*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st. Click here for more details. ***

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds. We have a happy coincidence with Friday also being the end of the month, so we can wrap the week and the month in this commentary.

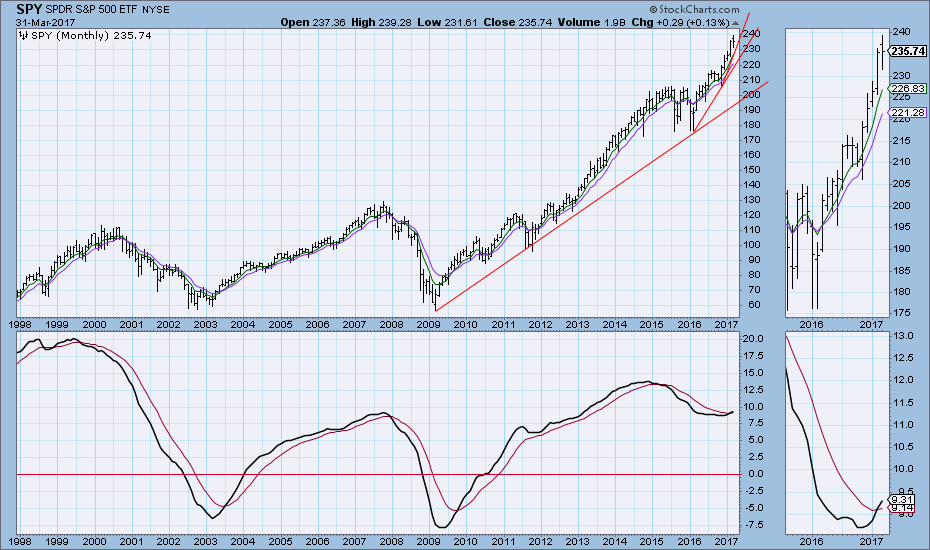

A new long-term BUY signal was generated this month when the monthly PMO crossed up through its signal line.

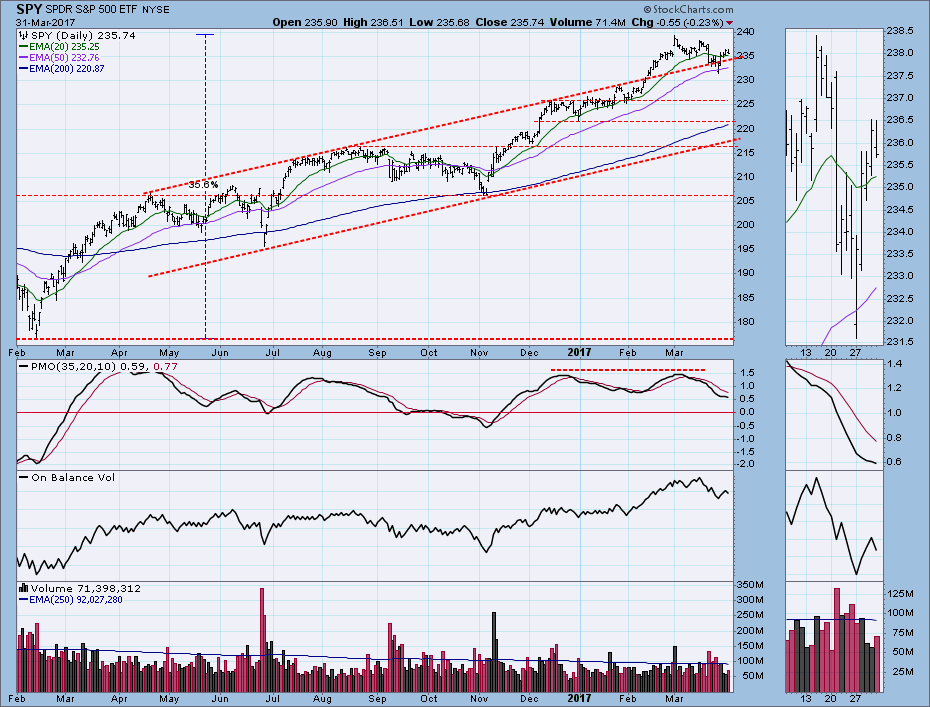

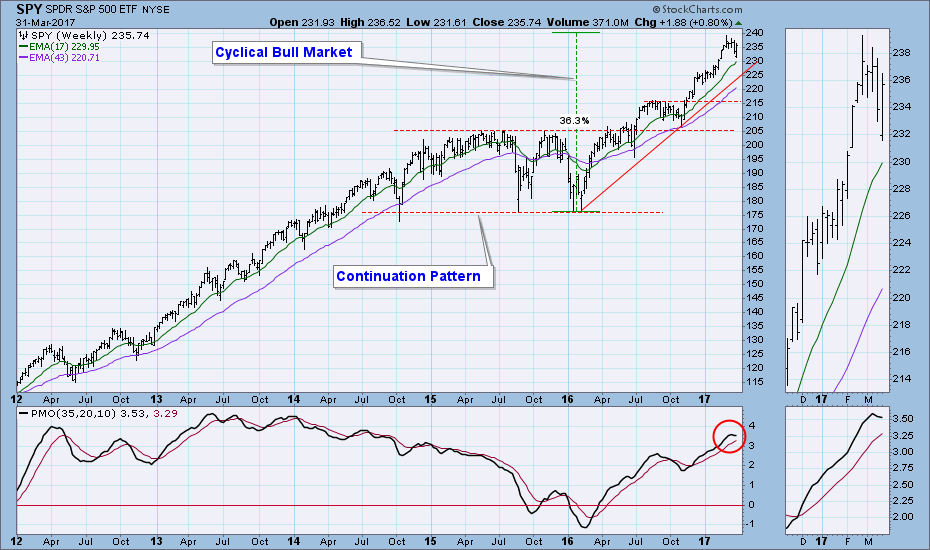

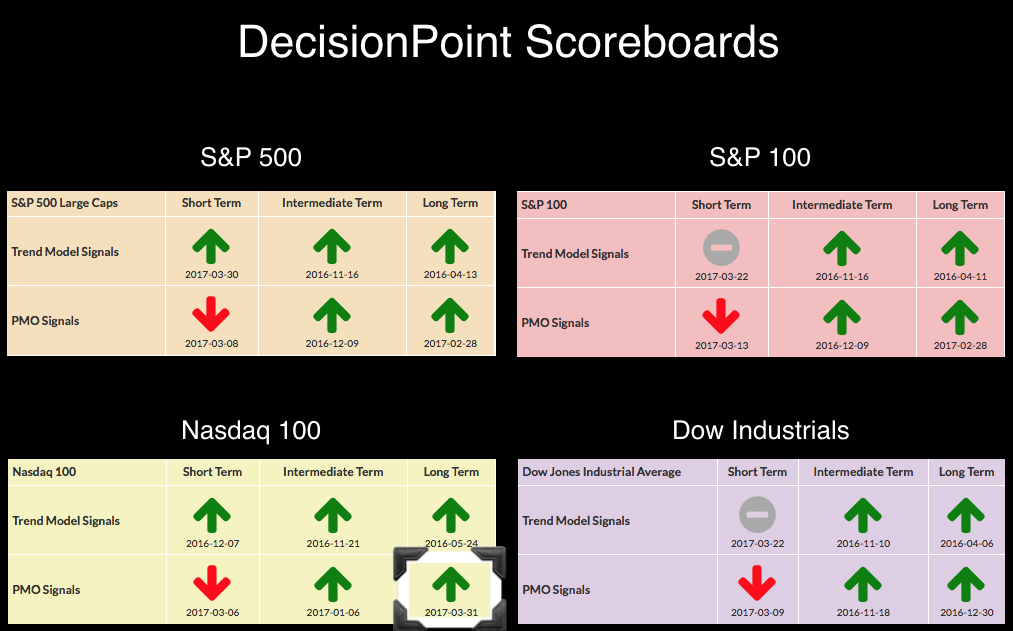

STOCKS: Based upon a 11/15/2016 Intermediate-Term Trend Model BUY signal, our current intermediate-term market posture for the S&P 500 (SPY) is bullish. The Long-Term Trend Model, which informs our long-term outlook, is on a BUY signal as of 4/1/2016 so our long-term posture is bullish.

