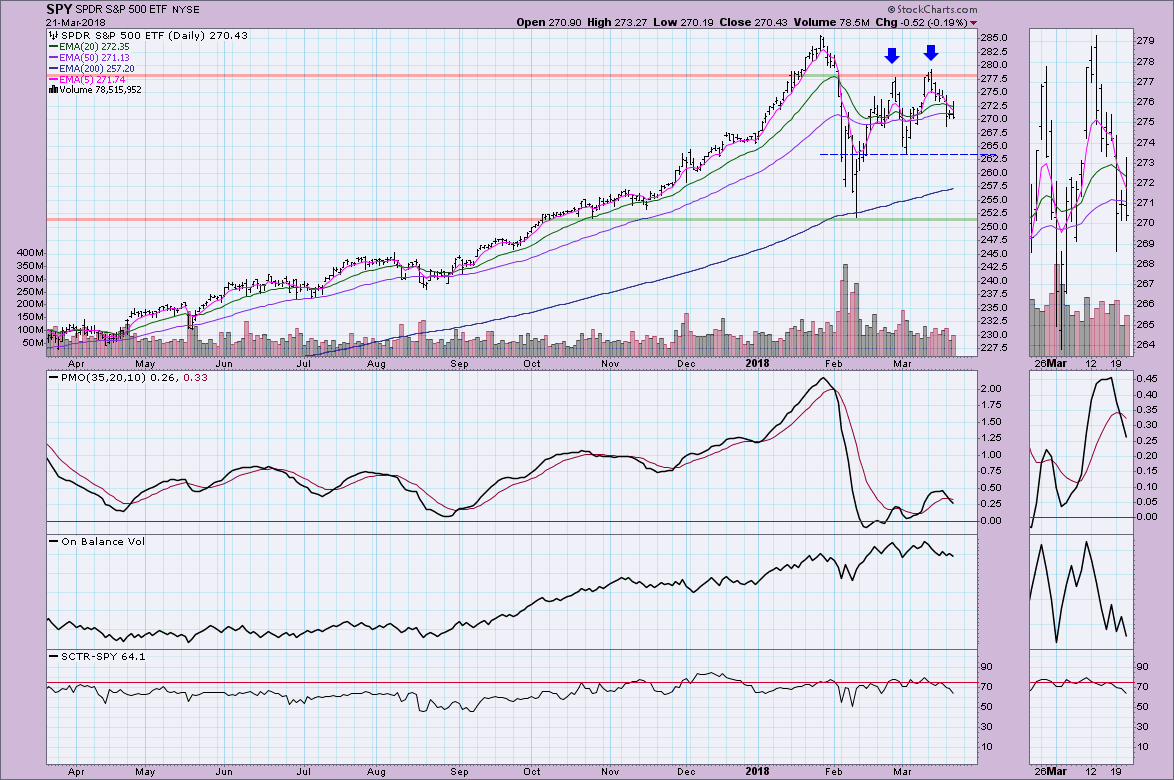

IT Trend Model: BUY as of 11/15/2016

LT Trend Model: BUY as of 4/1/2016

The SPY is holding on to very short-term support, but tomorrow will be the test. I suspect it will fail that test and head toward $268.50.

The daily chart suggests another test of the February low. I admit to being somewhat 'faked out' by this month's low, seeing it has the final test, that led to a V-bottom, not a double-top. Since failing to reach all-time highs and failing to penetrate overhead resistance at the February top, a double-top has formed. You'll see the same formation on the Dow and OEX (see yesterday's article). You can see that if the confirmation line is broken on the double-top, the minimum downside target would take price down to test the February low after all. One positive is that the PMO is still trending up since its low at the February low. OBV however is not looking healthy.

