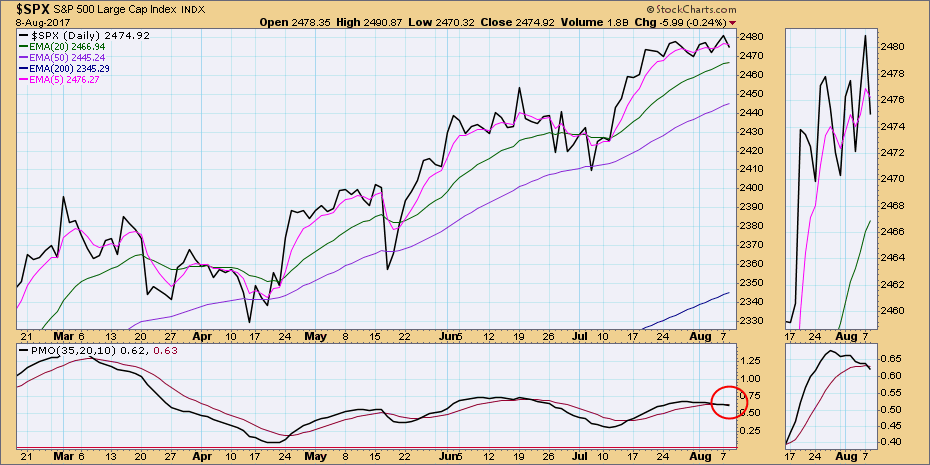

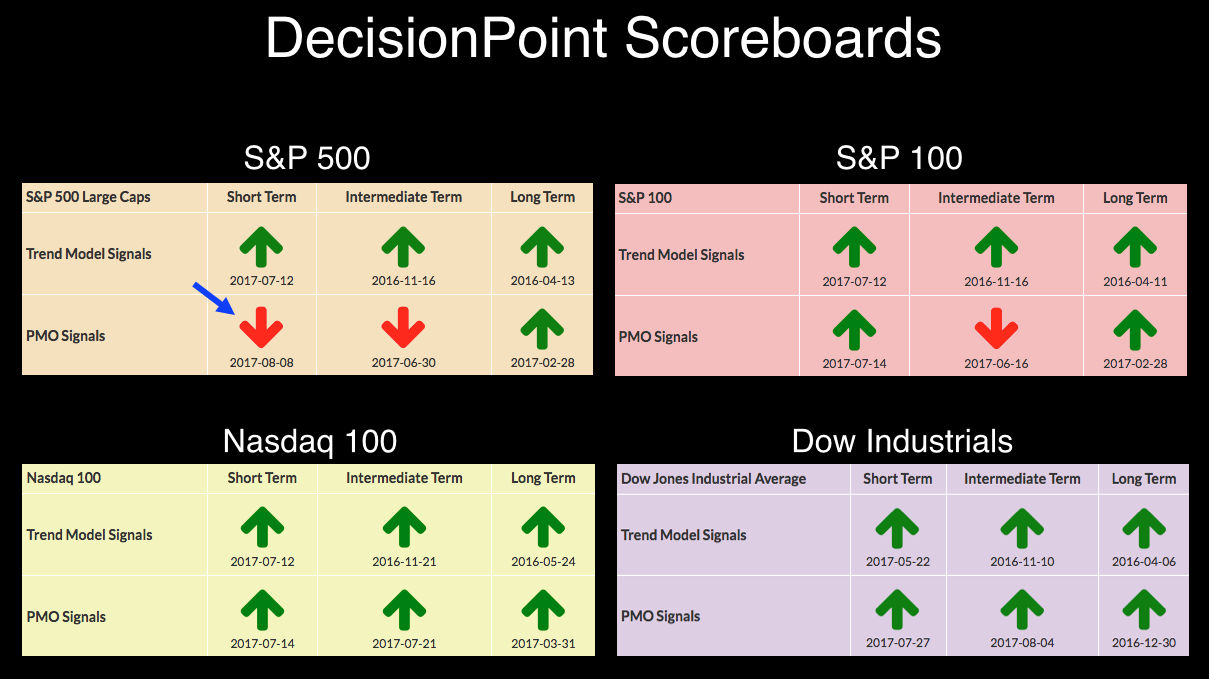

Today on the daily chart the $SPX PMO dropped below its signal line and generated a short-term PMO SELL signal. More notable, price opened and traded higher, but then it reversed and closed lower -- a key reversal day.

The line chart shows the modestly overbought PMO topping, then falling through its 10EMA.

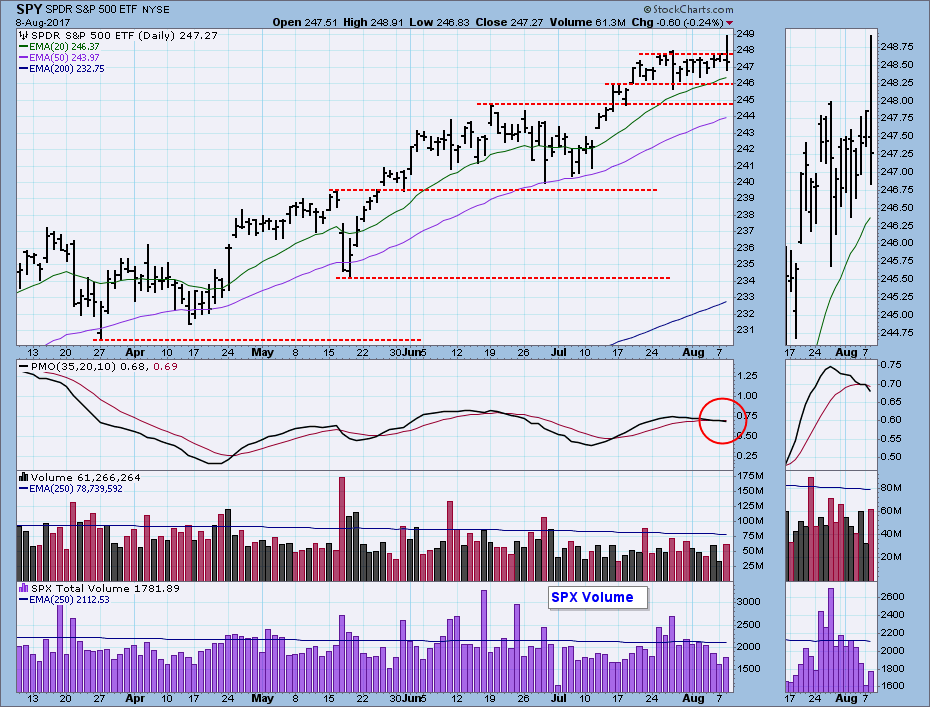

The key reversal is obvious on the daily bar chart below. Note that volume for both SPY and $SPX was well below the one-year average, so today was not a blowoff day. That is not necessarily a positive thing, considering (in my opinion) the distribution that has been taking place for the last few weeks.

Technical Analysis is a windsock, not a crystal ball.

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)