TAKEAWAYS

- Rising yields have wreaked havoc on equities but it's not necessarily a cause for worry

- Growth stocks have performed well during high interest rate environments and are likely to do so again

- The Bullish Percent Index can signal when a turnaround will occur

The stock market plunged on Tuesday, with the Dow Jones Industrial Average ($INDU), S&P 500 ($SPX), and Nasdaq Composite falling over 1% at the close. There are few different possible reasons for this.

One could be the August Job Openings and Labor Turnover Survey (JOLTS) report. The report exceeded expectations, with 9.6 million job openings reported (versus 8.8 million expected), indicating the tight labor market.

The other, and the one probably more reflective of the selloff, is the 10-year Treasury yield spiking to 4.8%. The last time yields were at that level was in August 2007. However, relatively speaking, are they really that high? Pre-2007, the average was almost 6%. And if you go back 45 years, you can see that since 1979, when interest rates were higher than they are now, the S&P 500 rallied up until the dot-com crash. Even this time, from a very long-term perspective, the S&P 500 is in an uptrend.

CHART 1: 10-YEAR US TREASURY YIELD INDEX VS. THE S&P 500. Higher interest rates don't necessarily mean that equities will fall. Between 1979 and 2000, interest rates were higher than now, yet equities rose.Chart source: StockCharts.com. For educational purposes.

So even though the "higher for longer" narrative is likely to be here for a while, it doesn't necessarily mean the stock market will crash. In a market that's charged ahead rapidly, a pause can be healthy and an opportunity to pick up assets at a better value.

Sure, there's the concern that record-high yields might freeze the housing market and tip the economy into a recession. But this isn't a repeat of the situation that led to the 2007–2008 housing crisis. Mortgage rates, closely correlated with the 10-year yields, have risen and are averaging 7.3%. But those holding mortgages have locked in the lower 30-year fixed rates, and we aren't seeing the subprime mortgages that were prevalent during the housing crisis.

A Look at the Sectors

Among the 11 sectors, Technology, Consumer Discretionary, Real Estate, and Financials tend to be more sensitive to changes in the 10-year yield. Financials can benefit from higher interest rates, but, if the rates are too high, it also increases the likelihood of defaults while discouraging demand for loans.

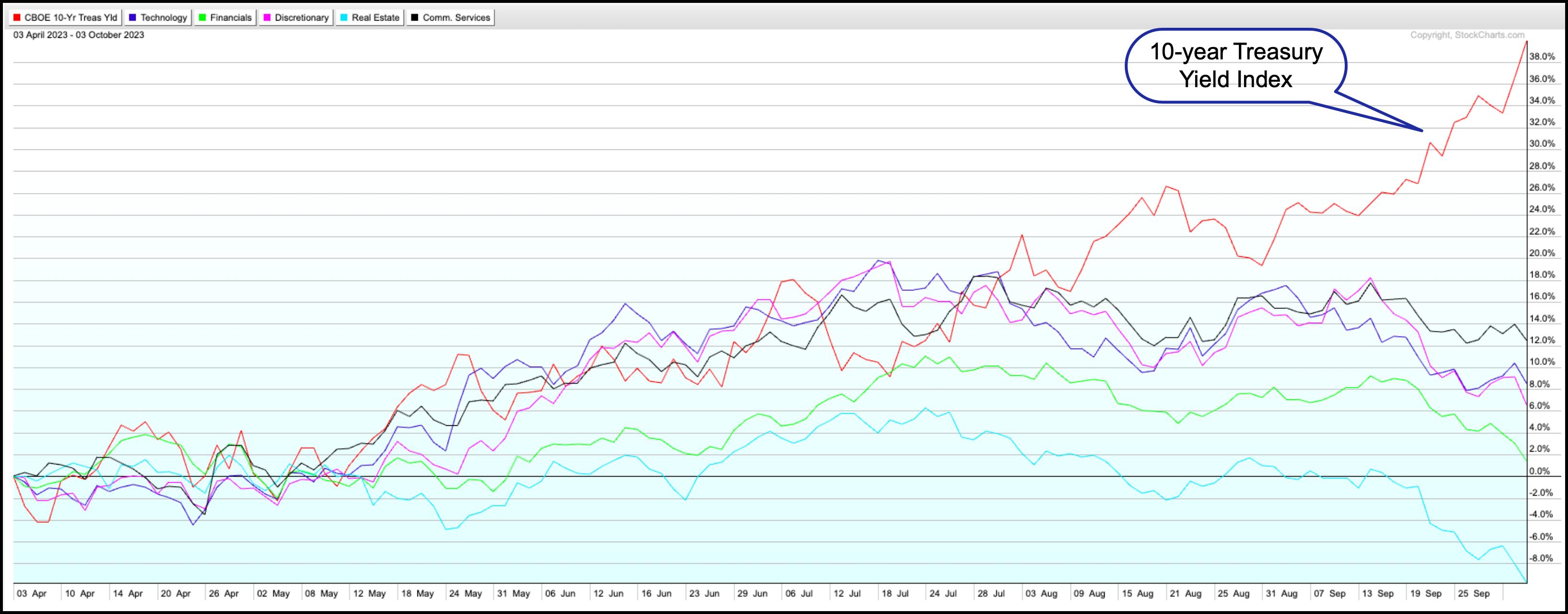

The PerfChart below compares the performance of the 10-year Treasury Yields to some of the different S&P 500 sectors.

How To View PerfCharts

- PerfCharts can be accessed from Your Dashboard or the Charts & Tools tab.

- From Your Dashboard, in the Member Tools section, under Charting Tools, scroll down to PerfCharts and click on it.

- Enter the symbols you wish to view separated by commas, i.e., ($TNX,XLK,XLY,XLC,XLF,XLRE).

- Hit enter.

- Right-click on the slider on the far right (below the chart) to select a time frame. For the example in the article, the time frame was Past Six Months.

CHART 2: COMPARING PERFORMANCE OF 10-YEAR US TREASURY YIELD WITH S&P SECTOR ETFS. Rising yields hurt the Real Estate sector. Financials are barely in positive territory. Technology, Communication Services, and Consumer Discretionary are also trending lower, but their performance is in positive territory.Chart source: StockCharts.com. For educational purposes.

You can see the contrasting trajectories between the 10-year yield and sector ETFs. As yields rose to higher levels in July, the sectors began topping out. In the last month, when the 10-year yield surged to record levels, the sectors saw an accelerated slide.

Performance of Technology, Communication Services, and Consumer Discretionary are still in positive territory. If you look at the six-month Sector Summary tool, these three sectors are the top-performing ones. It's likely that when certainty and stability return to the market, these three sectors will lead the rally.

StockCharts Tip

StockCharts Tip

- The Sector Summary can be accessed directly from Your Dashboard, Member Tools, or from the Charts & Tools tab.

- Change the Period from the dropdown menu to Six Month or any other period you wish to use.

CHART 3: TOP PERFORMING SECTORS IN THE LAST SIX-MONTH PERIOD. Communication Services, Technology, and Consumer Discretionary are the top three sector performers for the last six months.Chart source: StockCharts.com. For educational purposes.

So, Where Should You Invest?

