One of the best sentiment indicators we had for gold was the premium/discount for Central Gold Trust (GTU), a closed-end fund which owned only gold bullion. (Closed-end funds trade like stocks, and the pressures of bid/ask can cause them to trade at a premium or discount to net asset value--NAV.) We have always believed that the amount of premium/discount was an excellent indication of bullish or bearish excess. Unfortunately, last week that indicator was lost to us when Sprott Physical Gold Trust (PHYS) acquired GTU.

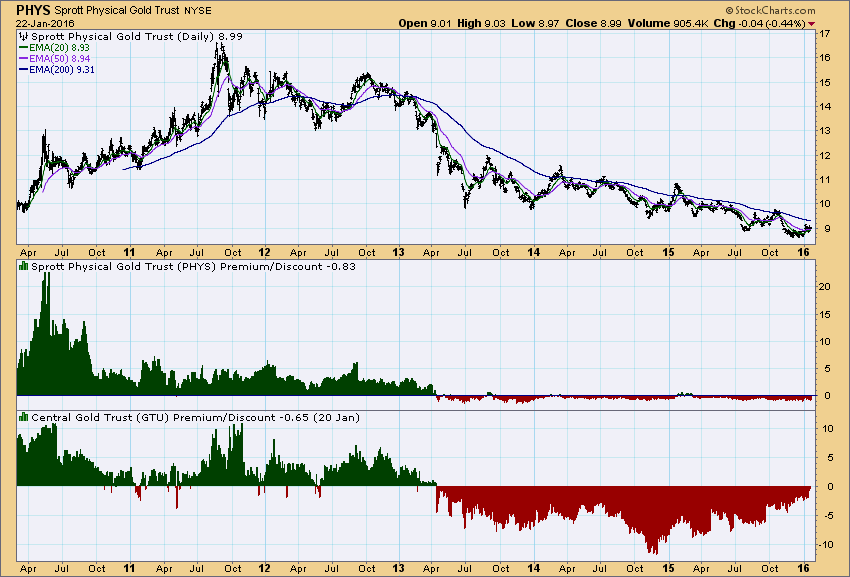

While PHYS is also a closed-end fund similar to GTU, there is quite a bit of difference between the two premium/discount readings, as you can see on the following chart.

While the premiums for both funds are quite similar since 2012, the discounts are vastly different, with PHYS keeping a discount of around -1% from 2013 compared to GTU discounts as high as -12%. I don't know the reason for this, but clearly PHYS does not show us the extremes of bearish sentiment that we could see with GTU.

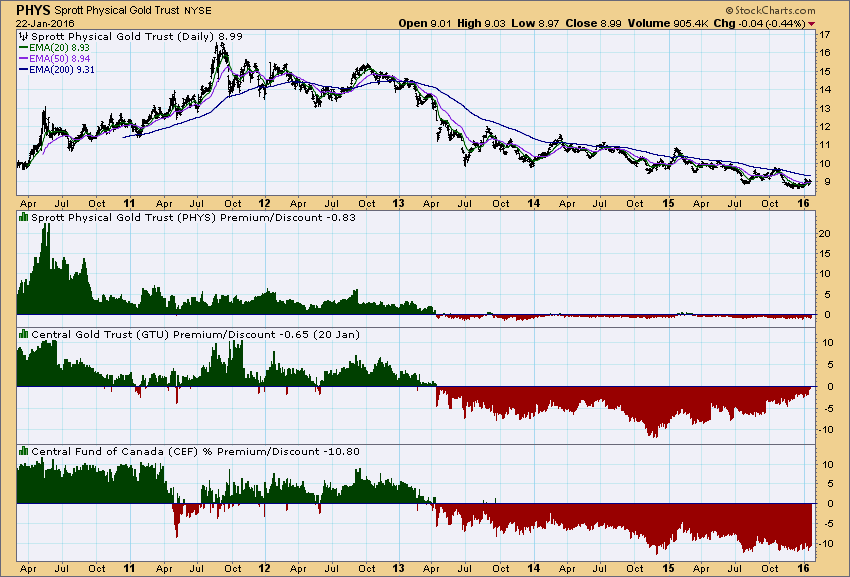

Central Fund of Canada (CEF) is another precious metals fund that can provide input in this area, but it is a mixed gold and silver bullion fund. It currently has about 76 ounces of silver to one ounce of gold, which results in an asset value split of 63% gold to 37% silver. Perhaps this will serve as a substitute to GTU?

The bottom panel of the next chart shows the CEF premium/discount. Again, we have similar premium activity, but the discount for CEF is persistently around -10% compared to the gradual decrease in the GTU discount for the last year. One explanation for this difference could be that CEF silver assets are severely discounted, but I am not completely satisfied with that conclusion.

Another explanation could be that Sprott's efforts to acquire GTU over the last year had the beneficial effect of reducing the amount of GTU's discount, something I have not previously taken into account in my analysis. At any rate, GTU is gone, so I think I'll start watching the premium/discount data for both PHYS and CEF -- I think they are useful sentiment indicators.

Another explanation could be that Sprott's efforts to acquire GTU over the last year had the beneficial effect of reducing the amount of GTU's discount, something I have not previously taken into account in my analysis. At any rate, GTU is gone, so I think I'll start watching the premium/discount data for both PHYS and CEF -- I think they are useful sentiment indicators.

A finally my current gold outlook: Sentiment is bearish, consistent with the PHYS/CEF discounts. The trend is down, and the EMAs are bearish, but the PMO is on a BUY signal, and price is forming a rounded bottom. The short-term trend and momentum are positive, and I think a rally to the top of the trend channel (1200?) is possible. Cancel that outlook if the PMO tops.

A finally my current gold outlook: Sentiment is bearish, consistent with the PHYS/CEF discounts. The trend is down, and the EMAs are bearish, but the PMO is on a BUY signal, and price is forming a rounded bottom. The short-term trend and momentum are positive, and I think a rally to the top of the trend channel (1200?) is possible. Cancel that outlook if the PMO tops.

Technical analysis is a windsock, not a crystal ball.