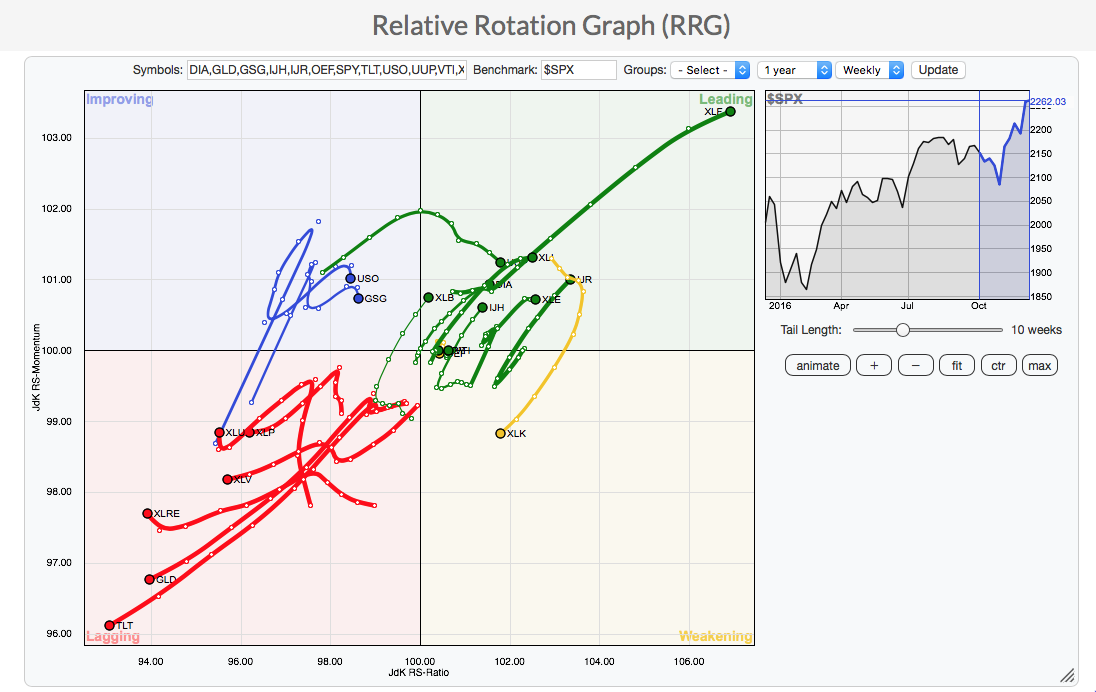

I was first introduced to Relative Rotation Graphs (RRGs) at the 2014 ChartCon. I was blown away by its simplicity and visual impact. Julius de Kempenaer, a fellow blogger here at StockCharts developed RRGs. I would direct you to ChartSchool to read more about the inner workings that create these graphs. I was recently asked if I could put together an RRG chart for the members of the DecisionPoint Market/Sector Summary. After writing about sector rotation on Tuesday, this fit in very well as an expansion of that article.