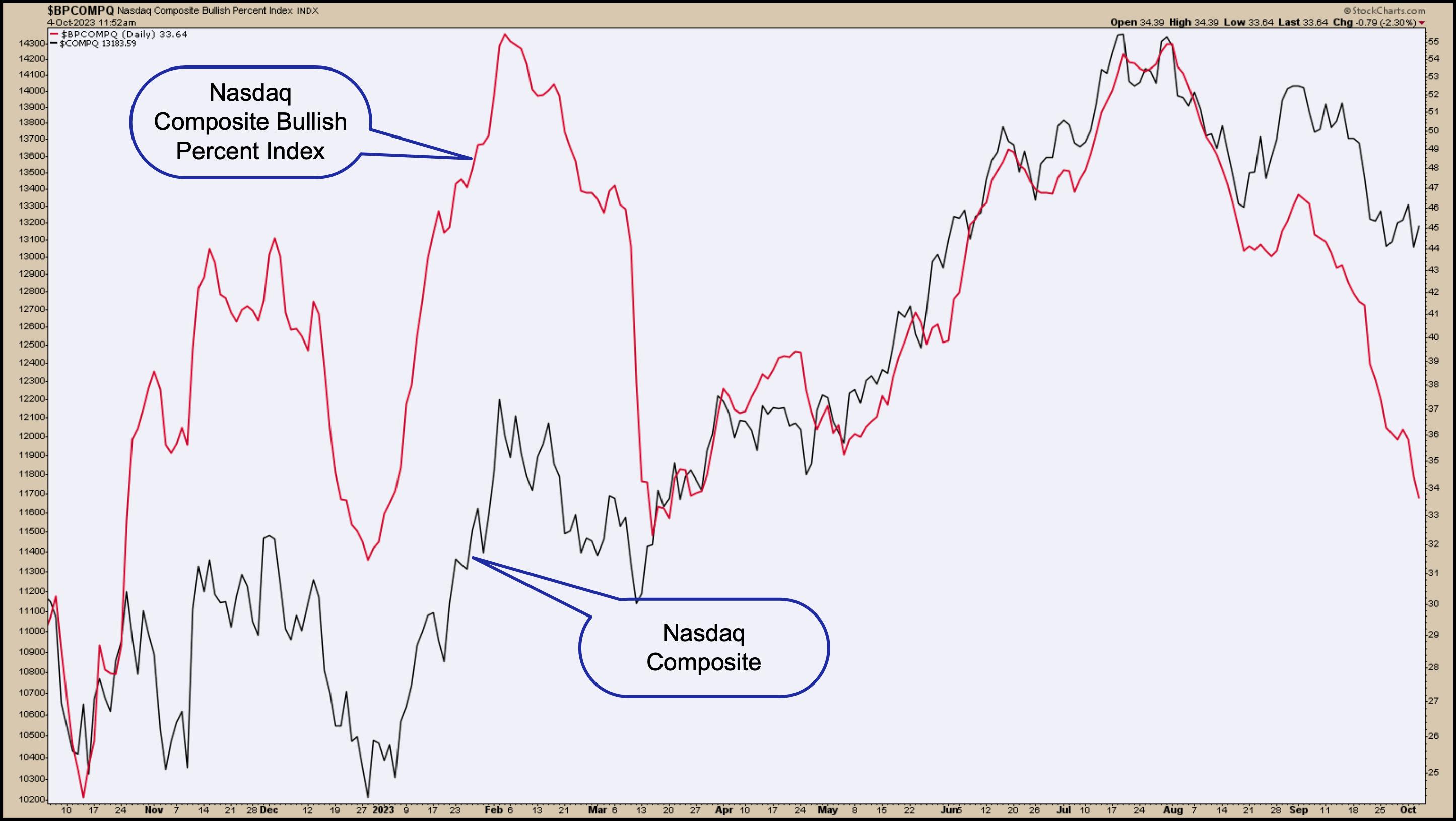

The logical place would be to watch the mega-cap tech stocks. Besides analyzing the chart of $COMPQ, you could also look at the Nasdaq Composite Bullish Percent Index ($BPCOMPQ). This is a great indicator that shows clear signals based on Point & Figure charts.

The chart below displays the $BPCOMPQ with the Nasdaq Composite overlaid on the index. There are different ways to apply the Bullish Percent Index, but one way is to look for reversals in the indicator.

StockCharts Tip

StockCharts Tip

To overlay the index, go to the Indicator dropdown menu and select Price, then add $COMPQ as a parameter and position it behind price.

CHART 4: NASDAQ COMPOSITE BULLISH PERCENT INDEX VS. NASDAQ COMPOSITE. When the Bullish Percent Index reversed, it was followed by a strong rally in the Nasdaq Composite.Chart source: StockCharts.com. For educational purposes.

The Bullish Percent Index tends to reverse sharply. While the indicator is trending lower, it's pretty close to its last two lows, which didn't hit oversold levels of below 30. Both lows reversed sharply, after which the Nasdaq rallied. There's a chance it could happen again, so save this chart to a ChartList you look through daily, because a reversal could be quick.

The Bottom Line

You don't want to miss out on the opportunity to pick up stocks at a value. Thus, when the stock market reverses and gains momentum, you want to get in the trend earlier rather than later. Be prepared with the stocks you'd like to add to your portfolio.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

Happy charting!

Happy charting!