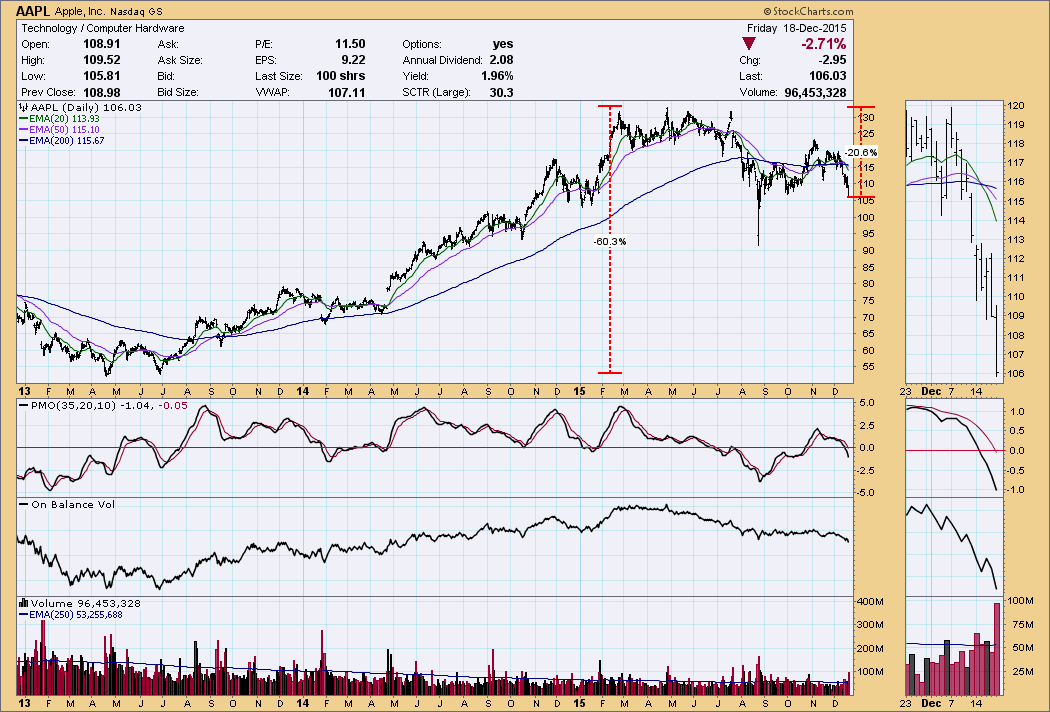

With Apple (AAPL) down about -20% from this the all-time high, I am hearing with some frequency on the cable financial shows the question of whether it is time to buy or hold AAPL. As of Friday's close my answer is a resounding no.

Technically speaking, the 20EMA is below the 50EMA, which is below the 200EMA. This is a negative stack which needs to be reversed. While it is true that the EMAs were in a positive stack just a few weeks ago, and the trend for the last six months is essentially sideways, current momentum is down, as evidenced by the falling PMO (Price Momentum Oscillator). The intermediate-term trend is not officially in a down trend yet--we have a top beneath a top, but we still need a bottom lower than the August low. We can look for evidence of a reversal of the short-term trend to the up side, a PMO bottom for example, but at this moment there are no hopeful signs.

The weekly chart shows that the weekly PMO is falling and has topped below the signal line--a very negative situation--and the 17EMA has crossed down through the 43EMA, generating a SELL signal.

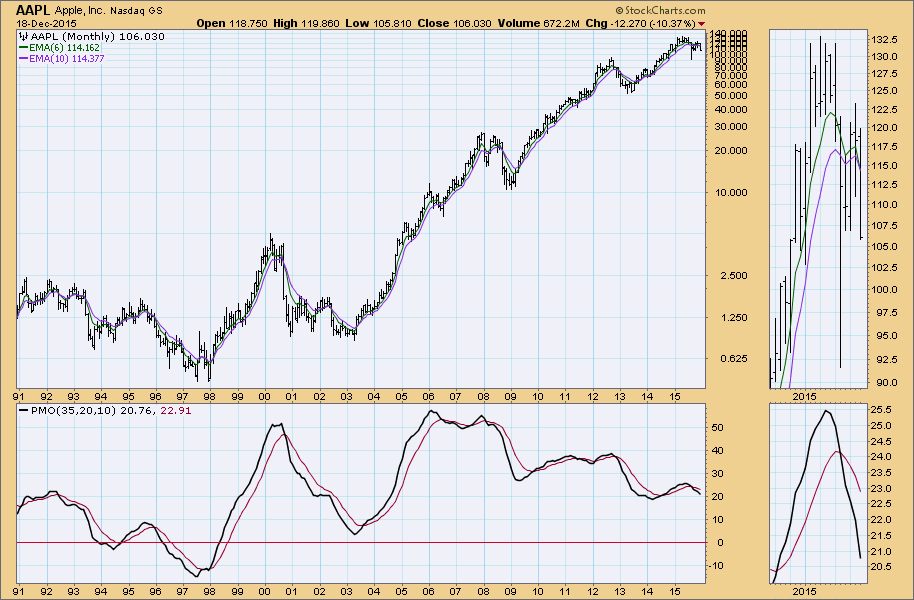

On the monthly chart the PMO is falling below its signal line, and PMO tops have been diverging negatively from price since 2008. Also, the 6EMA is below the 10EMA, which will generate a long-term SELL signal if it remains that way at the monthly close.

CONCLUSION: AAPL presents a thoroughly negative technical picture in all time frames, and, in my opinion, now is not a good time to own it. A daily PMO bottom would provide a sign that maybe the trend was becoming favorable, but remember that is a short-term condition.

Technical analysis is a windsock, not a crystal ball.