DecisionPoint covers United States Oil Fund (USO) regularly in the DP Market Update on Tuesdays, during the webinar on Wednesdays and in the DP Weekly Update on Fridays (found in DP Reports Blog). It appeared USO would make a turnaround as we got a prescient PMO Crossover BUY signal in mid-January followed by a break from the steep declining trend price was traveling in. I watched from the sidelines as price fluctuated between 18 and 20, first appearing as a possible bull flag but finishing as a continuation rectangle pattern.

DecisionPoint covers United States Oil Fund (USO) regularly in the DP Market Update on Tuesdays, during the webinar on Wednesdays and in the DP Weekly Update on Fridays (found in DP Reports Blog). It appeared USO would make a turnaround as we got a prescient PMO Crossover BUY signal in mid-January followed by a break from the steep declining trend price was traveling in. I watched from the sidelines as price fluctuated between 18 and 20, first appearing as a possible bull flag but finishing as a continuation rectangle pattern.

Looking at the USO daily chart, we see that price broke down from this continuation pattern yesterday and followed through by trading and closing below support at 18 today. Biggest news is a PMO crossover SELL signal that generated today as the PMO crossed below its 10-EMA. The crossover occurred below the zero line which is especially bearish. Before this crossover even occurred, I knew this was not likely going to be the big turnaround for USO. Why? Notice how the PMO shot skyward when the declining trend was broken. It continued to rise strongly, but notice that price could only consolidate sideways and didn't seem to be taking advantage of the positive momentum. Additionally price never was able to penetrate the 50-EMA which kept the Trend Model SELL signal easily intact.

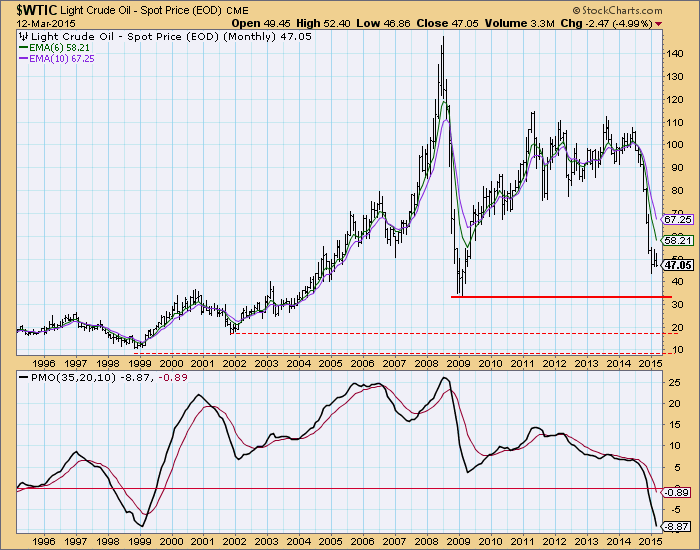

Let's look at the price of oil itself. Price formed a symmetrical triangle pattern. This is more often times than not a reversal pattern, but price broke down below it which is definitely bearish. Note that the PMO also generated a crossover SELL signal on oil. Like USO, it occurred below the zero line which is extremely bearish.

Finally a longer-term look at the monthly Oil chart shows that support at the 2009 low (35.13) has not been reached. There are lower levels of support, but let's see what happens with the first support line.

Looking at Brent Crude Oil we note there was also a PMO crossover SELL signal generated today. The price pattern is unlike USO and $WTIC. It's negative just as with USO and $WTIC, but it shows an inverted bowl or gradual rollover in prices. Price did react better to a strong PMO, rising with the momentum not moving sideways. Additionally, the PMO crossover SELL signal occurred above the zero line which isn't quite as bearish.

Ultimately, oil has lost any positive momentum it had coming from the late January price breakout. Support has not been tested on $WTIC which implies there is more decline on its way.