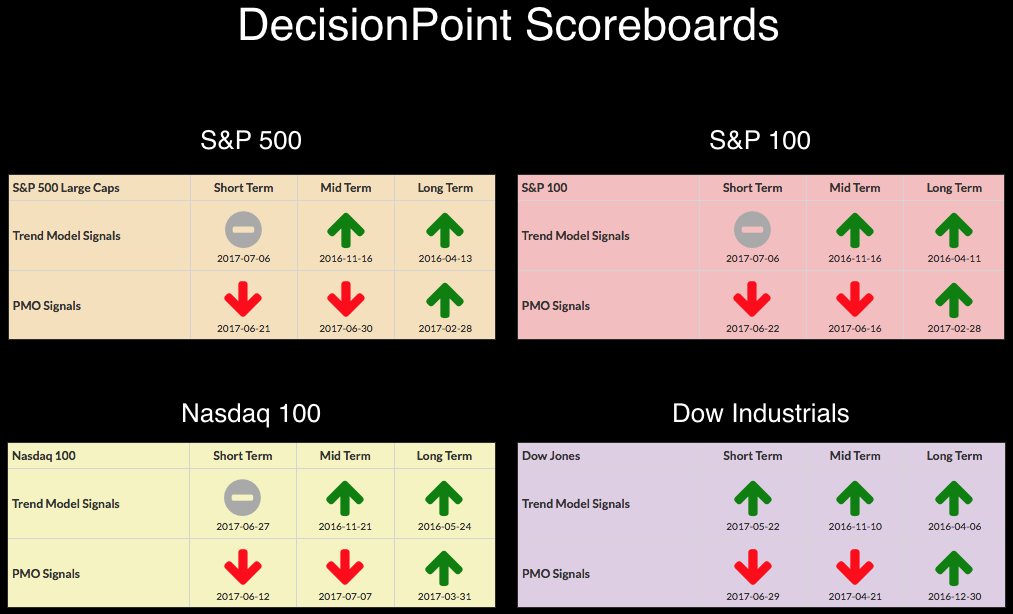

No new signal changes on the DecisionPoint Scoreboards, but we did see three new Intermediate-Term Trend Model (ITTM) Neutral signals generate on three different sectors. Utilities, Consumer Discretionary and Consumer Staples. It's odd to see both Consumer Staples and Discretionary hitting bearish signals, but I think that is a symptom of the rotation of money throughout the various sectors.

No new signal changes on the DecisionPoint Scoreboards, but we did see three new Intermediate-Term Trend Model (ITTM) Neutral signals generate on three different sectors. Utilities, Consumer Discretionary and Consumer Staples. It's odd to see both Consumer Staples and Discretionary hitting bearish signals, but I think that is a symptom of the rotation of money throughout the various sectors.

The purpose of the DecisionPoint Alert Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine SPDR Sectors, the U.S. Dollar, Gold, Crude Oil, and Bonds. To ensure that using this daily reference will be quick and painless, we are as brief as possible, and sometimes we let a chart speak for itself.

SIGNALS: Here we include charts of any important signal changes triggered today by our Intermediate-Term Trend Model.

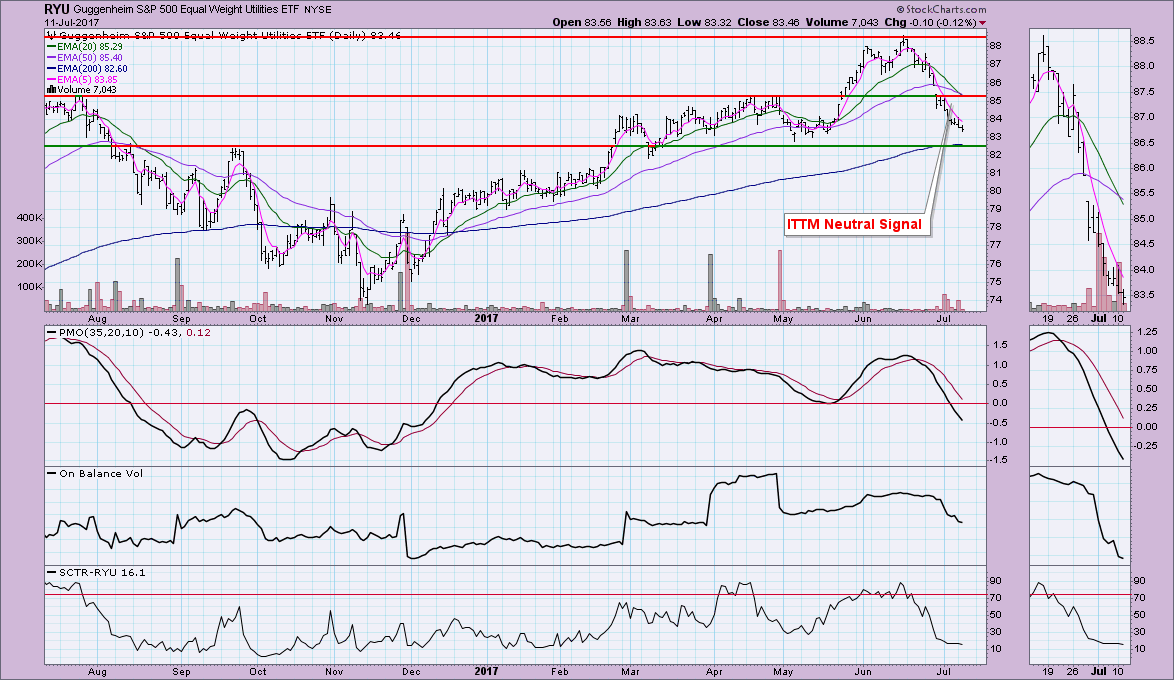

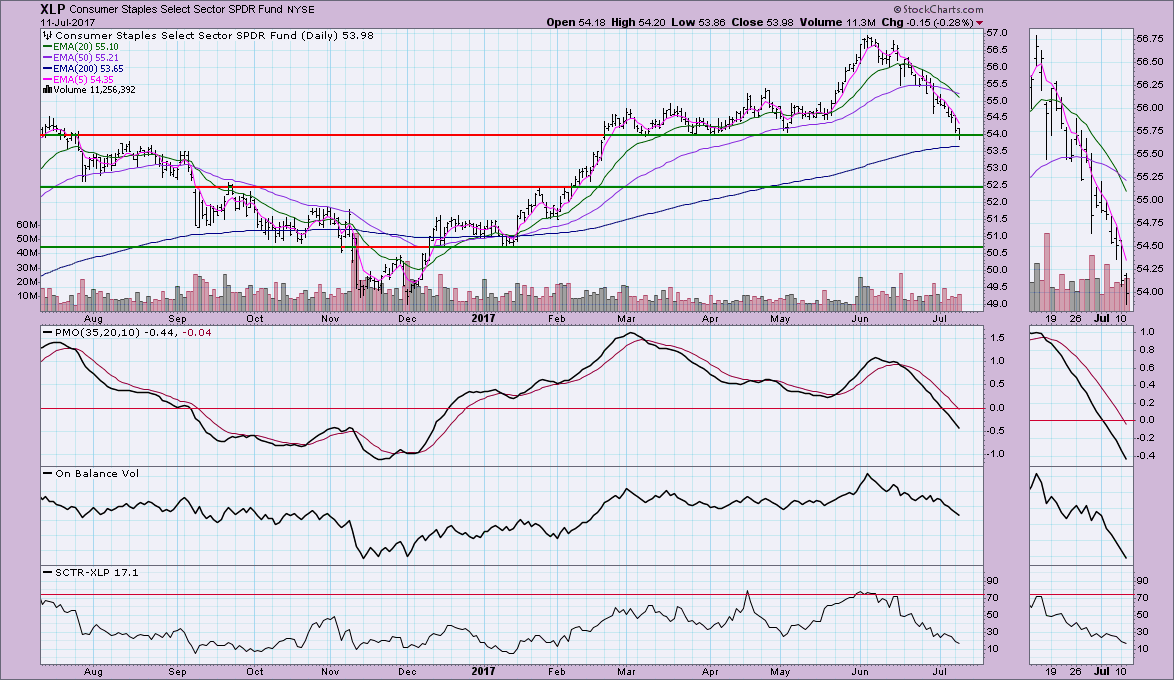

There were three new Intermediate-Term Trend Model signal changes to report from the last two days. The equal-weight Utilities ETF (RYU), the equal-weight Consumer Discretionary ETF (RCD) and the Consumer Staples SPDR (XLP) all logged ITTM Neutral signals today.

RCD probably has the most opportunity to wiggle its way out of this Neutral signal. The 20-EMA is very close to the 50-EMA, so another crossover is certainly possible. However, I like that price is now at very strong support and I see a positive divergence between OBV bottoms and price bottoms.

Neither RYU or XLP look favorable. At least RYU is nearing important support that could possibly hold. You can see the negative 20/50-EMA crossover that generated the ITTM Neutral signal.

Like RYU, there's nothing very positive about this chart. It appears that strong support at $54 is about to be broken. The indicators are all very negative.

NOTE: Mechanical trading model signals define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

STOCKS

IT Trend Model: BUY as of 11/15/2016

LT Trend Model: BUY as of 4/1/2016

The 10-minute bar charts shows a steady declining tops line that is forming strong resistance.

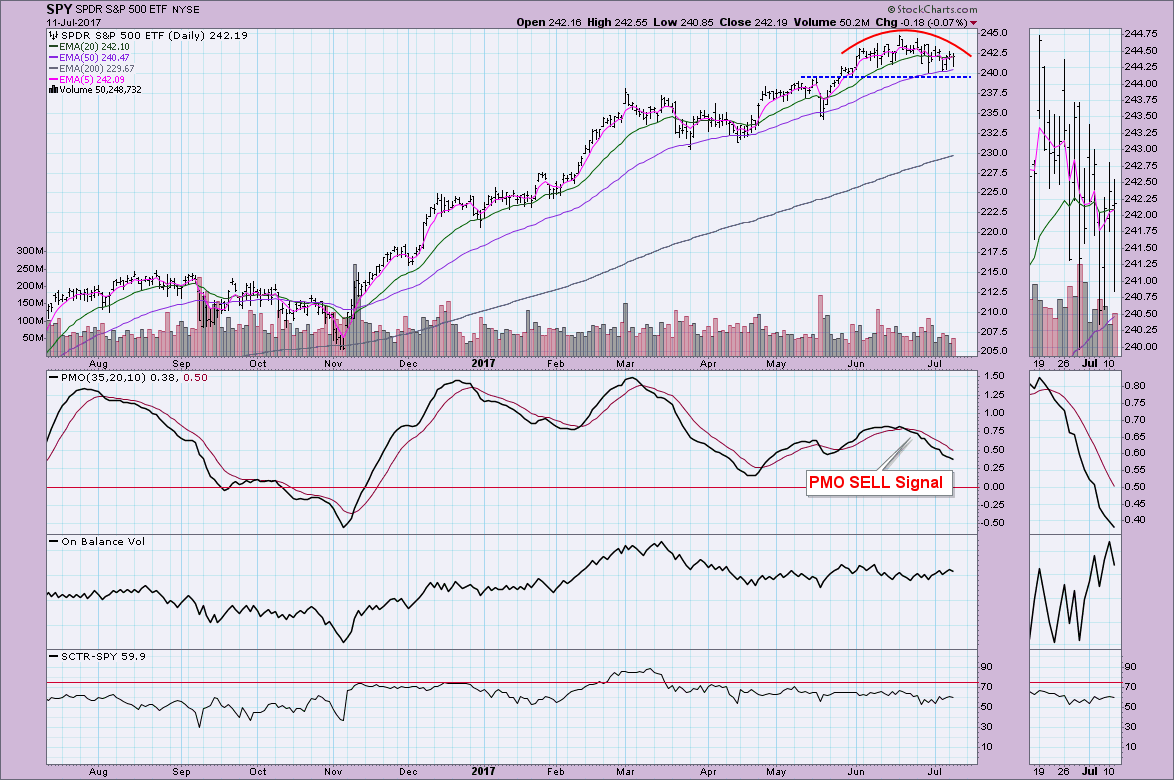

There is a rounded top on the SPY right now that suggests we will see support at $240 broken. The PMO has now traveled past its previous bottom which will set up a negative divergence when it turns back up.

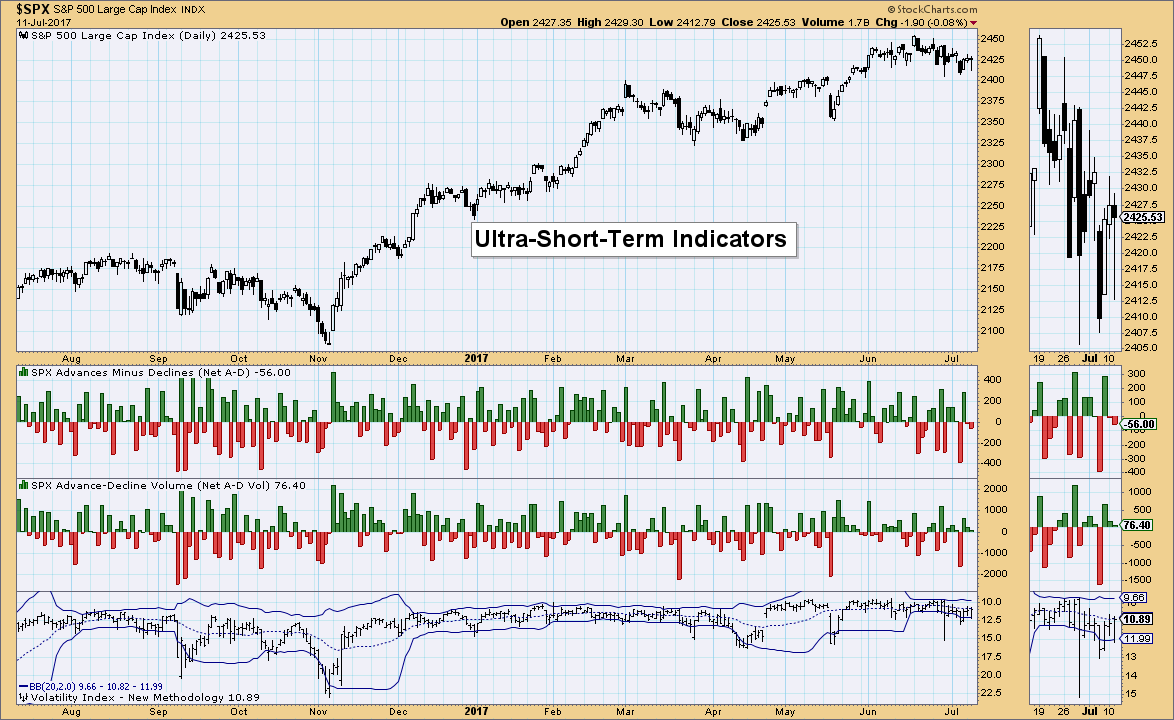

Ultra-Short-Term Indicators: No climactic readings to talk about, although the VIX did penetrate the lower Bollinger Band intraday which could speak to higher prices for part of tomorrow's trading. What we want to see is comparable climactic breadth readings like we had last Thursday. Since we don't see that, I don't think we will see a sustained bounce.

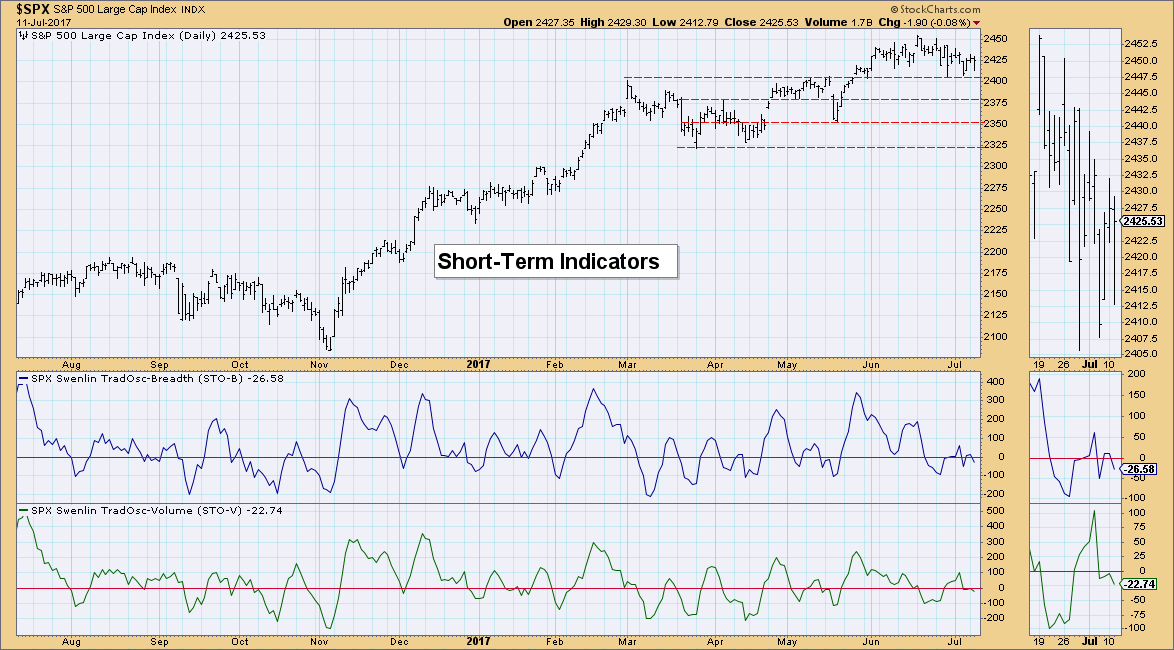

Short-Term Indicators: The market is consolidating so the short-term indicators are replicating that as they wiggle and twitch sideways. We've seen in mid-April and mid-May similar consolidation which concluded with a rally. They're pointed down right now, so I wouldn't be looking for much of a rally just yet.

