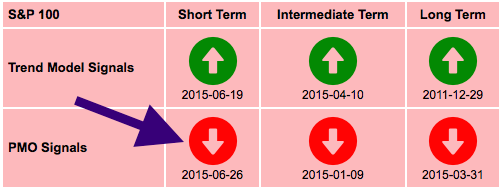

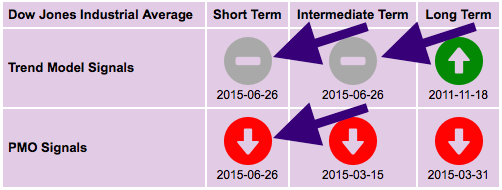

Just a quick article to alert you that we had some important DP Scoreboard Updates today. The S&P 100 and Dow Industrials both generated Price Momentum Oscillator (PMO) SELL signals. Additionally, the Dow had a Short-Term Trend Model (STTM) and Intermediate-Term Trend Model (ITTM) Neutral signals update. Here are the new Scoreboards:

The Dow Industrials appeared to be on its way to test all-time highs, instead it turned back down before executing fully. A bearish conclusion to a possible bullish pattern is negative. You can see the 5-EMA downside crossover the 20-EMA generating the STTM Neutral Signal on the Scoreboard. Price could find support around 17700. If it doesn't, the next likely stop would be the February low.

There is a similar situation on the S&P 100. The bullish double-bottom aborted. Price has been in a trading range for the last few months. The new PMO SELL signal is a problem, but it also appears there will soon be a STTM Neutral signal in its future as the 5-EMA is about ready to cross below the 20-EMA. It is a Neutral signal because the 20-EMA is above the 50-EMA implying a bullish environment. If the 20-EMA was below the 50-EMA at the time of the negative 5/20-EMA crossover, the STTM signal would be a SELL.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin