As reported on Thursday, the rate of inflation in February rose to a 40-year high, with the U.S. facing even higher levels as the Russian war on Ukraine continues. Prices for oil, wheat and other commodities impacted by the war have already risen to decade-highs, with many metals reaching levels not seen in years.

This high inflation poses risks to many consumer-related areas of the market, as spending is reduced in the face of rising prices. In addition, stocks with high growth continue to get pummeled as the future value of their earnings are reduced. For those seeking to reduce inflation risk, the best plan is to invest in companies that are increasing their dividends. In fact, the faster the dividend growth, the better, as studies show that these stocks will considerably outperform the broader markets.*

Subscribers to my MEM Edge Report have already been alerted to one such stocks, as oil producer Occidental (OXY) recently announced an increase to their dividend in late February. The stock has gained 68% since we added it to our buy list in early January on the heels of robust 4th quarter results. Below are other stocks not on our list for your consideration.

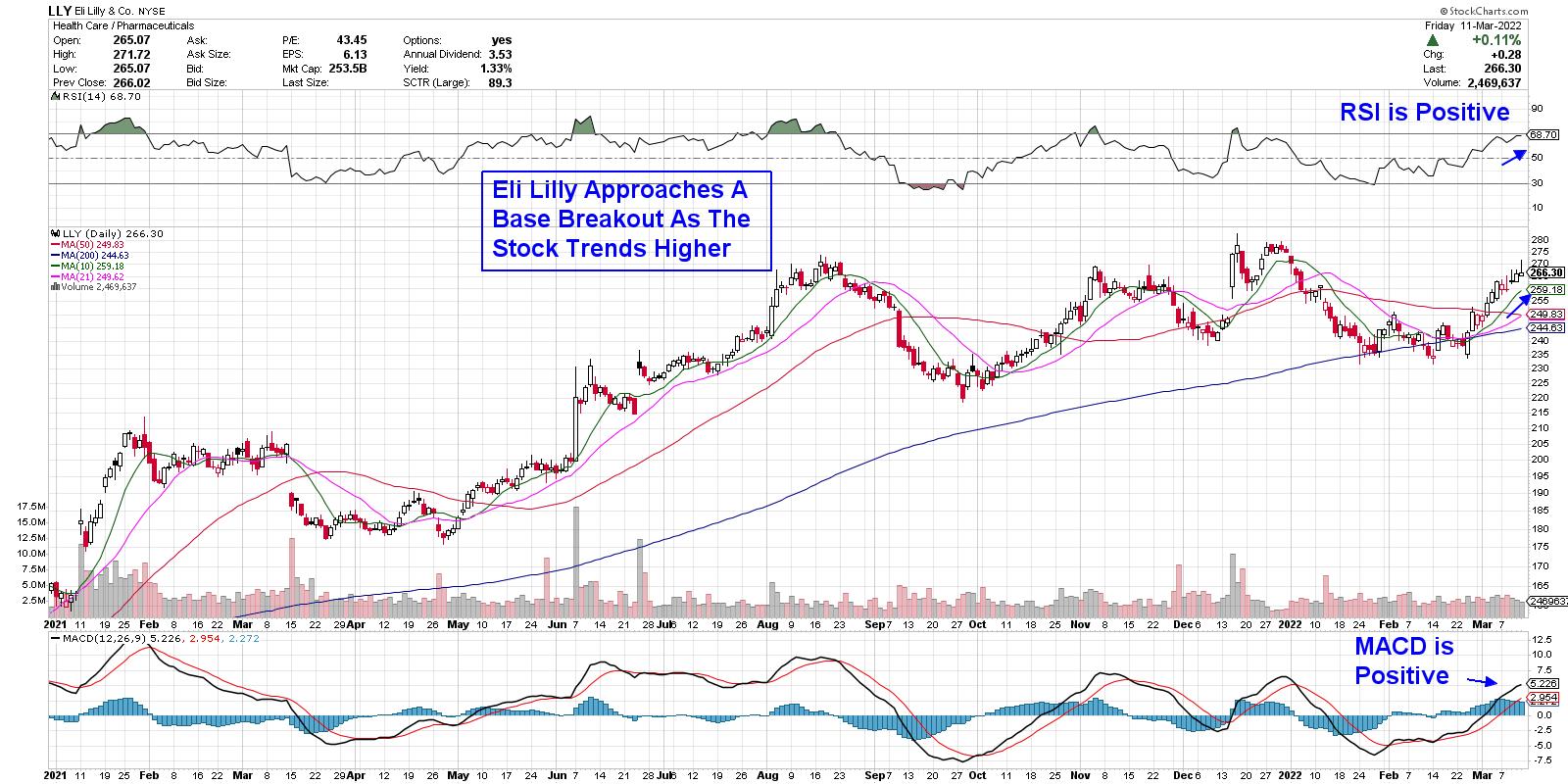

DAILY CHART OF ELI LILLY & CO. (LLY)

Eli Lilly (LLY) is an ideal candidate, as the well-known Pharmaceutical company has raised their dividend by 15.3% over the past 12 months. This is far higher than the 7.6% increase in inflation that was just reported.

The company has even more going for it, as they've been able to increase prices for their various drugs without any pushback while not seeing higher material costs to create these drugs. LLY is in an uptrend after breaking back above each of its moving averages as it moves closer to a base breakout at $284.

DAILY CHART OF GENERAL DYNAMICS (GD)

Aerospace/Defense company General Dynamics (GD) recently announced an increase in their dividend after releasing earnings that were above estimates earlier this year. The company is one of the top shipbuilding and land weapons providers and analysts are raising earnings estimates for next year, as they're well-positioned to capitalize on increased military needs in the face of Russia's attack on Ukraine.

GD is currently extended following its recent run-up; however, its 2.2% dividend coupled with a P/E that's 20x last year's earnings, make this stock a solid hedge given renewed demand for advanced weapons and technology systems. Look for a pullback to the $228 level as an entry point.

While the broader markets are in a downtrend, select stocks, such as those listed above, are expected to continue to outperform due to continued demand for their products, coupled with their attractive yields. Both of these stocks outperformed during the stagflation period of the late 1970s as well, as investors sought a hedge against high inflation.

It's been a difficult period for the markets, as intraday volatility remains high. There are areas of the market that have been able to withstand this, however, such as commodity stocks on our MEM Edge Report. If you'd like immediate access to these stocks as well as be alerted to broader market conditions, take a 4-week trial of my twice weekly report for a nominal fee. You can use this link here.

On this week's edition of StockCharts TV's The MEM Edge reviews the rotation that continues to take place as the markets grapple with inflation and rate hike fears. She also shares how to trade the pullback in stocks on the move.

Warmly,

Mary Ellen McGonagle, MEM Investment Research