I've been warning all year about this cyclical bear market and, unfortunately, it's not over just yet. Sentiment is turning more and more bearish, which is good, but we haven't seen the peak to mark the market bottom. That will take time and patience. In the meantime, relative strength in the health care sector (XLV) cannot be ignored. Check out this relative strength chart:

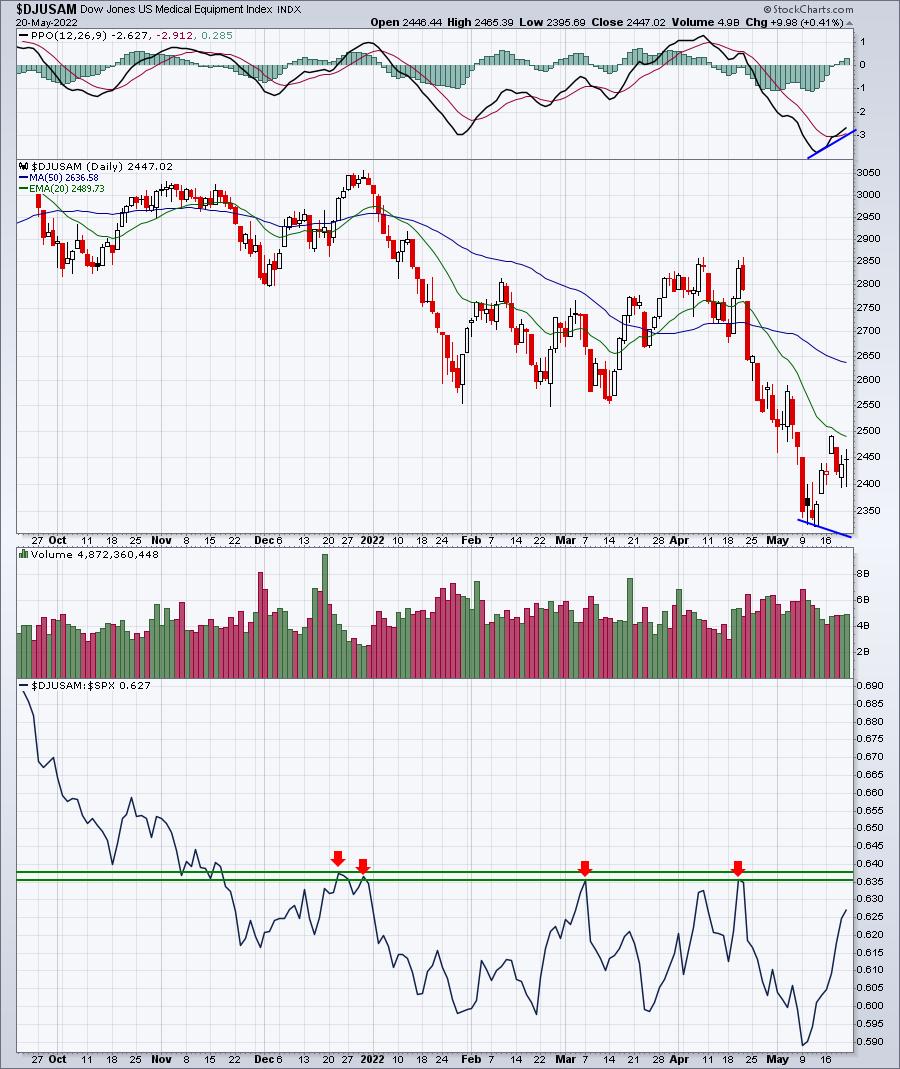

Money has been rotating into health care stocks, and the chart above clearly depicts this. Within the health care sector (XLV), medical equipment stocks ($DJUSAM) tend to perform exceptionally well from May through July and the group is nearing a relative high for 2022:

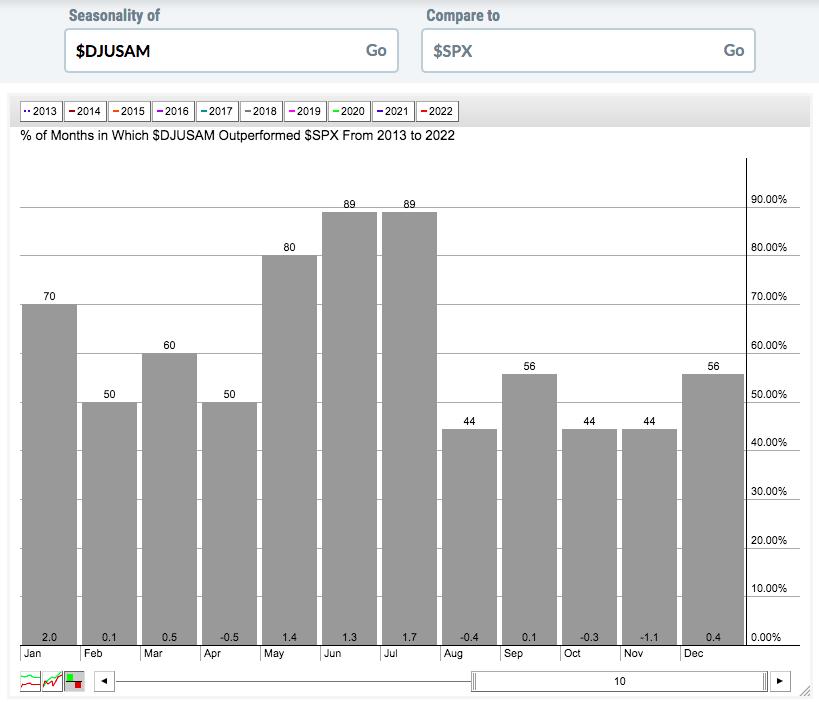

If medical equipment stocks fall back one more time in the near-term, there's an excellent chance we'll see a positive divergence form. If that's the case, you should be aware that medical equipment stocks LOVE the May through July period. Since the April 2013 breakout in the benchmark S&P 500 (above prior highs in 2000 and 2007), it's rather obvious that medical equipment stocks thrive from May to July. Check this out:

The above chart shows the relative outperformance of the DJUSAM over the next couple months. May through July are clearly the months where we see significant outperformance by medical equipment companies.

Cyclical bear markets definitely favor defensive sectors, and the DJUSAM is likely to provide great individual stock trading candidates as money rotates even further into defensive areas. On Monday, in my FREE EB Digest newsletter, I'll provide a medical equipment company that is poised to benefit from this summer rotation into defensive sectors. If you're interested, simply CLICK HERE and provide your name and email address in the area provided. I'll make sure you're set up and I'll get that chart out to you first thing Monday morning!

Happy trading!

Tom