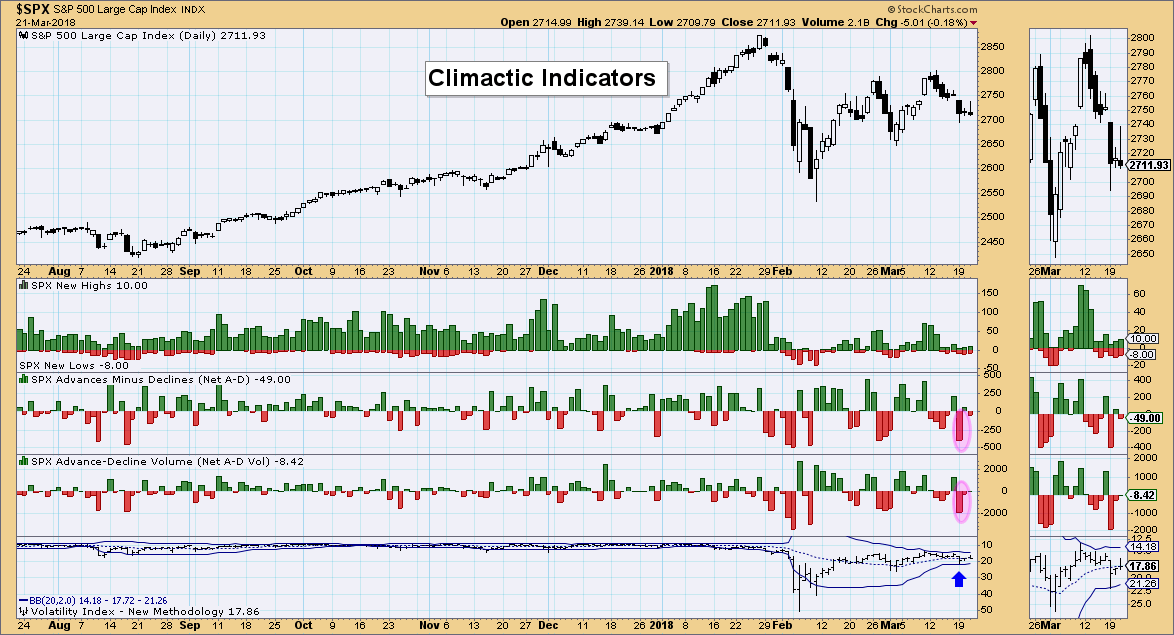

Climactic Indicators:

We had climactic readings Tuesday which I pointed out in yesterday's article. I labeled it as a selling exhaustion and typically after that you'll see a bounce. We ended up with sideways movement and that isn't favorable.

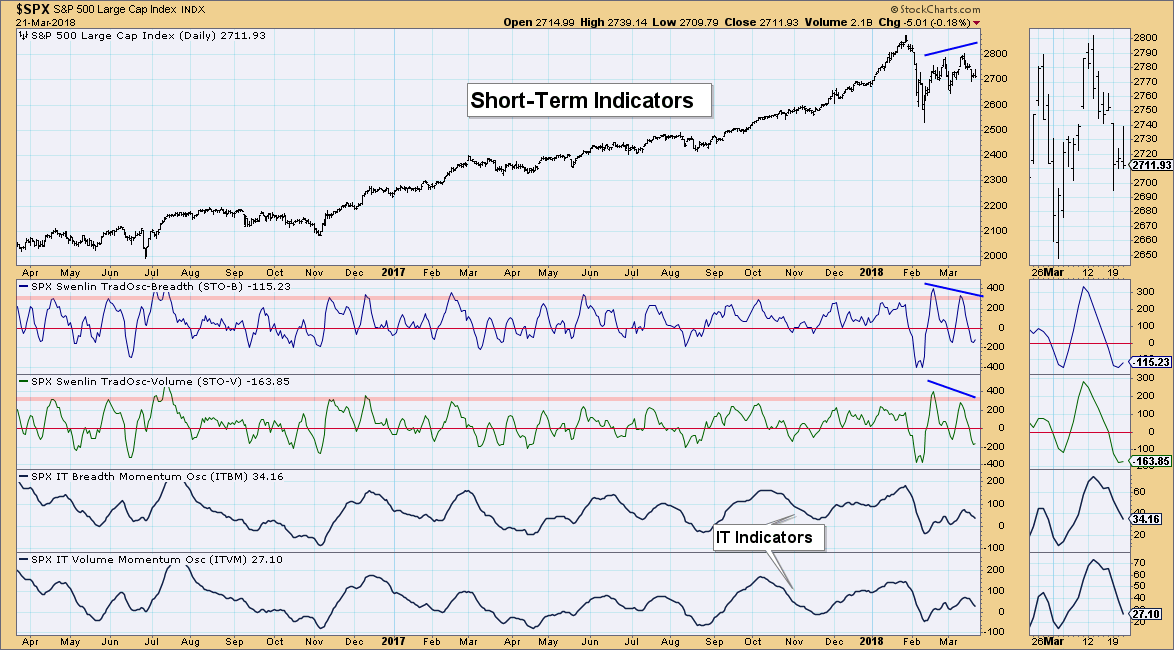

Short-Term Indicators:

These indicators are attempting to bottom. The bearish divergences on these indicators are worrisome even if we see these indicators bottom. This tells me we should see a test of this month's low.

