I generally do not review stocks in the DecisionPoint blog, but the Consumer Discretionary sector took a hit today, most notably Kohls Department Stores (KSS) and Ralph Lauren Polo brand (RL). These two stocks had the misfortune to miss their revenues by a great deal today. However, even had this not been the case, as Arthur Hill discussed today in the Market Message, this sector is struggling in this bear market environment. This is a sector that is strong in bull markets, but generally suffers in bear markets. This sector is made up of retailers and if consumers are defensive and the market is bearish, they aren't going to spend as much money on the "extras". I highly recommend you review his blog today (and then come back here!)

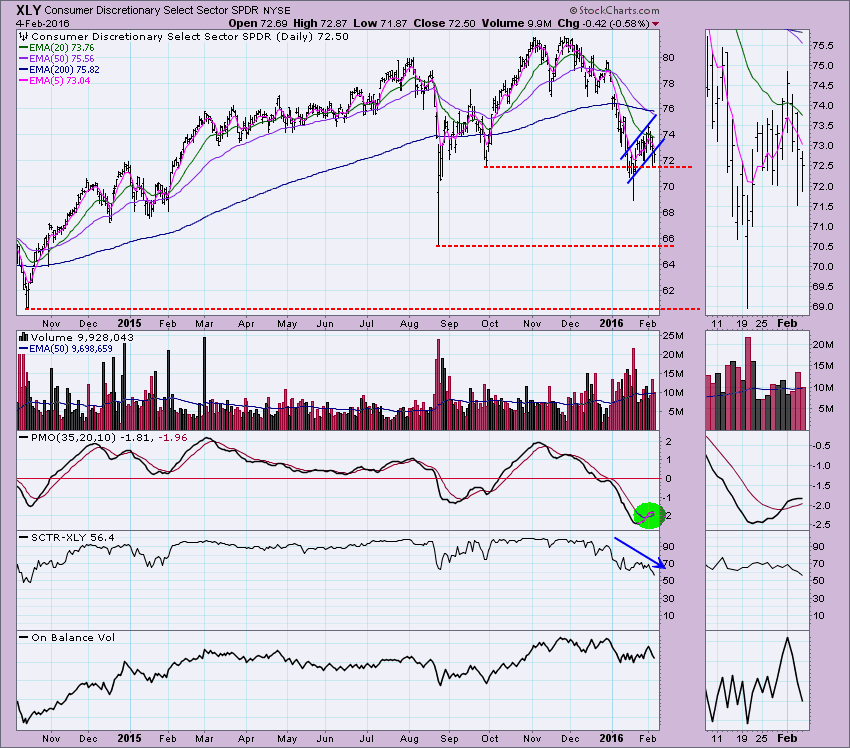

The sector SPDR (XLY) was in a rising trend channel, but that was broken and now price is testing the October low. If support doesn't hold, it is a long way down to the next support level. The PMO is decelerating, the SCTR is falling and OBV has been mostly stagnant since last month.

Kohls and Polo are a good representation of this sector. Kohls is a lower-priced (always a sale) department store, while Polo is an upscale brand. You'll see that Polo has been struggling in the long-term in comparison to Kohls. I think this makes sense given that shoppers in a depressed economy are looking for bargains, not status. Revenue misses are mostly to blame, but you can see that neither of these stocks were in a bull market because the 50-EMA is below the 200-EMA.

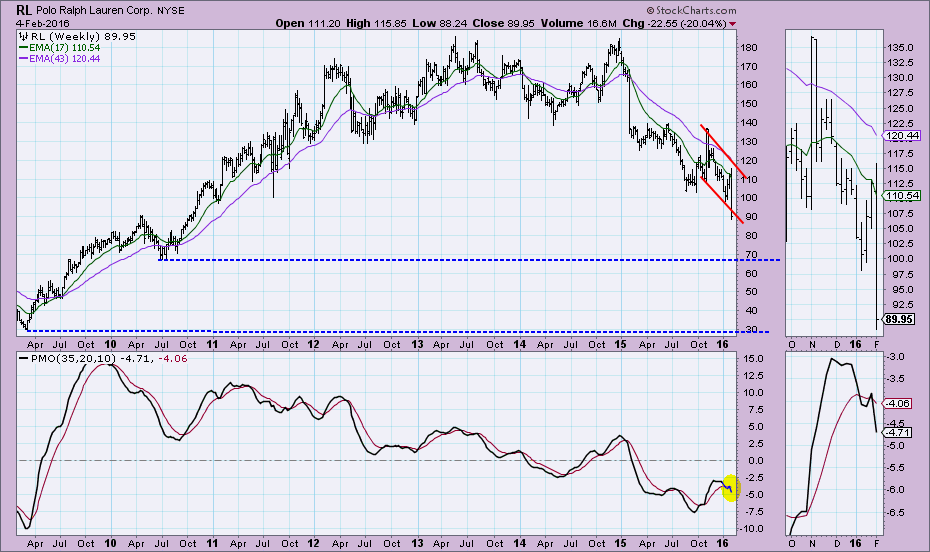

Let's start with Polo. Price was in a very steep rising trend channel that was going to be difficult to maintain anyway. Today was a tough one with price breaking down below this month's previous low. The big problem for Polo is not just the ugly daily chart with its plunging indicators.

Notice on the weekly chart, Polo has been in a bear market nose dive since the beginning of 2015. The PMO has generated a SELL signal below the zero line. Worse yet is that support is a long way down and in a bear market, consumer discretionary stocks have to overcome not only bear market weakness, but internal weakness as well.

Kohl daily chart isn't rosy either, but support has been reached just below the neckline on a double-top execution. A back of the napkin calculation tells me that the minimum downside target for Kohls is around $36.

Looking at the weekly chart, support at $36 is right on, even a move to $36 will keep it within a very long-term trading range. I'd still be concerned given that Kohls is part of a slumping sector.

Come check out the DecisionPoint Report with Erin Heim on Wednesdays and Fridays at 7:00p EST. The archives and registration links are on the Homepage under “What’s New”.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin