The market hit all-time highs today in less than impressive fashion, but they are all-time highs nonetheless. The ultra-short-term rising bottoms line is still intact and hasn't been tested since its inception, but it appears it will be forced to tomorrow.

The purpose of the DecisionPoint Daily Update is to quickly review the day's action, internal condition, and Trend Model status of the broad market (S&P 500), the nine SPDR Sectors, the U.S. Dollar, Gold, Crude Oil, and Bonds. To ensure that using this daily reference will be quick and painless, we are as brief as possible, and often we let a chart speak for itself.

SIGNALS: Here we include the current day's signal table, an excerpt from the DecisionPoint Alert Daily Report.

DECISIONPOINT ALERT DAILY REPORT Tuesday, 2/17/2015 ************************ DECISIONPOINT MARKET POSTURE *********************** The following is the market posture suggested by our mechanical trend- following tools. These are not trading recommendations, rather they are price activity flags that should be qualified by chart analysis. The Trend Model is used on all indexes. Days Index 02/17 Points Percent Index Posture Date Elap @Start Close P/L P/L ------------------- ------- -------- ---- ------- ------- ------- ------- Stocks Medium-Term Bullish 10/31/14 109 200.55 210.11 +9.56 +4.8% Stocks Long-Term Bullish 10/31/14 109 200.55 210.11 +9.56 +4.8% Gold (NY Spot) Bullish 01/12/15 36 1233.40 1208.60 -24.80 -2.0% 20+Yr T-Bond (TLT) Bullish 01/17/14 396 102.22 126.26 +24.04 +23.5% ------------------- ------- -------- ---- ------- ------- ------- ------- Dollar Index (UUP) Bullish 07/21/14 211 21.47 24.88 +3.41 +15.9% Commodities (GSG) Neutral 07/14/14 218 32.64 21.22 .... .... Crude Oil (USO) Neutral 07/30/14 202 36.92 19.79 .... .... ------------------- ------- -------- ---- ------- ------- ------- ------- S&P 500 (SPY) BUY 10/31/14 109 200.55 210.11 +9.56 +4.8% S&P Equal Wt (RSP) BUY 11/03/14 106 77.77 82.12 +4.35 +5.6% Dow (DIA) BUY 02/03/15 14 176.33 180.57 +4.24 +2.4% Nasdaq 100 (QQQ) BUY 10/29/14 111 99.44 107.01 +7.57 +7.6% NDX Equal Wt (QQEW) BUY 10/30/14 110 40.52 43.99 +3.47 +8.6% S&P 100 (OEF) BUY 02/04/15 13 89.96 92.82 +2.86 +3.2% S&P 400 MidCp (IJH) BUY 11/05/14 104 141.11 150.06 +8.95 +6.3% S&P 600 SmlCp (IJR) BUY 11/03/14 106 110.95 115.98 +5.03 +4.5% Total Market (VTI) BUY 11/03/14 106 103.53 108.64 +5.11 +4.9% Consumer Disc (XLY) BUY 11/05/14 104 67.27 74.72 +7.45 +11.1% Cons Disc EWt (RCD) BUY 11/03/14 106 82.65 90.77 +8.12 +9.8% Consumer Stpl (XLP) BUY 08/20/14 181 44.27 49.51 +5.24 +11.8% Cons Stpl EWt (RHS) BUY 10/21/14 119 97.79 107.84 +10.05 +10.3% Energy (XLE) Neutral 09/08/14 162 94.49 82.29 .... .... Energy EWt (RYE) Neutral 09/08/14 162 86.56 71.29 .... .... Financial (XLF) BUY 02/13/15 4 24.43 24.51 +0.08 +0.3% Financial EWt (RYF) BUY 02/05/15 12 44.36 45.13 +0.77 +1.7% Health Care (XLV) BUY 10/23/14 117 64.07 71.23 +7.16 +11.2% Health Cr EWt (RYH) BUY 05/09/14 284 115.84 149.34 +33.50 +28.9% Industrial (XLI) BUY 10/30/14 110 54.37 57.25 +2.88 +5.3% Industrl EWt (RGI) BUY 02/09/15 8 88.82 90.88 +2.06 +2.3% Materials (XLB) BUY 02/05/15 12 50.04 51.50 +1.46 +2.9% Materials EWt (RTM) BUY 02/03/15 14 85.23 90.25 +5.02 +5.9% Technology (XLK) BUY 02/09/15 8 41.04 42.67 +1.63 +4.0% Technolgy EWt (RYT) BUY 02/05/15 12 89.61 93.15 +3.54 +4.0% Utilities (XLU) BUY 08/28/14 173 42.24 45.13 +2.89 +6.8% Utilities EWt (RYU) BUY 08/20/14 181 71.41 76.78 +5.37 +7.5% Average 94 +6.9%

NOTE: Mechanical trading model signals define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

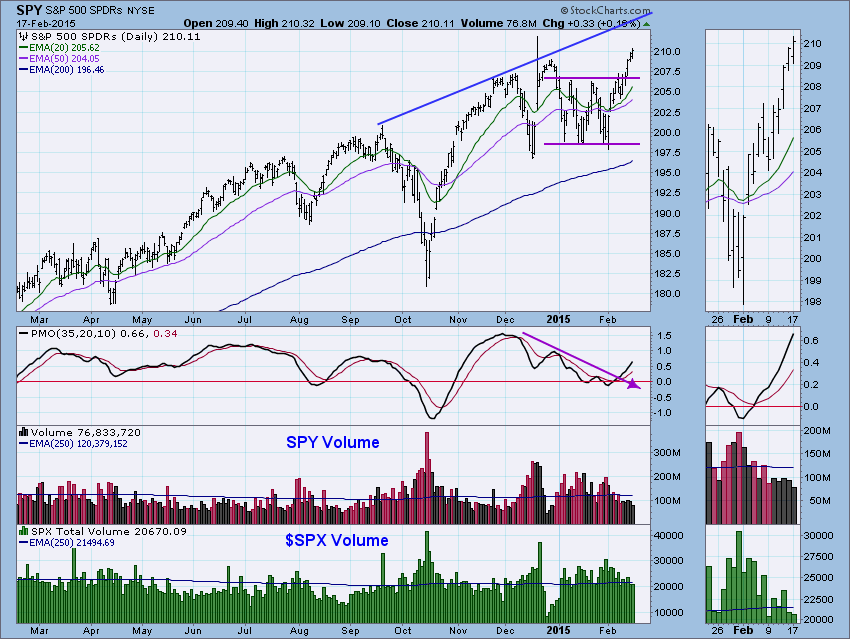

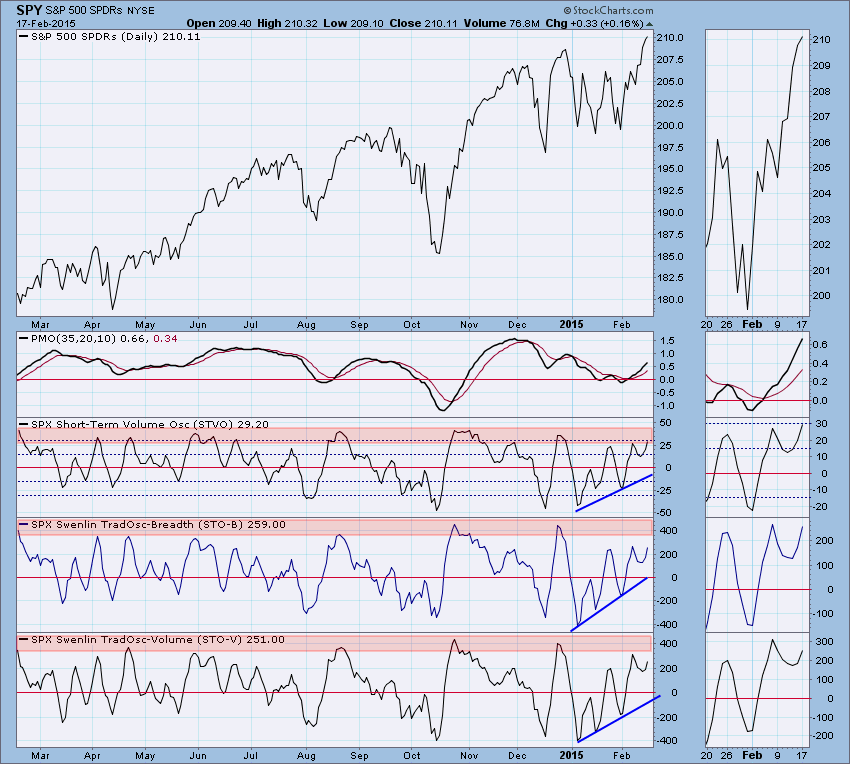

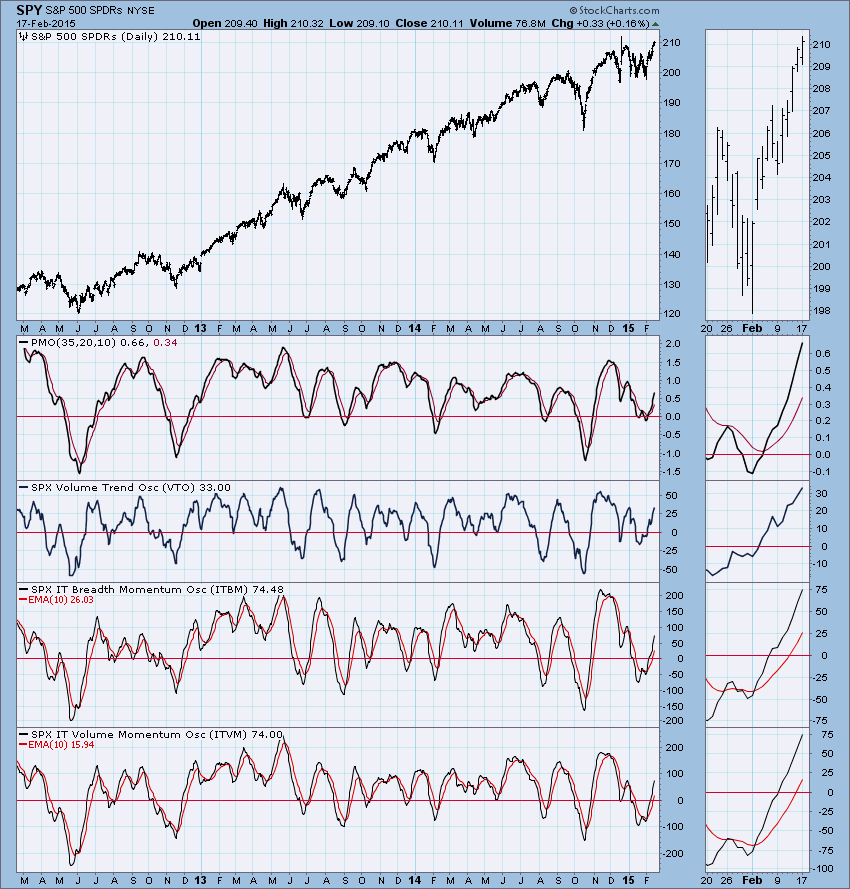

STOCKS: Based upon a 10/31/2014 Trend Model BUY signal, our current intermediate-term market posture for the S&P 500 (SPY) is bullish. The Trend Model, which informs our long-term outlook, is on a BUY signal as of 10/31/2014 so our long-term posture is bullish.

The execution of the triple-bottom pattern set a minimum upside target around 214 and price appears ready to test overhead resistance in that area. The PMO has broken from its declining trend which is bullish but volume keeps dwindling during an upswing that I would've expected to net more. The holiday weekend sandwiched in there probably didn't help with generating volume.

Ultra-Short-Term Indicators: These indicators have calmed down after creating a recent initiation impulse. Readings on the CVI and Participation Index - UP are still on the high side but lower. If we see a consistent drop, we should expect a possible reversal.

Short-Term Indicators: The recent bottom and continued rise of these indicators is bullish, but now we have to become concerned with them getting overbought.

Intermediate-Term Indicators: These are all bullish as they continue to rise and have not gotten overbought.

Conclusion: Short-term indicators are overbought and warn of a possible reversal, but the big picture intermediate-term indicators are strongly bullish. I believe the 214 minimum upside target is going to be hit, there just might be a pullback toward the neckline/breakout point before that happens based on overbought short-term indicators.

DOLLAR: As of 7/21/2014 the US Dollar Index ETF (UUP) is on a Trend Model BUY signal. The LT Trend Model, which informs our long-term outlook, is on a BUY signal as of 8/21/2014, so our long-term posture is bullish.

UUP broke down from the short-term, more accelerated rising bottoms support line. The 20-EMA remains as an ultra-short-term support level, but it appears to be deteriorating as the last two intraday lows penetrated it. The PMO is still quite overbought and needs more time to unwind. It's managed to uncoil with very little downside movement, so perhaps a sideways continuation would work instead of a major breakdown.

GOLD: As of 1/12/2015 Gold is on a Trend Model BUY signal. The LT Trend Model, which informs our long-term outlook, is on a SELL signal as of 2/15/2013, so our long-term posture is bearish.

Last week, the reverse flag formation executed and price is heading toward the target of 1180. It will require a breakdown through rising bottoms support to get there. The PMO is now neutral which is good news but it needs to get oversold before we can get bullish. The Intermediate-term Trend Model BUY signal is in jeopardy as the 20-EMA reaches out toward a negative cross over the 50-EMA.

CRUDE OIL (USO): As of 7/30/2014 United States Oil Fund (USO) is on a Trend Model NEUTRAL signal. The LT Trend Model, which informs our long-term outlook, is on a SELL signal as of 8/28/2014, so our long-term posture is bearish.

USO has been forming a bullish flag. A breakout from that flag would create a minimum upside target around 24. I think that is rather optimistic and here's why. The PMO has managed to move from very oversold territory back to neutral with the breakout and formation of the flag.

While the PMO is looking bullish on its meteoric rise, note that the typical range for the PMO is 2.5 to -2.5. So in actuality, the PMO is reentering its normal range. The readings do not need to mirror the last PMO bottom and reach 10 before being overbought. It only needs to reach 2.5.

BONDS (TLT): As of 1/17/2014 The 20+ Year T-Bonds ETF (TLT) is on a Trend Model BUY signal. The LT Trend Model, which informs our long-term outlook, is on a BUY signal as of 3/24/2014, so our long-term posture is bullish.

Price tested support today. The PMO is beginning to reach oversold territory with respect to its previous lows. At this point, the PMO is falling quickly and very bearish so I don't think this support line will hold.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin