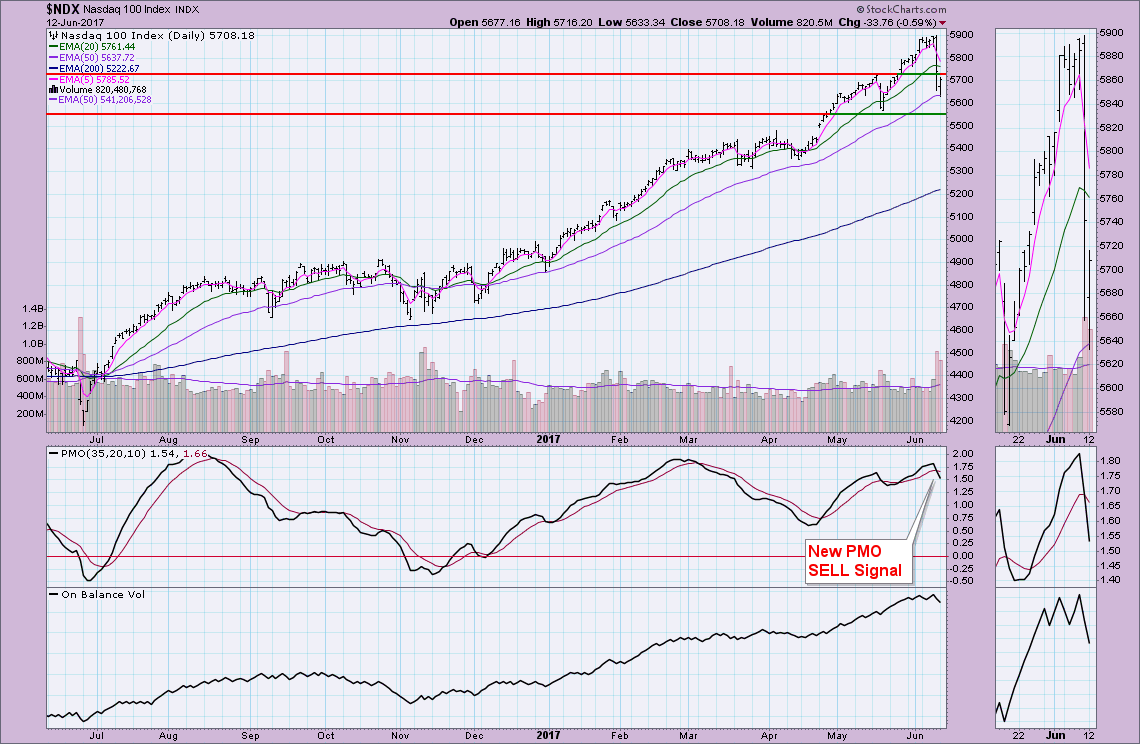

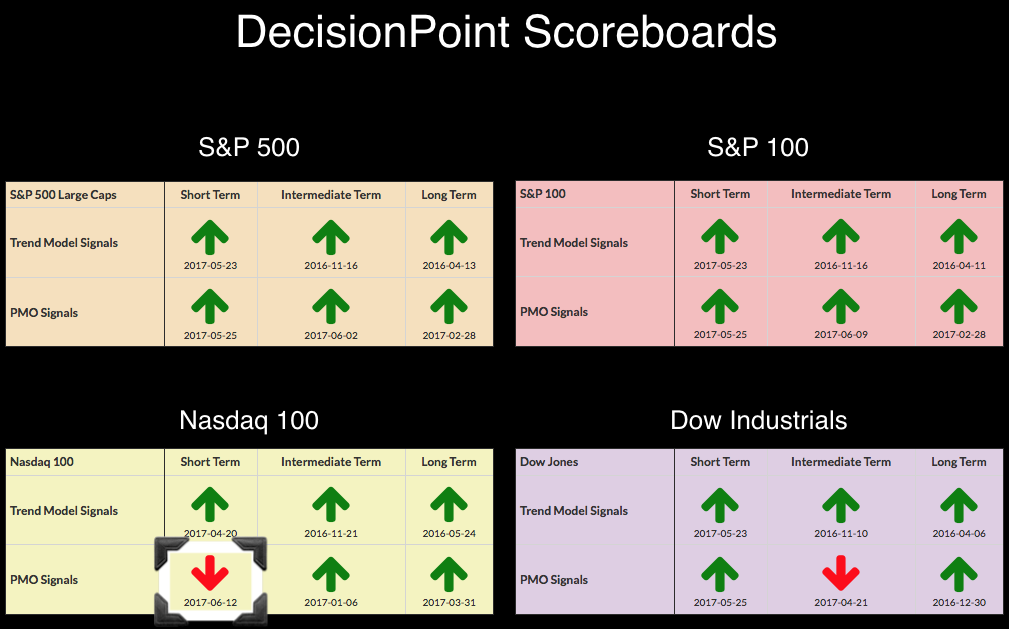

As the market closed, I received a Technical Alert that the NDX had triggered a PMO SELL signal. Additionally, I received notice that a new Intermediate-Term Trend Model (ITTM) BUY signal just occurred today on the Financial SPDR (XLF). I've updated the NDX Scoreboard. It is the first PMO SELL signal to occur since the recent pullback. It's not surprising as we've been seeing the technology sector hit hard over the past week with big declines from major players like Apple (AAPL), Nvidia (NVDA) and Facebook (FB).

Yesterday's plunge on the NDX brought price below support at the mid-May top. At this point, I believe support will hold at 5550 or 5500. It's been time for a pullback in the technology sector and I think it's just about finished. We'll want to watch the direction of the PMO this week. I do want to point out that the last PMO SELL signal only resulted in mostly sideways consolidation. I suspect we'll see something similar this time around as well.

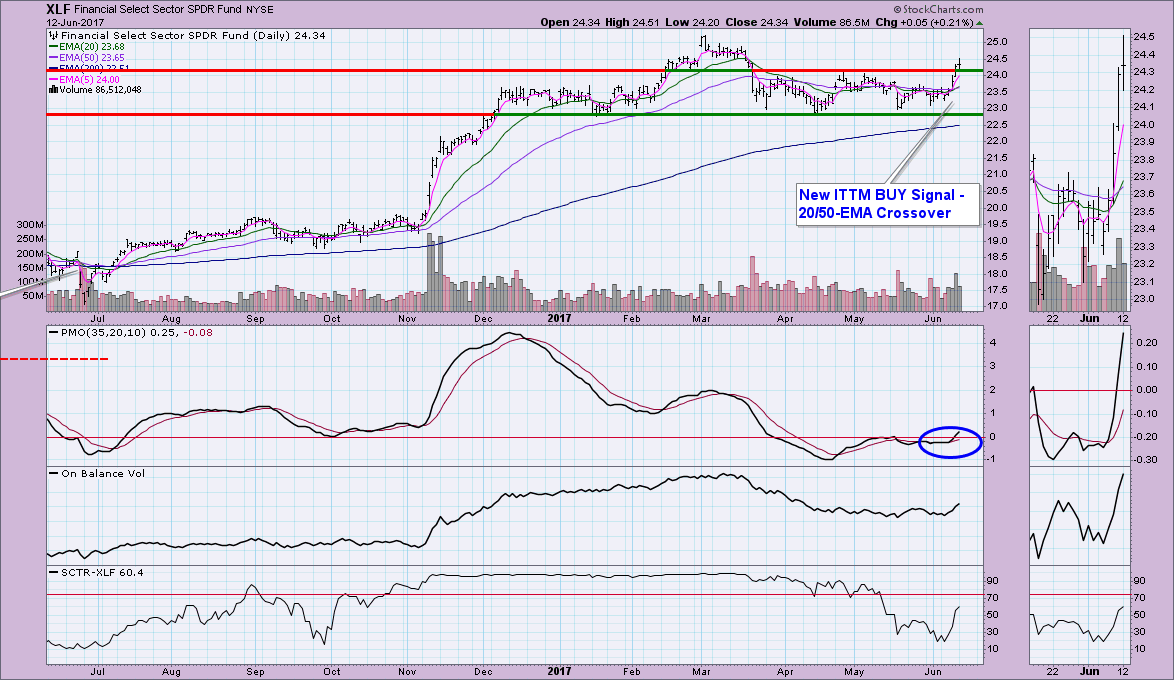

At the end of today's MarketWatchers LIVE show, Tom and I were asked the question, "If you could only hold one sector ETF, which would it be?" Tom's reply was XLF and you can see why. Really nice breakout today on a new ITTM BUY signal. I also note that a PMO BUY signal in oversold territory appeared late last week. The SCTR is heading toward the "hot zone" above 75. The Fed will publish