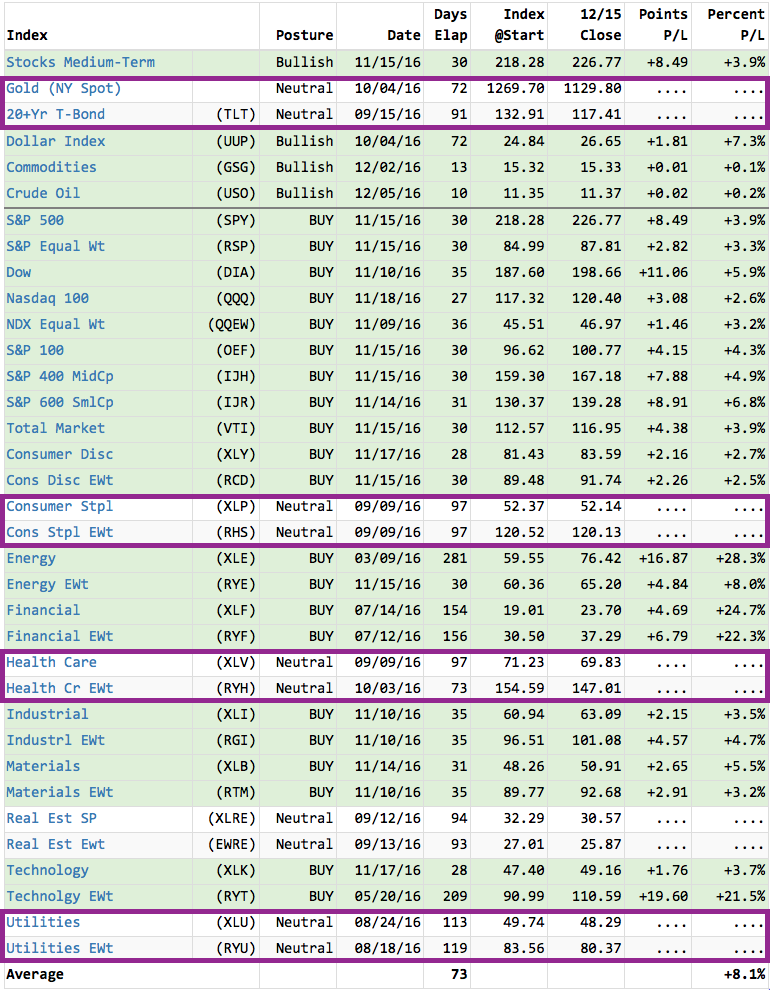

Here is today's DP Market/Sector Summary Posture Table. The signals are based on the Intermediate-Term Trend Model. Note that the Neutral signals are all on "defensive" sectors. These sectors and metals tend to do very well in an economic downturn but not so well in an economic expansion or strong bull market.

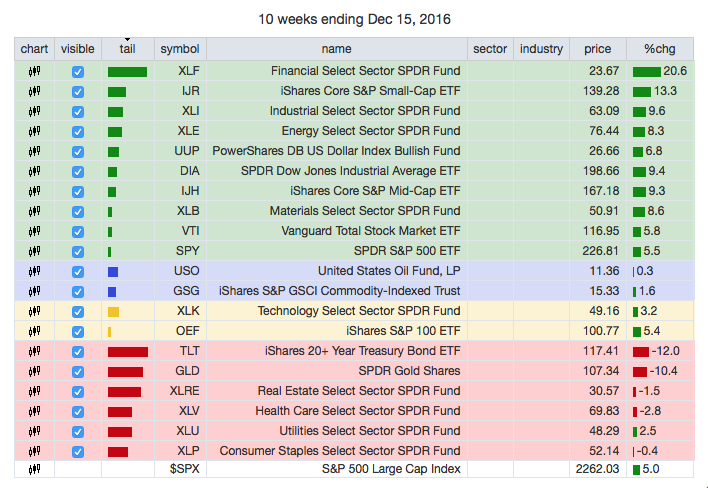

I opted not to include the equal-weight sectors as it simply cluttered up the chart. The RRG is below. Fascinating, right? You can click on the chart to reach this RRG that I have created if you want to bookmark it. There is far more information contained in the graph and the table beneath than in the posture table, but it confirms everything in the table.

The members that have Neutral signals are in the bottom left quadrant, "Lagging". USO and GSG are on fairly recent ITTM BUY signals. Looking at where they came from (red quadrant) and where they have traveled to, "Improving", it makes complete sense that BUY signals were triggered.

You'll note on the posture table that the longest ITTM BUY signal belongs to XLE. That is confirmed by the RRG where XLE is in the very best area of the graph. Remember that the NDX had been traveling with the other indexes, but began to lag. That is reflected in XLK's travel from Leading to Weakening.

It was suggested that I include this graph at the beginning of all of the DP Alert blog articles. Seeing how powerful these are in helping us visualize the information on the posture table, I may just add it in after all.

The NEW DecisionPoint LIVE public ChartList has launched! Click on the link and you'll find webinar charts annotated just before the program. Additional "chart spotlights" will be included at the top of the list. Be sure and bookmark it!

Come check out the DecisionPoint Report with Erin Heim on Wednesdays and Fridays at 7:00p EST, a fast-paced 30-minute review of the current markets mid-week and week-end. The archives and registration links are on the Homepage under “Webinars”.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin