I love to use the Advanced Scanning Workbench and find it absolutely invaluable in my investment mining process. Every other Monday, I review the PMO scan that I've chosen for the day and use the results to create my "Monday Set-Ups" symbol list. "Monday Set-Ups" is a segment where both Tom and I discuss what we think might be hot properties in the coming week or more. Now that I'm running the scans more often, I've been tweaking them as I go along. I've now got what I think is the most robust scan in my toolbox.

I love to use the Advanced Scanning Workbench and find it absolutely invaluable in my investment mining process. Every other Monday, I review the PMO scan that I've chosen for the day and use the results to create my "Monday Set-Ups" symbol list. "Monday Set-Ups" is a segment where both Tom and I discuss what we think might be hot properties in the coming week or more. Now that I'm running the scans more often, I've been tweaking them as I go along. I've now got what I think is the most robust scan in my toolbox.

First, if you're not an Extra member or above...I'll wait here while you go upgrade or join. Scanning is probably one of the most powerful tools on StockCharts.com and even more powerful is the ability to create and save your own scans. You can't do it if you aren't an Extra member or above. By the end of this article, I think you'll be convinced.

The actual scan code with comment lines is below. You can directly copy and paste this into the Advanced Scanning Workbench.

// Narrows down the universe to stocks with decent volume and from the US

[type = stock] AND [Daily SMA(20,Daily Volume) > 100000]

AND [country is US]

// Keeps the penny stocks and high volatility stocks out of your results

AND [Close > 10]

// This identifies a PMO that hasn't yet had a positive crossover its signal line

AND[today's PMO Line(35,20,10) < today's PMO Signal(35,20,10)]

// This identifies a PMO rising for three days

AND [today's PMO Line(35,20,10) > yesterday's PMO Line(35,20,10)]

AND [yesterday's PMO Line(35,20,10) > 2 days ago PMO Line(35,20,10)]

AND [2 days ago PMO Line(35,20,10) > 3 days ago PMO Line(35,20,10)]

//This ensures we get a positive IT and LT Trend Model configuration

AND [today's ema(20,close) > today's ema(50,close)]

AND [today's ema(50,close) > today's ema(200,close)]

//This identifies stocks with SCTRs greater than 75 or in the "hot zone"

AND [SCTR > 75]

I've added the comment lines (lines that begin "//") so that you can understand what the code language is asking for.

I prefer to trade US stocks that trade at least 100,000 shares in a day and are priced above $10. This keeps the highly volatile and low volume stocks out of the results. This was something I only recently added. Originally, I didn't mind getting a long list of results and I wasn't as concerned about volatility or volume. As my trading changes to quality over quantity, so does my strategy in my scans. I don't want a long list, I want a quality list.

Many times you'll get a PMO crossover BUY signal late into the rally move. I don't want to miss that shift. It does add risk jumping in early as rising PMOs don't always culminate in a BUY signal and fake outs can occur. So the PMO sections of the code look for a PMO that isn't on a BUY signal yet, but has a PMO that has been rising for at least three days.

The next section of code refers to the DecisionPoint Trend Model signals. Recall that an Intermediate-Term Trend Model (ITTM) tracks 20/50-EMA crossovers. When the 20-EMA is above the 50-EMA, that stock is currently on a ITTM BUY signal. Similarly, the Long-Term Trend Model (LTTM) tracks 50/200-EMA crossovers. If the 50-EMA is above the 200-EMA, it is on a LTTM BUY signal and is considered in a "bull market".

To finish the filtering process, I added a line that will only pull stocks that have SCTR rankings above 75. I learned from Greg Schnell that stocks above 75 are currently high performers and are showing internal and relative strength. I affectionately have named the area above 75 as the "hot zone". I want stocks that already have a great batting average. Picking low ranked stocks under the assumption they're at a bottom and are ready to improve is similar to saying "he's due!" when a low batting average player arrives at the plate. Just because he's batting low doesn't mean he'll ever be a Babe Ruth.

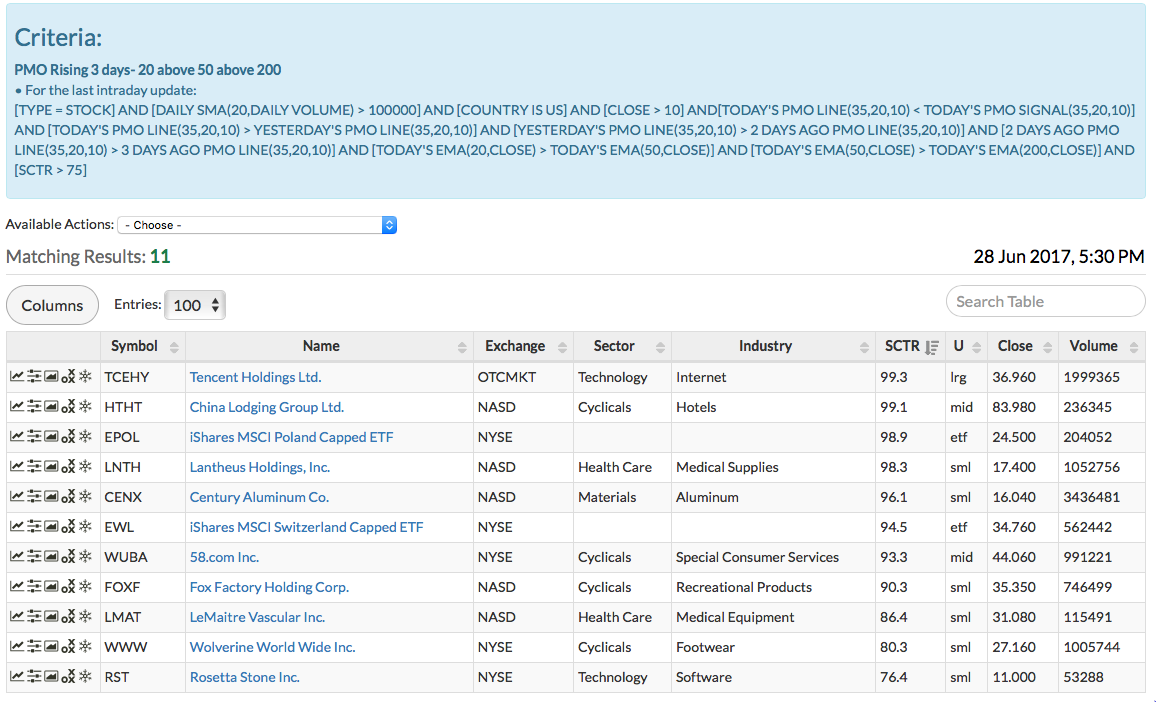

Now you know the "why's" behind this PMO scan. Here's the list that was produced on this scan today:

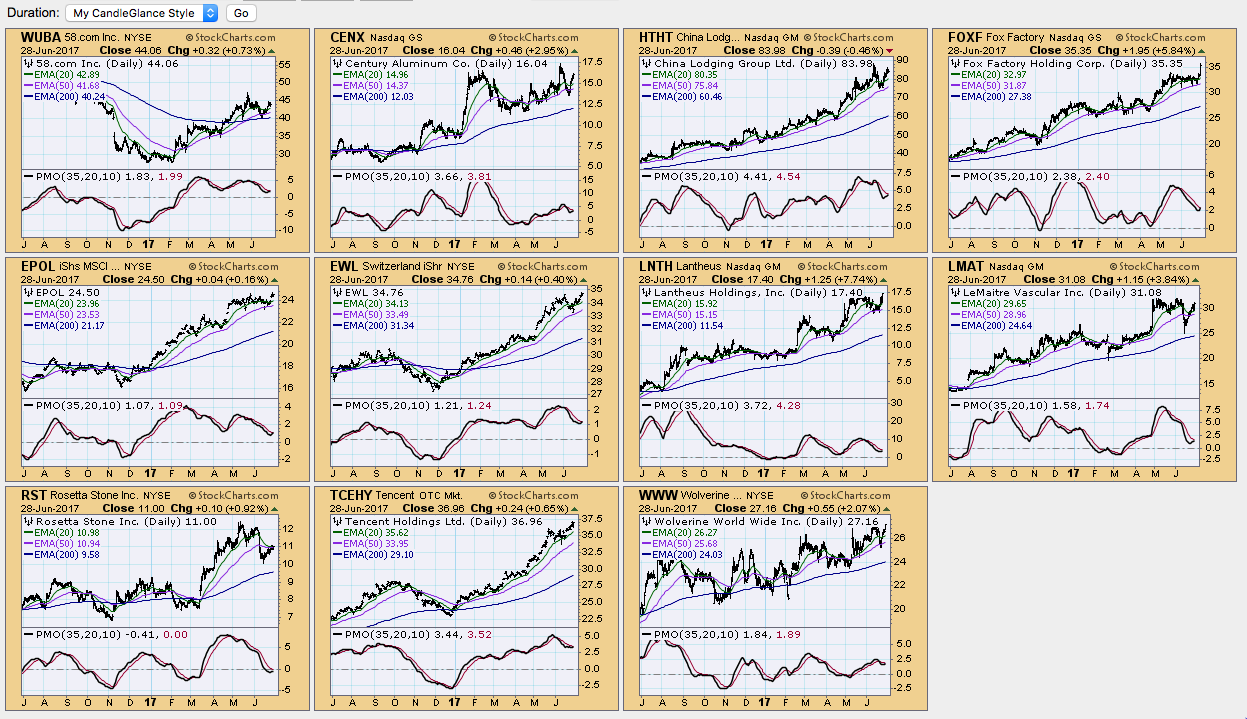

I sorted them by SCTR ranking before storing them in a ChartList. The next step for me is to look at the results in "CandleGlance". By doing this I can review far more charts at once and look for key clues to sort out the best candidates. With CandleGlance up, this is your opportunity to see the location of the PMO and any interesting breakouts or chart patterns.

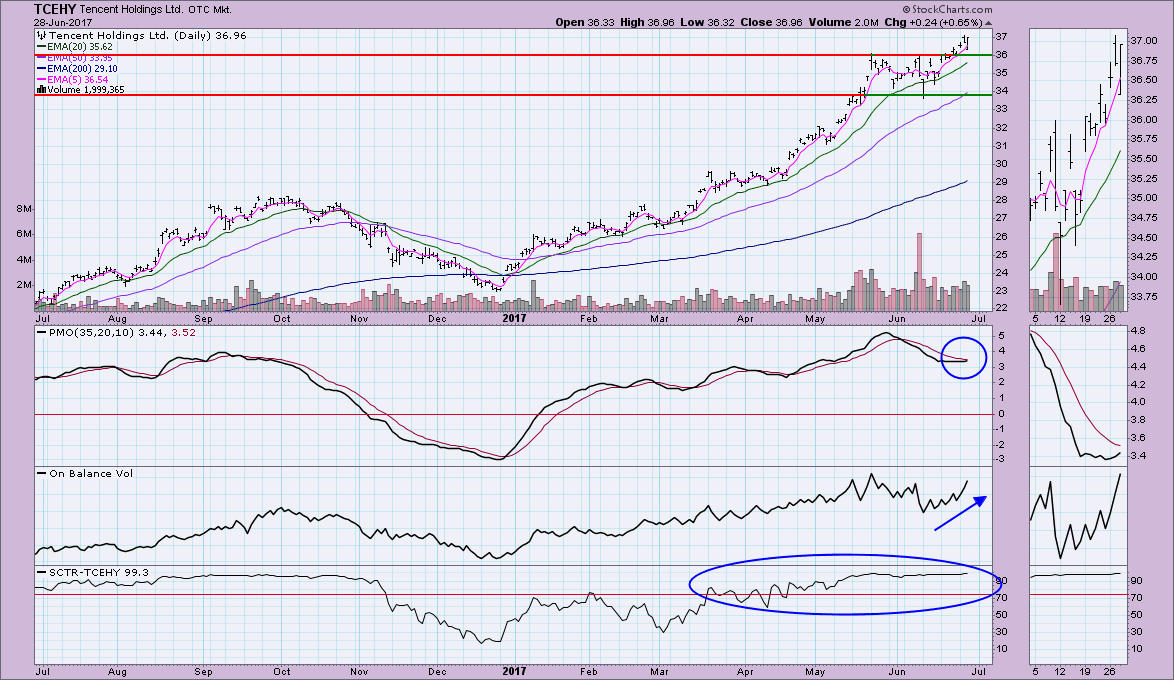

If you'd like CandleGlance to come up with your own ChartStyle like mine, simply save your ChartStyle as "CandleGlance". Two that caught my eye in the CandleGlance grouping Rosetta Stone (RST) and Tencent Holdings (TCEHY).

I like the rising PMO bottoms on RST and the nearing PMO BUY signal. Price is at key overhead resistance. A breakout could serve notice it's ready to rally higher. Reward would be a move from $11 to $12 or $12.50.

TCEHY indicators look great and you can see a recent breakout and test of support. PMO is nearing a BUY signal and even the OBV is trending higher with prices.

If you want to use customizable scans, you need to be an Extra member or above. Click on the "Your Account" link at the top right of the homepage to see what membership level you are and what's included.

While this a very powerful scan, remember these are attention flags. Trading straight off a scan or timing signal is never a good idea.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**