its minutes this week. This could effect this sector greatly if guidance isn't what everyone expects (rate hikes).

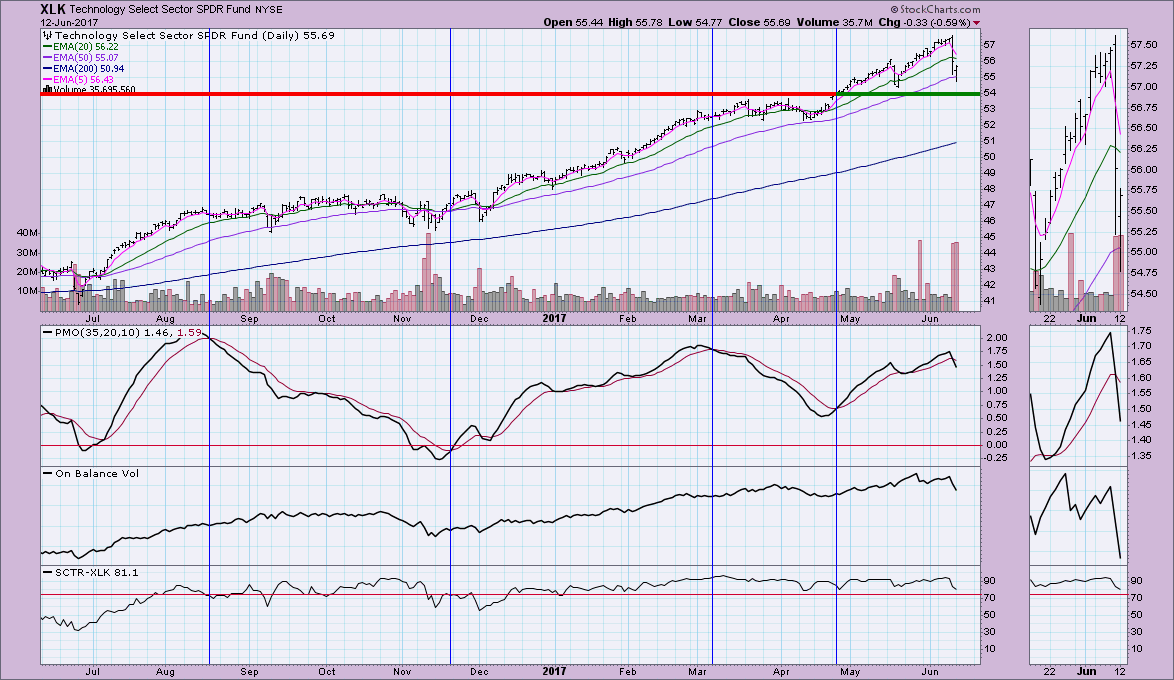

FYI, my ETF hold is Technology (XLK), it's following the NDX above and pulling back. Notice that the prior PMO SELL signals resulted in consolidation. I'm expecting the same with an entry when the $54 level is hit.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**