While we usually focus on the large-cap market indexes, they often disguise what is happening with smaller-cap stocks. Recently I decided to delve into this question with a chart showing the relative strength of smaller-cap indexes. The first relative strength panel examines all S&P 500 stocks on an equal-weighted basis. (The S&P 500 is a cap-weighted index, and its fifty largest stocks comprise about 70% of the index weighting.) To get the relative strength line, we divided the Guggenheim S&P 500 Equal Weight ETF (RSP) by the benchmark index, SPY. Granted, RSP isn't a smaller-cap index, but it gives the smaller-cap stocks in the SPX more weight. The other two relative strength panes are for the S&P 400 Mid-Cap ETF (MDY) and the S&P 600 Small-Cap ETF (IJR). As you can see, relative strength has been falling on all three indexes since the end of 2016.

While this condition can persist for quite some time, it is not necessarily fatal; nevertheless, it is highly undesirable to have such weakness in smaller-cap stocks. Note how a similar condition in 2015 led to a broad market correction. The ideal pattern, the one that confirms the general confidence of market participants, is when the smaller-cap stocks are stronger than the large-cap stocks, such as the rising-to-sideways pattern we can see in most of 2016.

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds.

STOCKS

IT Trend Model: BUY as of 11/15/2016

LT Trend Model: BUY as of 4/1/2016

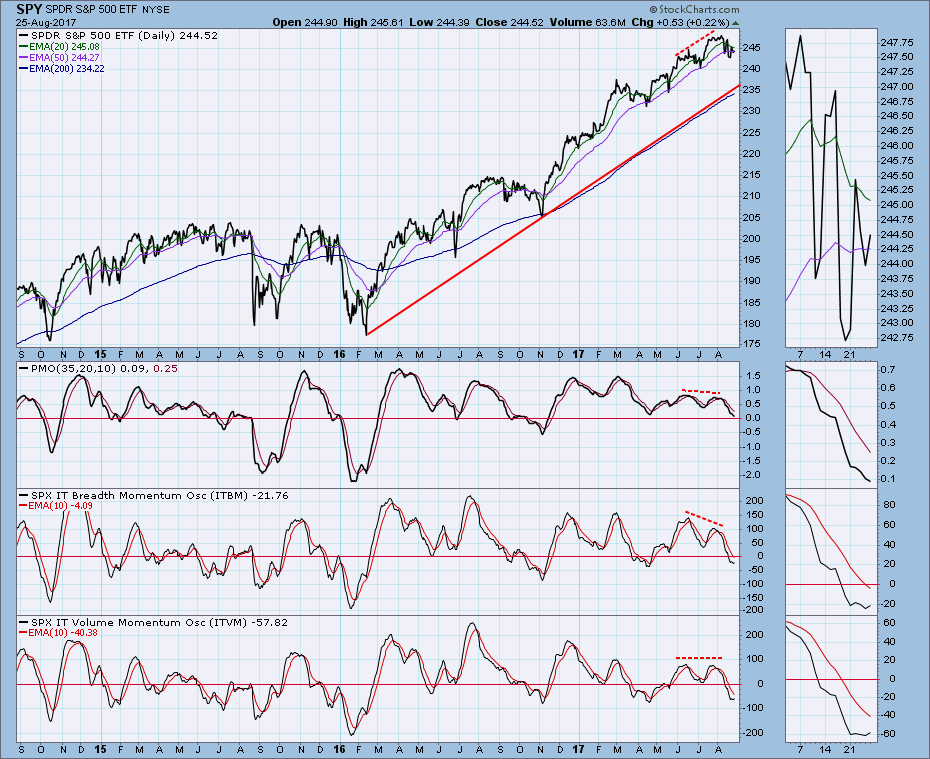

On Monday of this week stocks finished last week's decline, and Tuesday brought another oversold bounce followed by three days of consolidation; however, prices have entered a short-term down trend, and a down trend channel has been established. I note that volume on Tuesday's bounce was light (green arrows on chart), and it remained so for the rest of the week. This does not confirm the rally.

Last week the rising trend line was violated, but price seems to have recaptured it.

Last week the rising trend line was violated, but price seems to have recaptured it.

On the weekly chart price remains within the rising trend channel, but the weekly PMO has moved down from the tight sideways pattern it had maintained for months. This is not a major concern, because price has plenty of room to correct down to the rising trend line without causing major technical damage.

Short-Term Market Indicators: I'm not getting anything from these indicators this week.

Intermediate-Term Market Indicators: The ITBM and ITVM have turned up for the second time this week, and they are oversold relative to readings over the last 18 months.

Conclusion: Money is being focused on large-cap stocks and the smaller-cap stocks are weaker as a result. This is not healthy, and the market is vulnerable because of it. The lack of volume to confirm Tuesday's bounce makes me doubt that price is going to break out of the declining trend channel.

DOLLAR (UUP)

IT Trend Model: NEUTRAL as of 3/21/2017

LT Trend Model: SELL as of 5/24/2017

I'm embarrassed to say that I completely missed the reverse flag formation that had formed last week -- I interpreted it as a new rising trend. On Friday the flag broke down as we normally expect. UUP has already reached the next support, which is drawn across the August low. The daily PMO has topped below the zero line, so that support is in danger of failing.

It is no excuse, but the reason I missed the reverse flag on the daily chart is that I was more focused on the major support line drawn across the May 2016 low on the weekly chart. Price had bounced off that line, and it appeared to me that the support was going to hold. It still could hold, but the daily chart makes me think not.

GOLD

IT Trend Model: BUY as of 7/31/2017

LT Trend Model: BUY as of 4/12/2017

Gold is being squeezed into the apex of a rising triangle, the top of which is the upper limit of a five-month trading range. With a rising triangle we normally expect an upside breakout, and today's breakdown of the dollar may assist that outcome. Sentiment remains bearish. Renewed weakness in the dollar makes me one click more bullish.

Gold has made a decisive break above the bear market declining tops line, and the weekly PMO is positive.

CRUDE OIL (USO)

IT Trend Model: BUY as of 8/1/2017

LT Trend Model: SELL as of 3/9/2017

USO has been struggling with the declining tops line drawn from the January 2017 high, but it has also found support on a shorter-term declining tops line. Its reluctance to decline offers some hope that we may see another breakout attempt.

While the weekly PMO is positive, it looks ready to top. Note that the declining tops line is within the horizontal trading channel.

BONDS (TLT)

IT Trend Model: BUY as of 3/31/2017

LT Trend Model: BUY as of 6/16/2017

TLT has been pushing hard at the top of a rising wedge pattern. We normally expect this pattern to resolve downward, but an upside breakout seems more likely at this point.

TLT looks healthy in this time frame: positive EMAs, rising price trend, weekly PMO rising above the signal line.

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Carl

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)