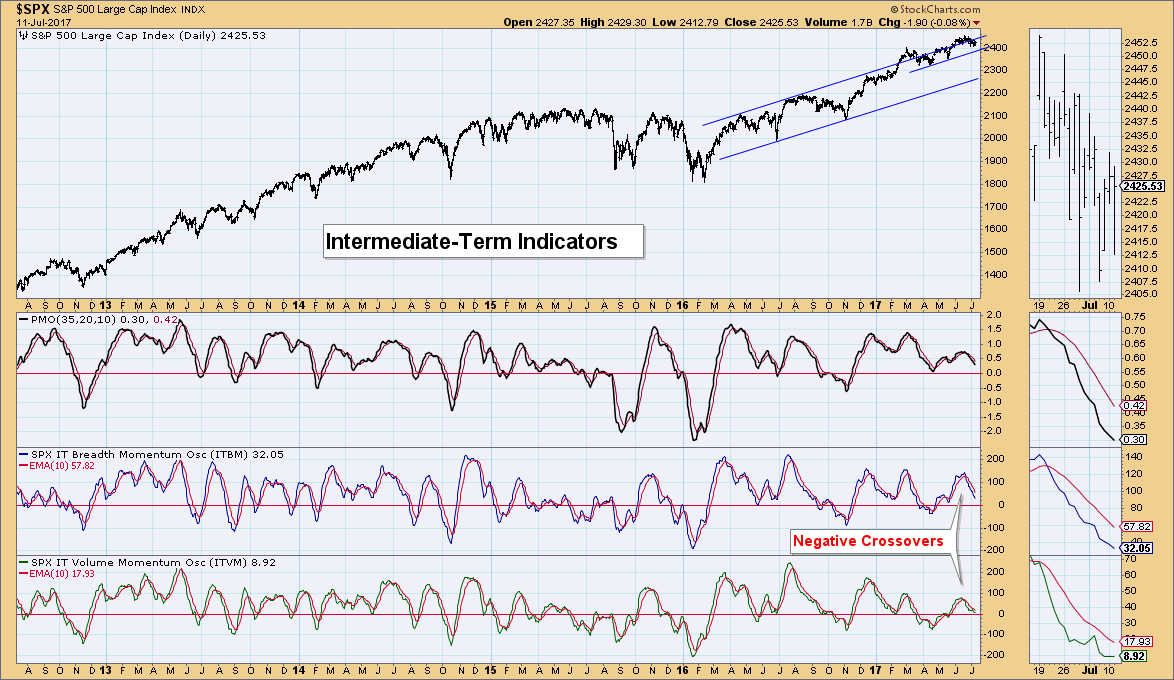

Intermediate-Term Indicators: Although the ITVM is trying to turn up, the overall trend is down. I suspect it will continue to fall until we see readings reach somewhat oversold territory. Until then, I view these as bearish.

Conclusion: Indicators are mixed. Short-term indicators are consolidating which suggests more of the same by price. However, the IT indicators are quite bearish as they sit in neutral and continue to fall. I think best case right now is more consolidation, but the indicators are worrisome, enough so that I am expecting a breakdown below $240 very soon.

DOLLAR

IT Trend Model: NEUTRAL as of 3/21/2016

LT Trend Model: SELL as of 05/24/2017

The Dollar started to mostly consolidate after its difficult journey at the end of June. Unfortunately, I see that as a possible bearish reverse flag formation. The minimum downside target would take price at least to support at $24.30. Given the negative indicators, I would say that support has not yet arrived for UUP.

GOLD

IT Trend Model: Neutral as of 6/29/2017

LT Trend Model: BUY as of 4/12/2017

The double-top neckline has been penetrated, but it appears that Gold wants to bottom here, not continue lower. In the thumbnail, you can make out a positive divergence between the last two OBV bottoms and price bottoms. The PMO and SCTR are bearish, so I doubt that support is going to hold here.

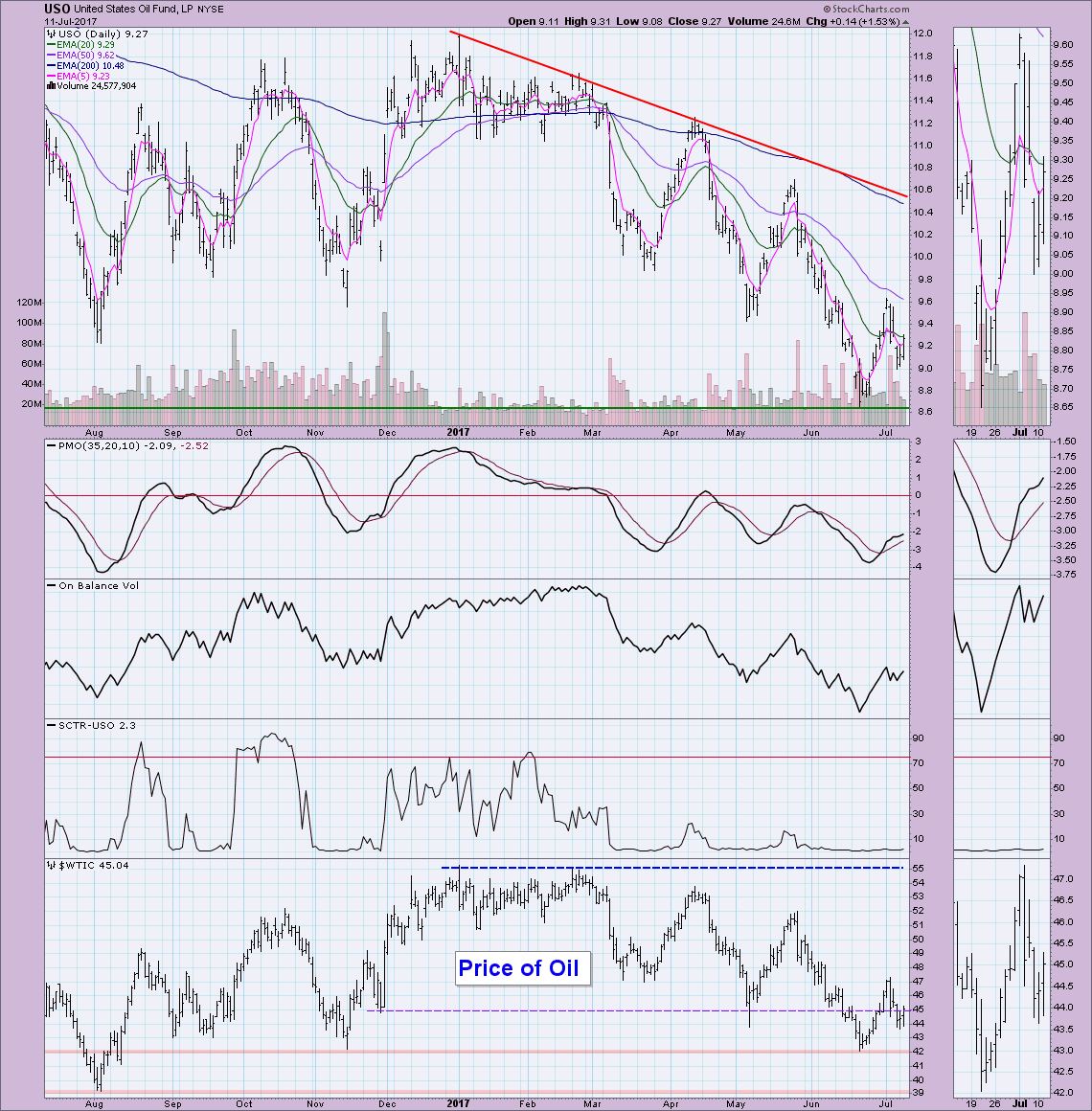

CRUDE OIL (USO)

IT Trend Model: NEUTRAL as of 3/8/2017

LT Trend Model: SELL as of 3/9/2017

USO has been very volatile and I don't think it is over yet. It put in a bottom at $8.60. What's frustrating is that price keeps breaking slightly above resistance and then it falls apart. Right now $9.00 is forming support and $9.60 is overhead resistance. The PMO looks good, I'd just like to see volume patterns with the OBV improve.

BONDS (TLT)

IT Trend Model: BUY as of 3/31/2017

LT Trend Model: BUY as of 6/16/2017

TLT is pausing just above support at $121.50. Given the ugly indicators, I have to say this support level will likely collapse. The next area of short-term support would be at the March low around $119. Unfortunately, I think we will see it drop down to the $115 level next.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**