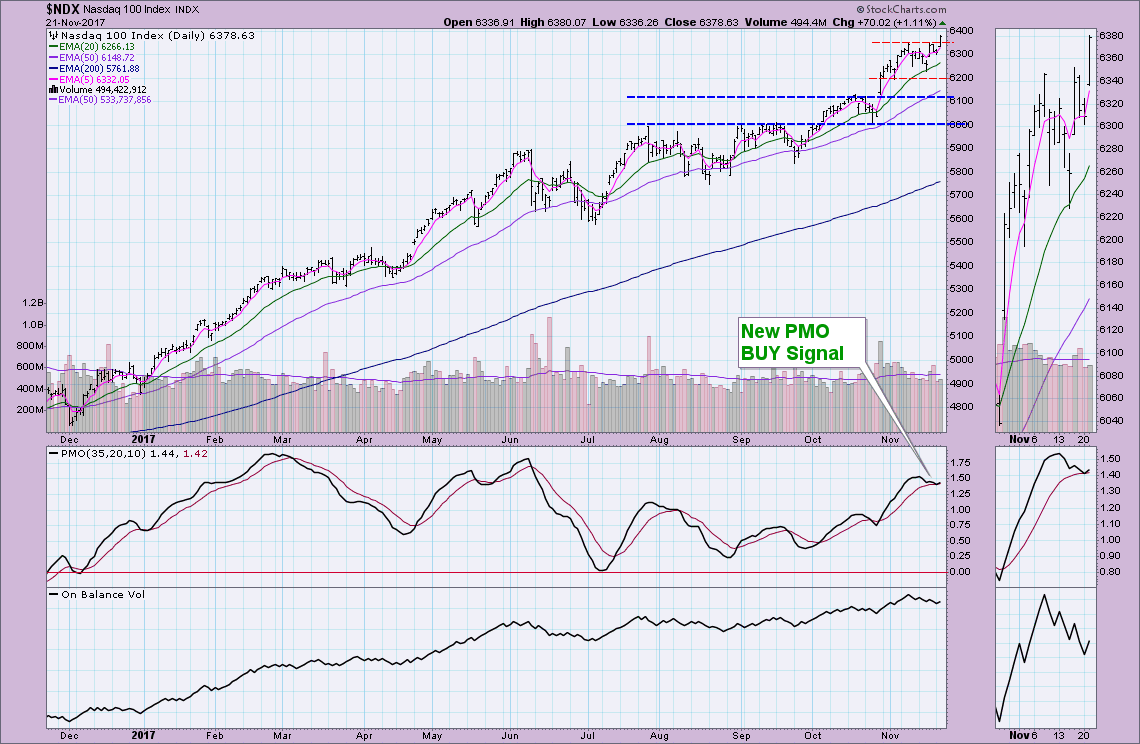

You know you're in trouble when you wake up and find a snarky tweet about the timeliness of a particular signal change. That was the case this morning when I got the tweet about the NDX PMO SELL signal that arrived after the market closed yesterday. Today, the PMO whipsawed and easily discarded the PMO SELL signal. I did mention that the margin was exceedingly thin and whipsaw could be a factor...and still could be, for that matter.

Today's breakout to new highs certainly confirms the PMO BUY signal which was triggered when the PMO crossed above its signal line. Volume isn't necessarily confirming as it dwindles, but it's a holiday week so I wouldn't read into volume. Until we get some serious margin between the PMO and its signal line, the BUY signal is shaky.

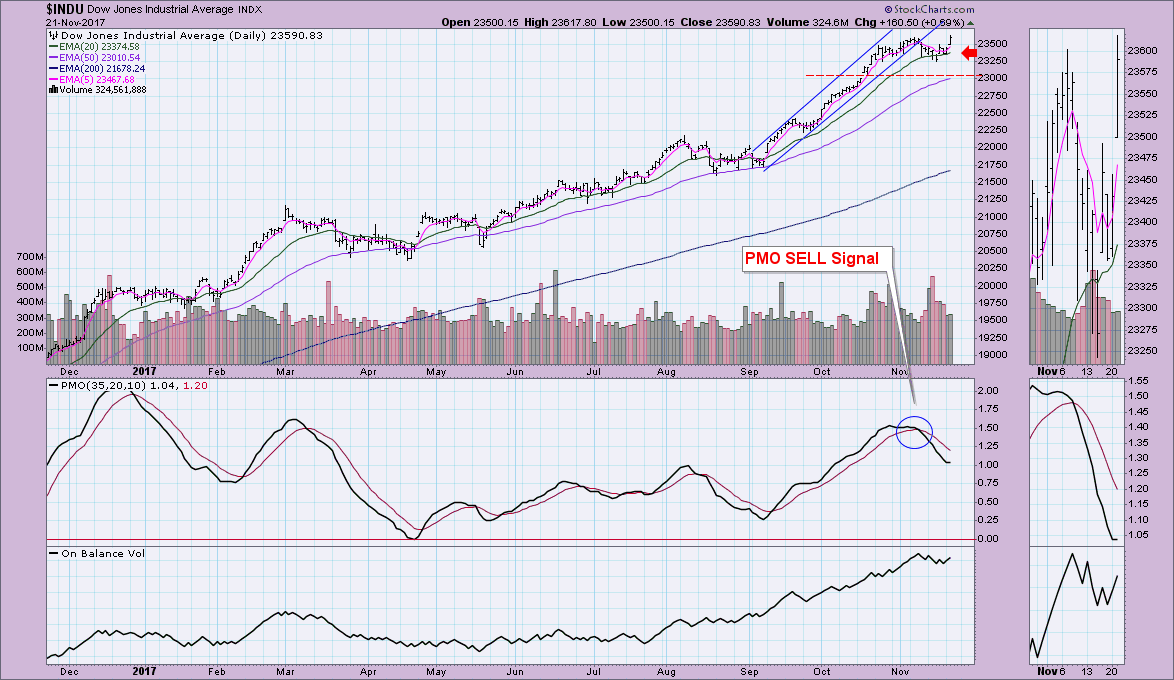

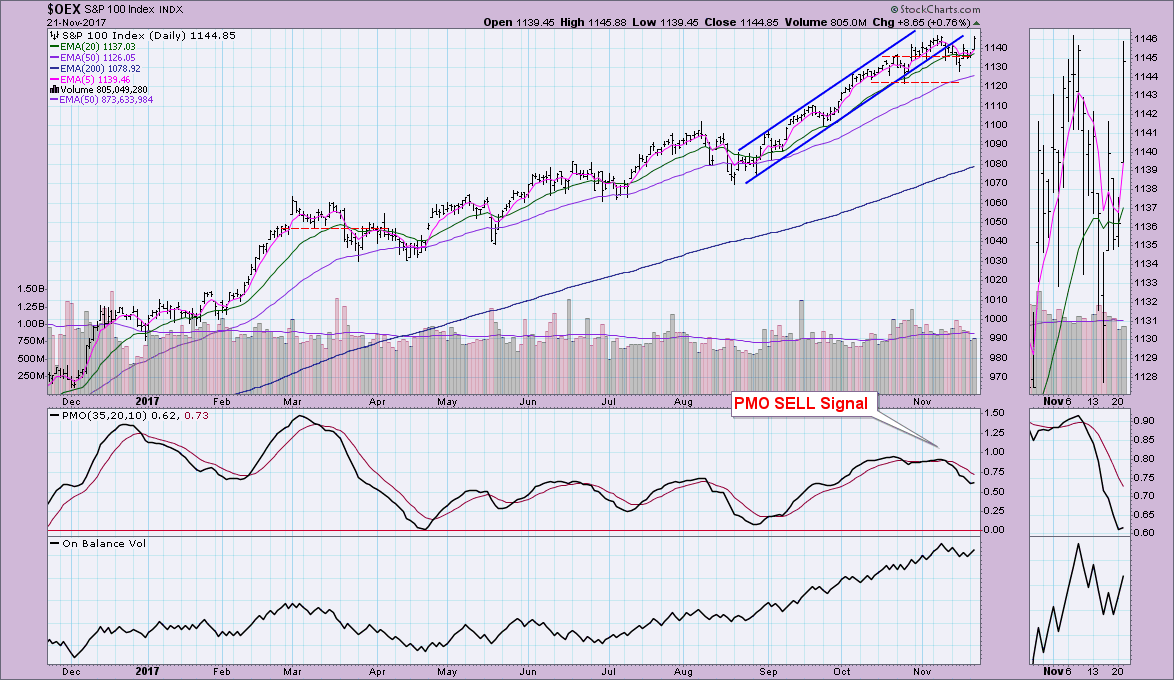

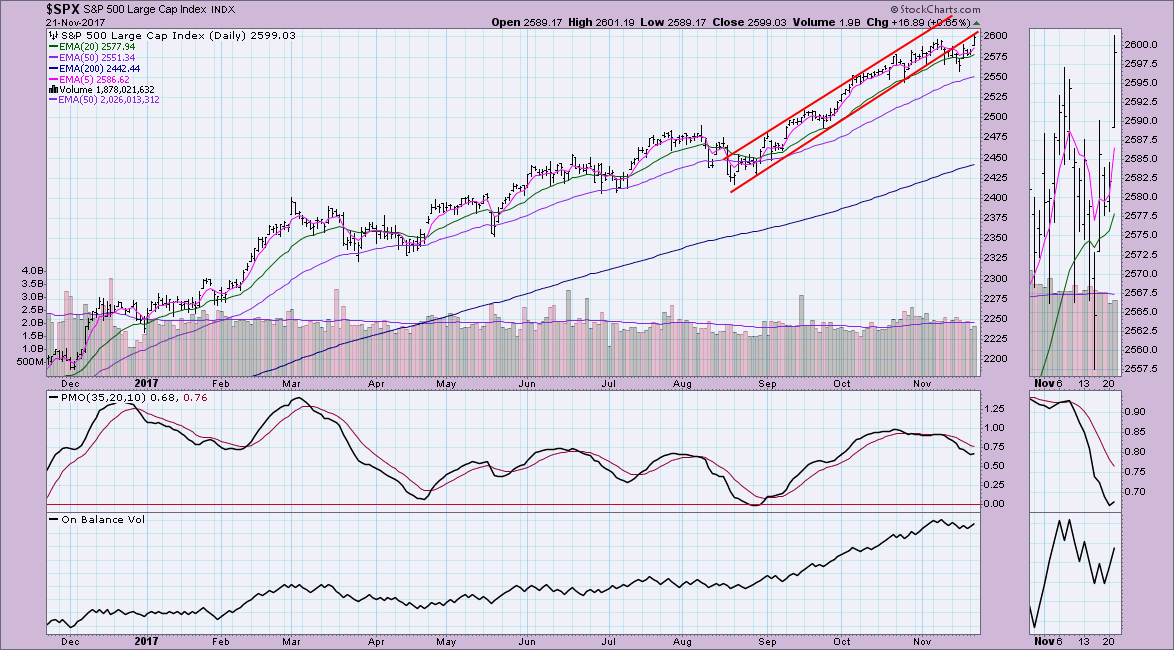

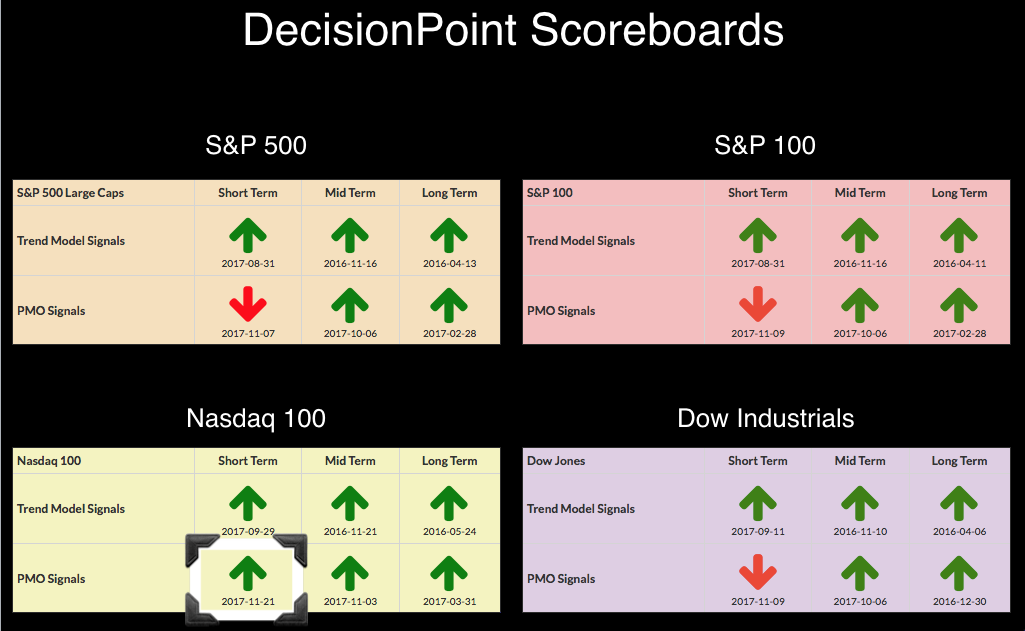

Note that the other three DP Scoreboard indexes have only managed a tick up by their PMOs. There is territory for their PMOs to scale before we even see a PMO BUY signal. With new all-time highs being logged on the SPX and Dow, I would expect to see those PMO BUY signals next month if not sooner. Santa Claus is coming to town and he usually brings a rally for investors.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**