SPY broke down on Monday, but bounced back up. The PMO is still falling, so the short term remains negative.

The weekly PMO is falling, and the rising trend line drawn from the 2016 low still looks like a reasonable downside target.

SPY is generally positive in the monthly time frame, but the most recent rising trend line looks too steep to be maintained and calls for a consolidation or correction.

Short-Term Indicators: These indicators have visibly decelerated, and we should look for them to top next week.

Intermediate-Term Indicators: While two of the three indicators are rising, they look as if they are preparing to turn down again.

Conclusion: The bull market remains intact, and the market doesn't seem to tolerate too much correction before it rebounds, such as what happened this week. There are reasons to be optimistic, but I think we'll need to see more churning or downside before the next up leg starts. The IT Trend Model BUY signal is very healthy and can absorb some punishment without the 20EMA dropping below the 50EMA (which would cause the BUY signal to change to NEUTRAL).

DOLLAR: As of 3/21/2017 the US Dollar Index ETF (UUP) is on an Intermediate-Term Trend Model Neutral signal. The Long-Term Trend Model, which informs our long-term outlook, is on a BUY signal as of 10/17/2016, so our long-term posture is bullish.

This week UUP dropped below the February low and officially established a down trend. The very next day it began moving higher again, making a third bottom, across which we can draw the bottom of a declining wedge formation. The declining wedge will most likely resolve to the upside, particularly with the dollar being in a bull market.

This time frame is negative. There is a negative divergence across weekly PMO tops, and the PMO is declining below its signal line. There is also a possible double top.

The monthly chart looks positive, but the PMO is too flat.

GOLD: As of 2/3/2016 Gold is on an Intermediate-Term Trend Model BUY signal. The Long-Term Trend Model, which informs our long-term outlook, is on a SELL signal as of 11/25/2016, so our long-term posture is bearish.

Gold nearly reached the level of the February top, but it turned down on Friday, hinting at a possible double top. Sentiment turned negative even before price began to top, showing that the positive sentiment of the prior two weeks was not deeply ingrained.

The weekly chart has a neutral triangle formation, but the PMO is rising above its signal line. Gold is basically positive in this time frame.

The weekly chart has a neutral triangle formation, but the PMO is rising above its signal line. Gold is basically positive in this time frame.

The monthly PMO is rising and above its signal line, making gold slightly positive in this time frame.

CRUDE OIL (USO): As of 3/8/2017 United States Oil Fund (USO) is on an Intermediate-Term Trend Model Neutral signal. The Long-Term Trend Model, which informs our long-term outlook, is on a SELL signal as of 3/9/2017, so our long-term posture is bearish.

On the daily chart crude oil remains within a narrowing trading range, and a new PMO BUY signal indicates that the current rally from this month's low will most likely continue to the top of the range.

The weekly chart shows the basing pattern, now about one year old.

The monthly PMO is rising, but it is a function of the flat prices for the last year. If sideways price movement continues, the PMO will migrate all the way back to the zero line.

BONDS (TLT): As of 3/31/2017 the 20+ Year T-Bonds ETF (TLT) is on an Intermediate-Term Trend Model BUY signal. The Long-Term Trend Model, which informs our long-term outlook, is on a SELL signal as of 11/17/2016, so our long-term posture is bearish.

The new IT Trend Model BUY signal today is the result of sideways price movement. It could be signalling higher prices, but TLT has topped within its trading range, so I'm not optimistic.

The weekly chart shows a new PMO BUY signal, but there is a PMO negative divergence as well.

I decided to post a monthly chart of $USB because it has a much longer data set than TLT. Note the steady price rise over more than 30 years within fairly regular trend channel. At the end we can see price break out of the channel in what is probably a final blowoff.

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

The DecisionPoint LIVE Shared ChartList has launched! Click on the link and you'll find webinar and blog chart spotlights. Be sure and bookmark it!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Carl