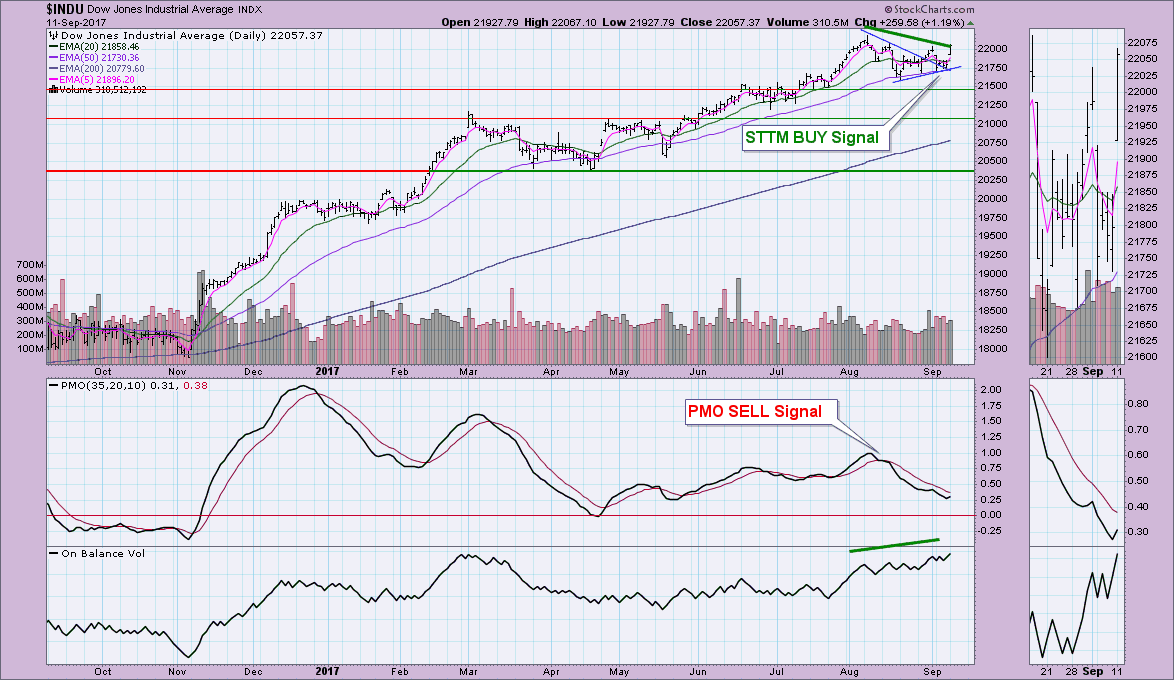

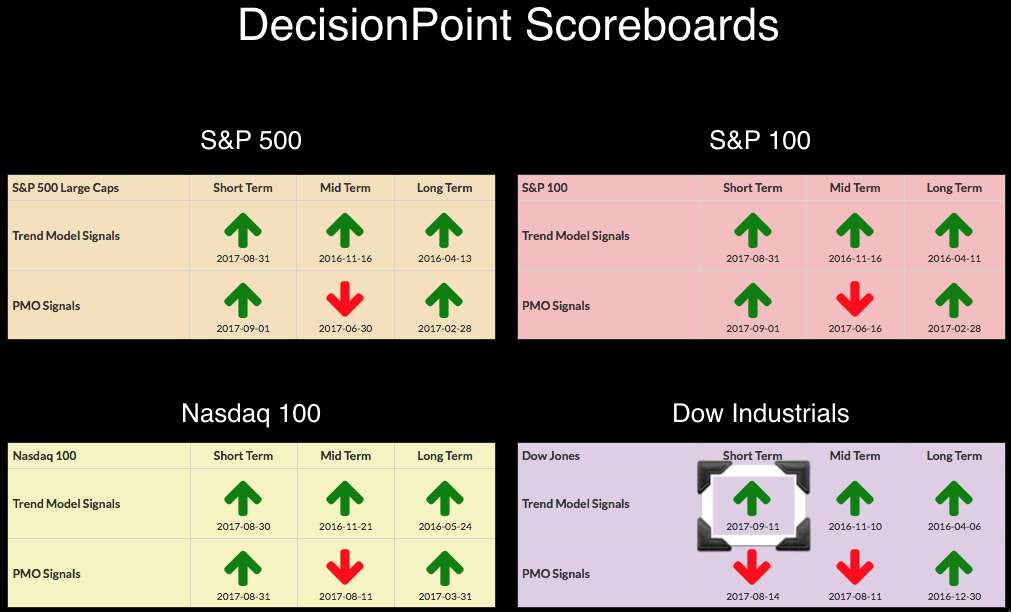

The Dow's 5/20-EMAs have been braiding and unfortunately that causes whipsaw signals. Today saw the recent 9/6 ST Trend Model Neutral signal fall away in favor of a new BUY signal. With the market hitting new all-time highs, this wasn't a surprise to anyone to see this signal appear.

The signal was generated when the 5-EMA crossed above the 20-EMA. You can see the margin, while not that thin between the two, should keep this signal intact. Any drop below the 20-EMA, however, and this signal will be canceled out. This is admittedly the trouble with the STTM, a 5-EMA is extraordinarily volatile. The positive divergence with the OBV is still in play and the PMO has turned up, so based on those technicals, I wouldn't expect to see this signal whipsaw away.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**