ChartWatchers February 25, 2022 at 11:15 PM

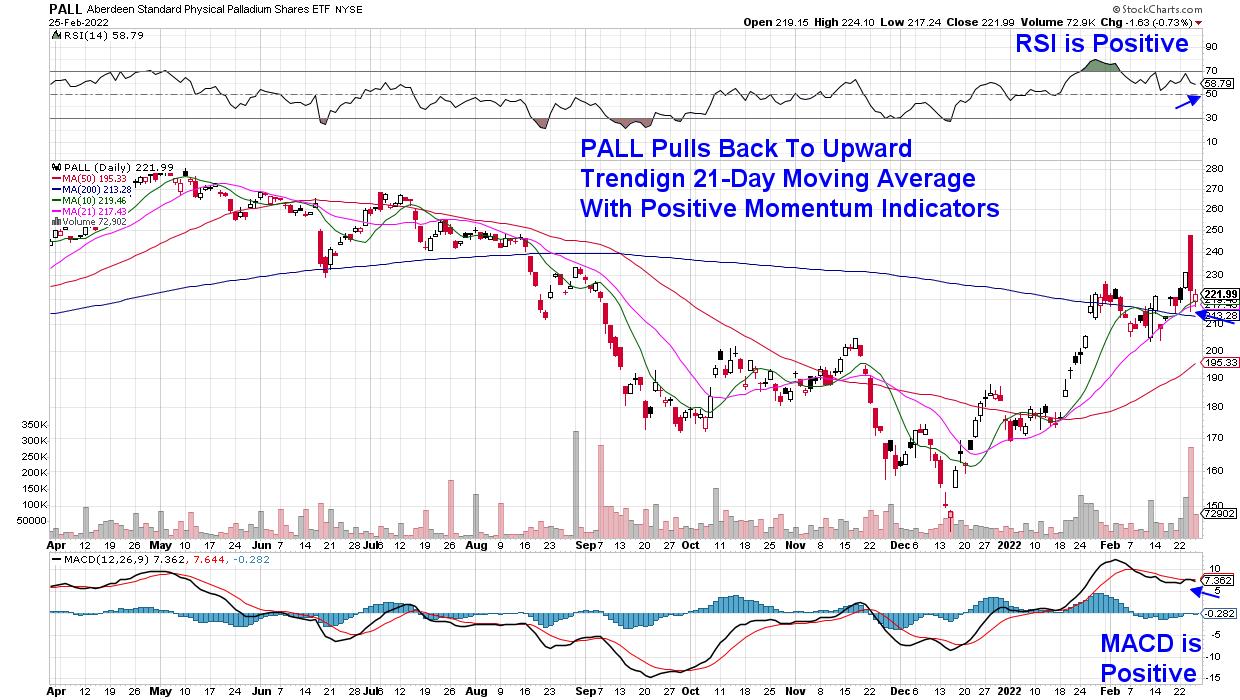

Russia's invasion of Ukraine is expected to create a sudden shortage of key products in the U.S. that in turn, will aggravate already high inflation rates... Read More

ChartWatchers February 25, 2022 at 10:18 PM

I'm a fan of relative strength and, even in a market that's been whipsawing back and forth, leaders emerge and you need to be vigilant in seeking them out... Read More

ChartWatchers February 25, 2022 at 07:14 PM

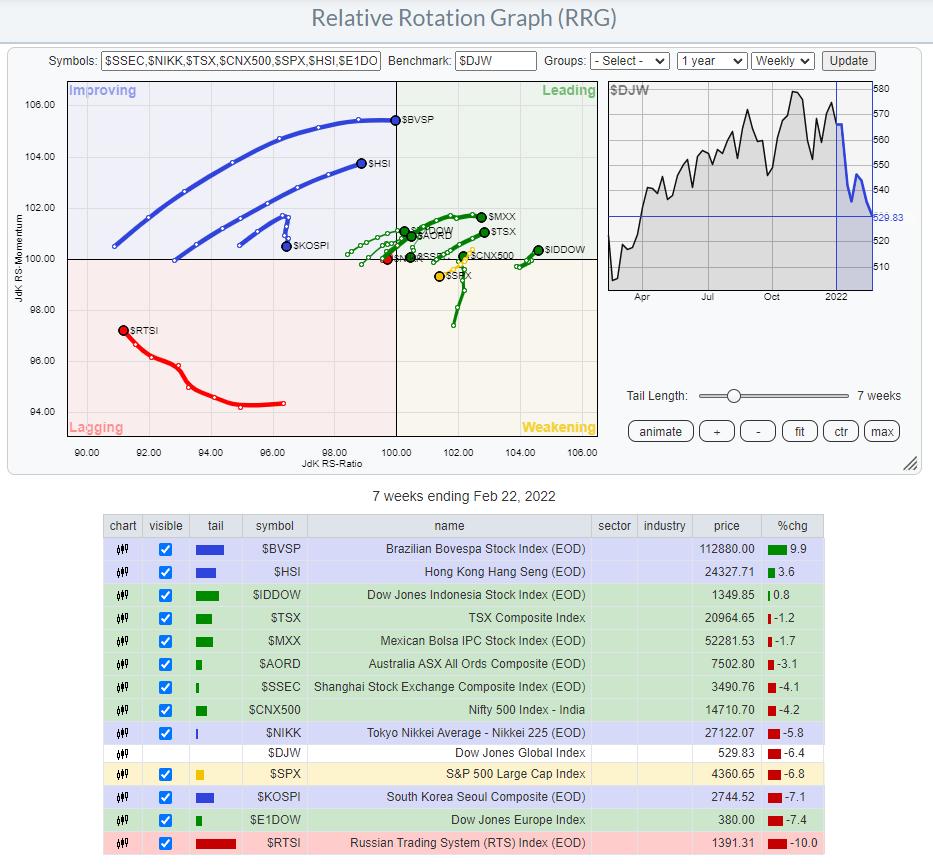

What a surreal experience it was waking up on Thursday morning. Switching on the news and seeing that Russia has actually invaded Ukraine. For us Europeans, wars since WWII have always been fought far away from home in Afghanistan, former Yugoslavia, Iraq, Iran, Kuwait, etc... Read More

ChartWatchers February 18, 2022 at 07:03 PM

A common question I am receiving via email and the Monday free DecisionPoint Trading Rooms (register here to be a part and/or receive the recordings): "How will we know it is safe to expand exposure or when seas aren't so stormy?" In this week's DecisionPoint show, Carl and I dis... Read More

ChartWatchers February 18, 2022 at 06:52 PM

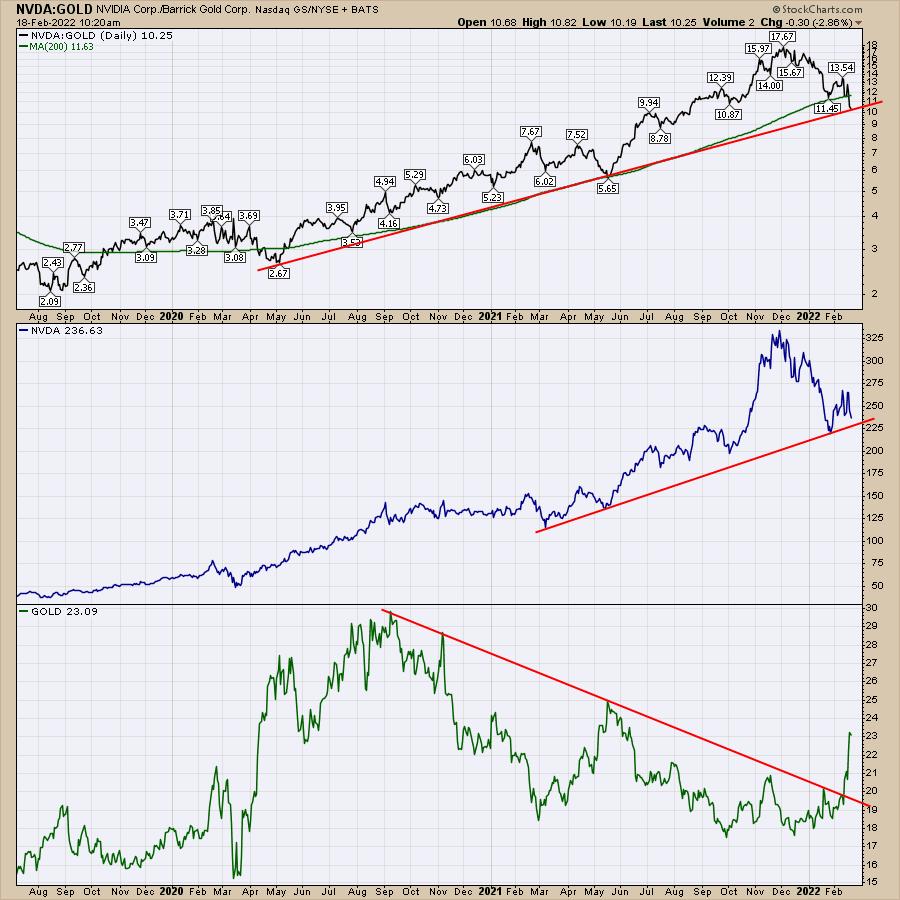

The chip leaders of 2021 are at risk of losing their throne to another group. And when we measure up the double AA battery versus a fossil fuel giant, it's surprising to see who is winning in the performance race... Read More