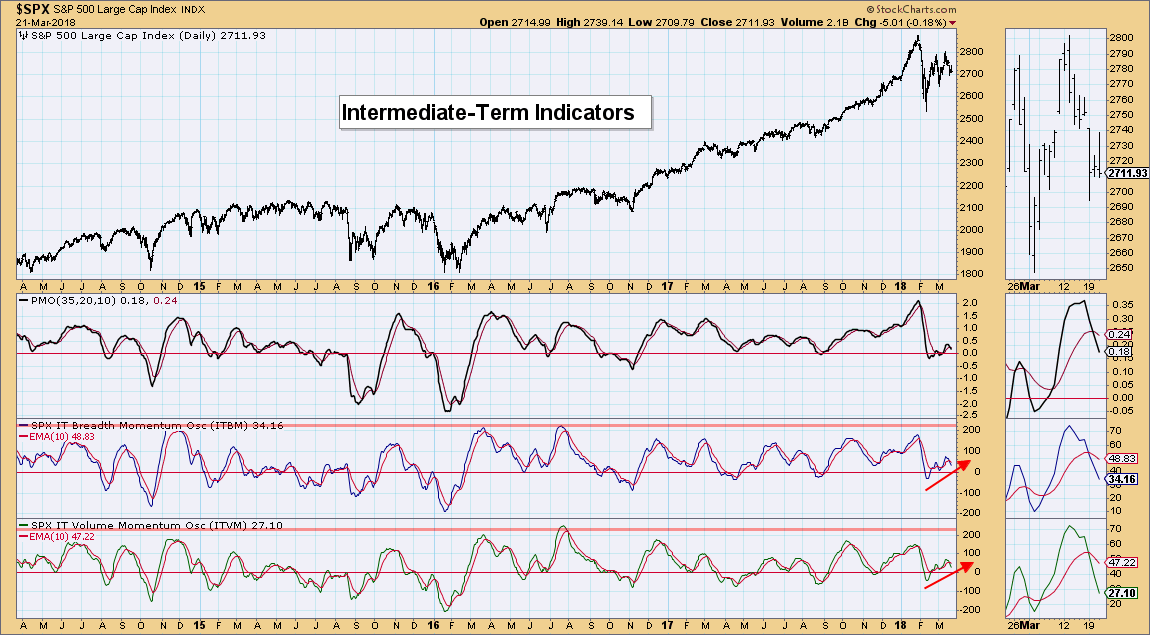

Intermediate-Term Indicators:

The ITBM and ITVM had negative crossovers this week but overall they are still trending higher. If readings drop further and break down the current rising trend, I'd be worried.

Conclusion:

The bearish bias of the daily chart as well as the indicators is an attention flag. Proceed with caution.

DOLLAR

IT Trend Model: SELL as of 12/21/2017

LT Trend Model: SELL as of 05/24/2017

I continue to wait patiently for a breakout on the Dollar. There is at least a short-term rising trend. Normally when I see the PMO rising so strongly from oversold territory, I'm happy. However, in this case, it has risen and price hasn't really gone along for the ride. So while momentum may be positive, price isn't reacting as it should. I'm still looking for a breakout, it just may not be an exciting breakout. Instead we could see more meandering in this gently sloping rising trend channel. The failed double-bottom from January/February shouldn't have been a surprise due to the LT Trend Model SELL signal, but the set-up was very good. More proof that a long-term bearish bias can thwart bullish chart patterns.

GOLD

IT Trend Model: BUY as of 1/2/2018

LT Trend Model: BUY as of 4/12/2017

With the Dollar failing to breakout, Gold has managed to hold above the confirmation line on the double-top. Today we saw a push above the declining trendline, but it still closed below. The 20-EMA is nearing a negative crossover the 50-EMA and that would give us an IT Trend Model Neutral signal. I'm still looking for a breakdown.

CRUDE OIL (USO)

IT Trend Model: BUY as of 9/7/2017

LT Trend Model: BUY as of 11/2/2017

USO broke nicely outside the symmetrical triangle. It's a continuation pattern and it activated as expected. Overhead resistance isn't very far away, but given the PMO BUY signal and strong OBV and SCTR, I suspect that resistance will be broken easily.

BONDS (TLT)

IT Trend Model: Neutral as of 1/11/2018

LT Trend Model: SELL as of 2/8/2018

TLT has been rising nicely within a wide rising trend channel. Today price poked below but closed well above. The PMO is decelerating, but given the steep pullback from the previous high, it's hung in there and I find that positive. The FOMC raising rates today could affect Bonds in a negative way, but so far this chart doesn't look that bearish yet.

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin