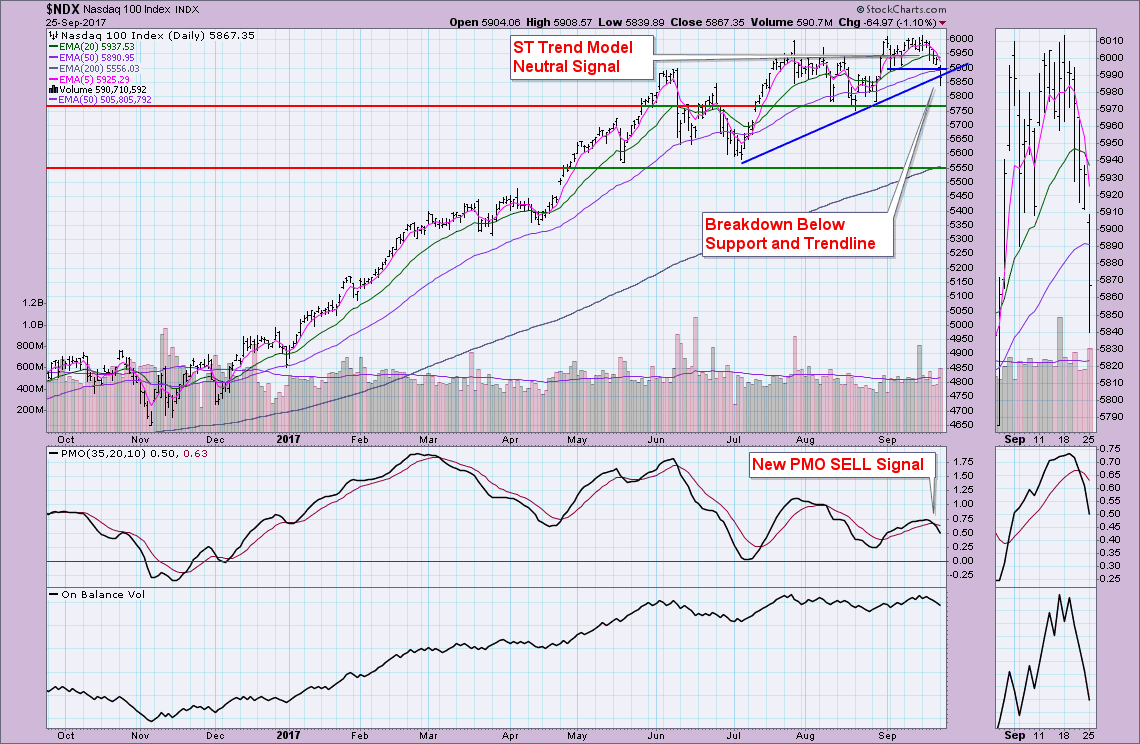

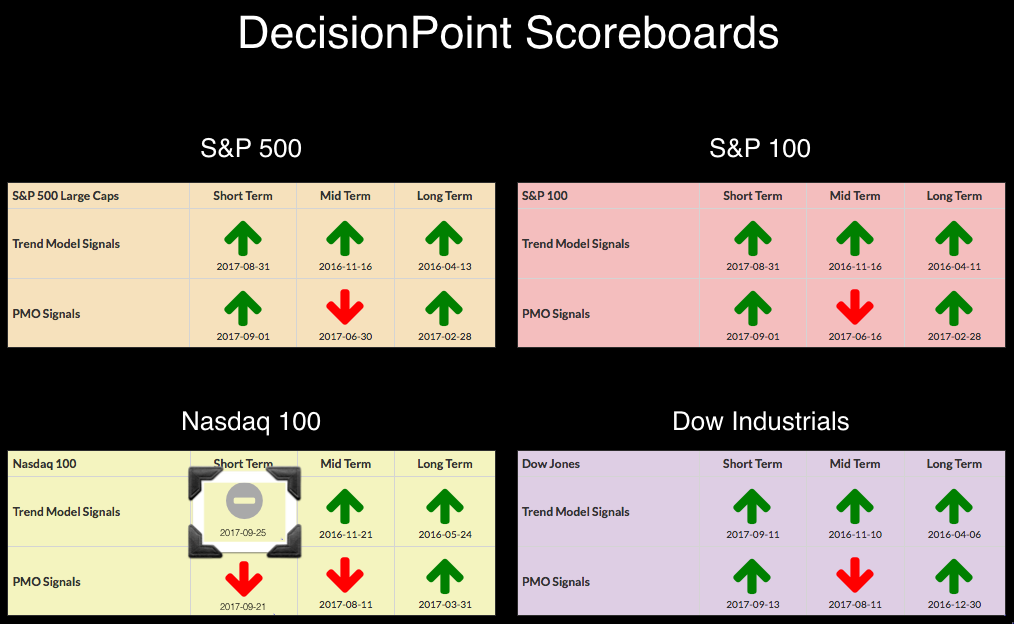

The Nasdaq 100 lost its PMO BUY signal on Friday and today it loses its ST Trend Model BUY signal (along with important support!). Natural Gas (UNG) had just picked up an IT Trend Model BUY signal, but it has whipsawed away into an ITTM SELL signal.

Today's over 1% drop on the NDX busted two areas of support that I had expected to hold. My thought was that after the pullback to earlier lows in September, the index would bounce back. Unfortunately, Apple (AAPL) has been dragging the index lower and it appears many of the other tech companies have been caught in the tide. The 5-EMA crossed below the 20-EMA which triggered the ST Trend Model Neutral signal. At this point, I would be looking for a test of the August lows. This would be a great place for technology to bounce. The PMO will likely be close to zero by that time and set up for a rally confirmation.

The 20-EMA crossed below the 50-EMA while the 50-EMA was below the 200-EMA. When the 50-EMA is below the 200-EMA, this suggests a stock or index is in a "bear market". We should expect bearish outcomes. Therefore, when we get those negative 20/50-EMA crossovers below the 200-EMA we move to a SELL. If the 50-EMA is above the 200-EMA, then we should have bullish expectations; consequently, we move to a Neutral instead of a SELL. The new PMO SELL signal combined with the new ST Trend Model Neutral signal and the new IT Trend Model SELL signal tells me this isn't a great time to enter UNG. However, it could set up a nice entry after the pullback toward August lows. The energy sector has reenergized (pun not intended) offering some interesting trades in the Oil and Gas industries.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**