ChartWatchers February 18, 2022 at 04:57 PM

I am rarely dramatic, but 2022 is an exception. I believe we are in the type of bear market that we haven't seen in a long, long time. The pandemic-driven cyclical bear market in 2020 was a health care crisis, not a financial crisis... Read More

ChartWatchers February 18, 2022 at 02:41 PM

Buyers and sellers are slugging it out for control of the long-term trend for the S&P 500. This battle is raging near the 200-day SMA, which is perhaps the most widely followed long-term moving average. The S&P 500 is also the most widely followed benchmark for US stocks... Read More

ChartWatchers February 11, 2022 at 11:52 PM

I don't have to tell you that these markets have been tough... Read More

ChartWatchers February 11, 2022 at 10:52 PM

Before we look at the two-bar reversal, let's first review the long-term technical position for the Dollar Index. It's laid out on a quarterly basis in Chart 1, along with a Coppock momentum indicator... Read More

ChartWatchers February 11, 2022 at 07:33 PM

I must sound like "Debbie Downer", given this is my second ChartWatchers article with "bear market" in the title. I am bearish right now, but had to remind myself of "Bear Market Rules" Thursday after getting a little too bullish on Wednesday... Read More

ChartWatchers February 11, 2022 at 07:19 PM

I sat down to write my article Friday morning and each time I thought I had the right headline -- I didn't! You see, it's different when the market is green, the VIX is calm, all is well... Read More

ChartWatchers February 11, 2022 at 02:58 PM

This Relative Rotation Graph shows the rotation for the NYFANG+ members over the last thirteen weeks (quarter). Plotting this universe against the S&P 500 index clearly shows the weakness that crept into this universe recently... Read More

ChartWatchers February 04, 2022 at 04:11 PM

There are never any guarantees in the stock market. As much knowledge as I've gained over the years, and as much respect I have for my fellow technicians here at StockCharts.com, there's simply no way to ever be sure that your forecast is the right one... Read More

ChartWatchers February 04, 2022 at 01:38 PM

The violent swing trade in Amazon (AMZN) was enough to shake the teeth loose on most risk managers. We saw a $350 swing down from Wednesday to Thursday, followed by a full reversal on Friday after the earnings call... Read More

ChartWatchers February 04, 2022 at 12:02 PM

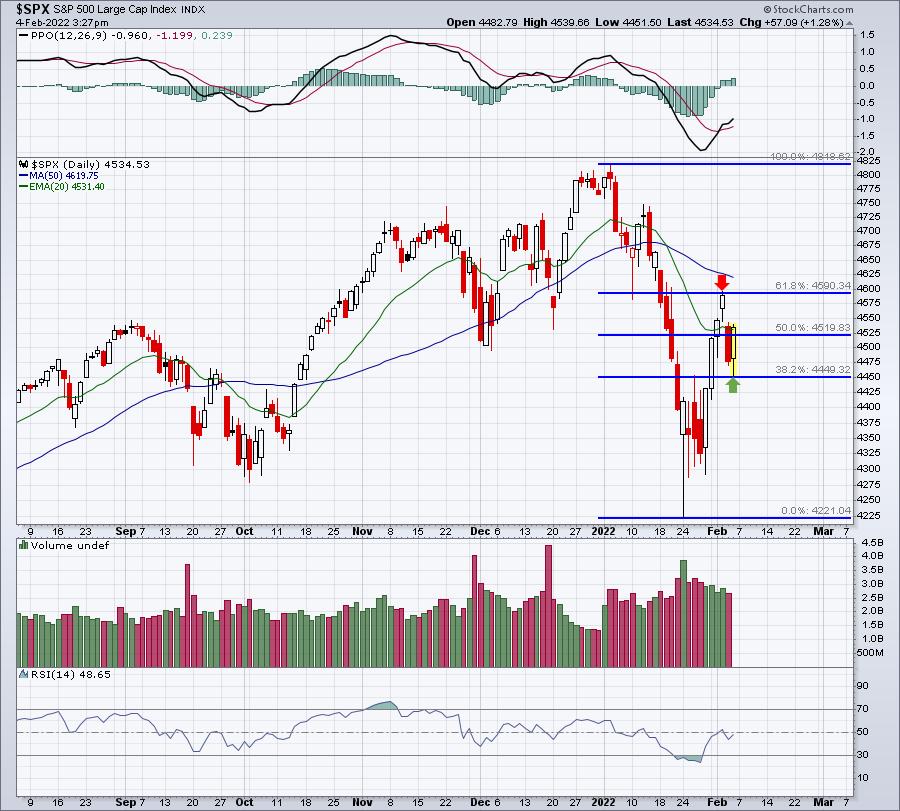

The 200-day SMA is quite the battle zone when it comes to the S&P 500. In fact, the index has crossed this key moving average 165 times since 2000. That's a lot of crosses, and a lot of needless whipsaws... Read More