When it comes to stock market performance, it's not always about reality. Many times, perceived problems can be a bigger problem than actual problems. As we wrap up 2021 and head into 2022, there's really no denying that inflation is a problem at both the consumer and producer levels. Check out these two charts:

Core Consumer Price Index ($$CCPI):

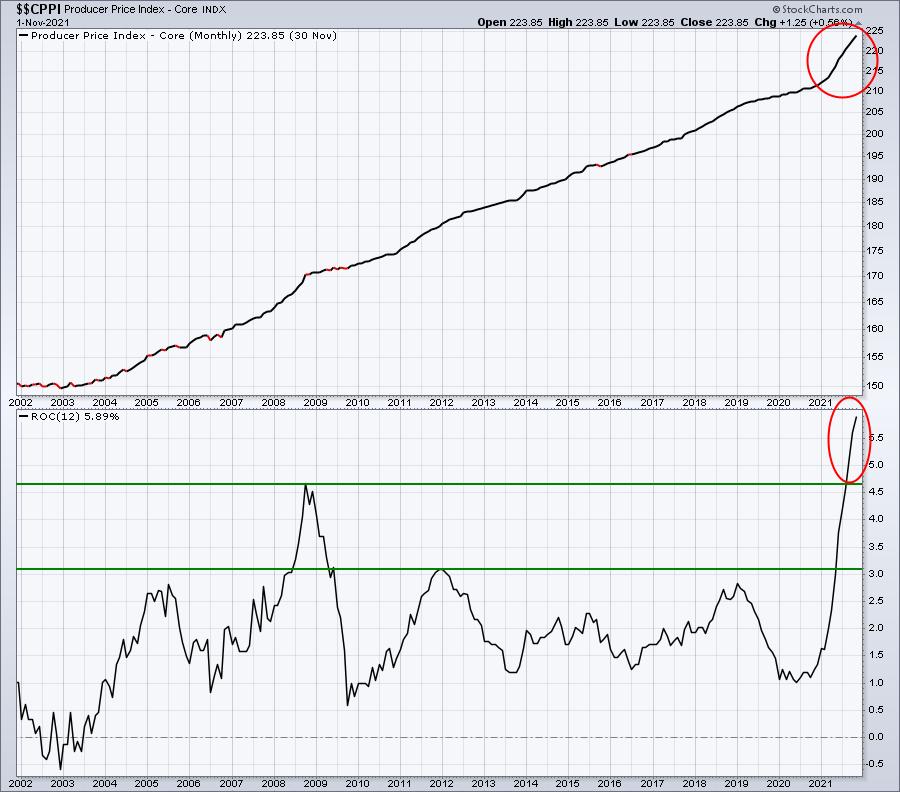

Core Producer Price Index ($$CPPI):

Can we agree that inflation is a problem -- at least in the short-term? I mean, we're talking 20-year highs in both cases. If you understand anything about the stock market, you should understand that inflation eats into the future earnings of growth companies. So, as a result, growth companies tend to perform poorly on a relative basis when inflation is spiking. Inflation picked up steam throughout 2021 and those rising prices took a toll on the relative performance of growth stocks vs. value stocks. For purposes of this example, let's look at the small cap growth vs. value ($DJUSGS:$DJUSVS):

If you look closely, the huge move higher in the Core CPI took place during the February-to-May period in 2021. That's when growth stocks were crushed on a relative basis.

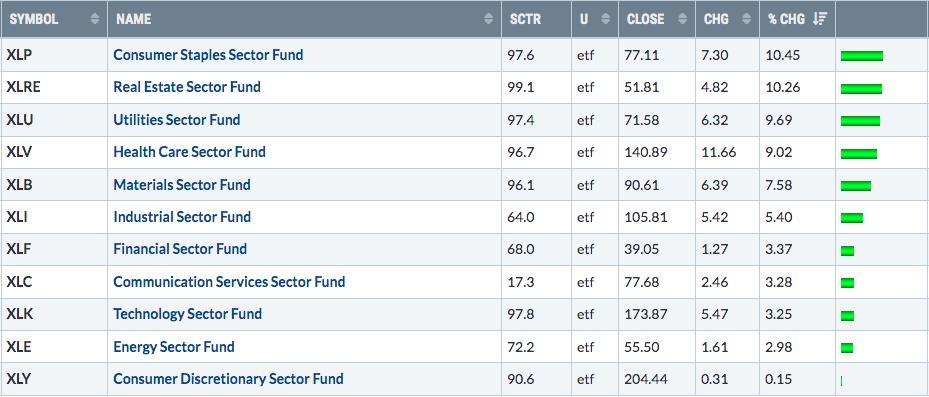

As we move into 2022, not much has changed. Inflation remains a big problem; Wall Street is taking notice and moving much more decisively into defensive areas. Over the past month, the benchmark S&P 500 has rallied strongly and set new all-time closing highs. But there's been one major change this time: defensive sectors have led the rally, and that's NEVER a good thing. Here's the performance of each of our 11 sectors over the past month:

Keep in mind that our four defensive sectors are consumer staples (XLP), real estate (XLRE), utilities (XLU) and health care (XLV). These four groups are in spots 1 through 4 over the past month. Defensive groups frequently lead when the stock market is weak, but rarely do they lead when the stock market is strong. Wall Street is losing confidence in this bull market rally.....and so should we.

I believe this is setting up for a very difficult period ahead. How difficult will it be? Well, I plan to discuss that very topic at our Market Vision 2022 event on Saturday, January 8th, 2022. This event will be FREE to all EarningsBeats.com members -- even 30-day free trial members. Last January, I boldly predicted that the S&P 500 would finish this year at 4750, 1000 points higher than the 3756 close on December 31, 2020. Given COVID, there weren't many analysts calling for nearly a 30% advance in the S&P 500. Yet where did we close on Friday? 4766, just 16 points away from the level I suggested one year ago. I see an absolutely WILD 2022 ahead. It will be very important to protect your capital throughout much of 2022 and I'll discuss how to do that next Saturday. To claim your seat and attend Market Vision 2022, it's very simple: just CLICK HERE and sign up for a FREE 30-day trial. We'll send out room instructions to all EarningsBeats.com members next Saturday. If you cannot attend the event LIVE, no worries. We'll record the event and send a copy of the recording to all EarningsBeats.com member to review at your leisure.

Happy New Year to everyone and, as always, happy trading!

Tom