Last week, the Federal Reserve announced plans to shift to a tighter monetary policy to allow for interest rate hikes sooner than expected. The move is in an effort to keep inflation from spiraling out of control and was in response to reports of a surge in inflation. November's Consumer Price Index rose the fastest it has since 1982, while the Producer Price Index showed a rise in wholesale prices, the fastest pace on record.

The data had Fed Chair Powell acknowledging that there's a real risk that the pandemic-era inflation will stick around for longer than initially expected. Investors initially cheered the news, as a Wednesday rally signaled relief that a plan of action was revealed.

Price action over the past two days has shown a different side, however, as already weak Retailers sold off further in the face of reduced consumer spending amid higher prices. Fast-growing Tech stocks also came under selling pressure, as the erosion of future earnings due to inflation spooked shareholders.

There were pockets of strength last week, however, with areas such as Real Estate stocks trading higher. REITs tend to do well in times of inflation, as they generate revenue through the properties they own. Many long-term leases on these properties include inflation clauses that allow them to increase rent, with the income being passed on to shareholders.

Among REITs, self-storage related facilities have been exhibiting the highest relative strength. With all the migration taking place amid a shift among employees who can now work from home, demand for extra storage has been very high.

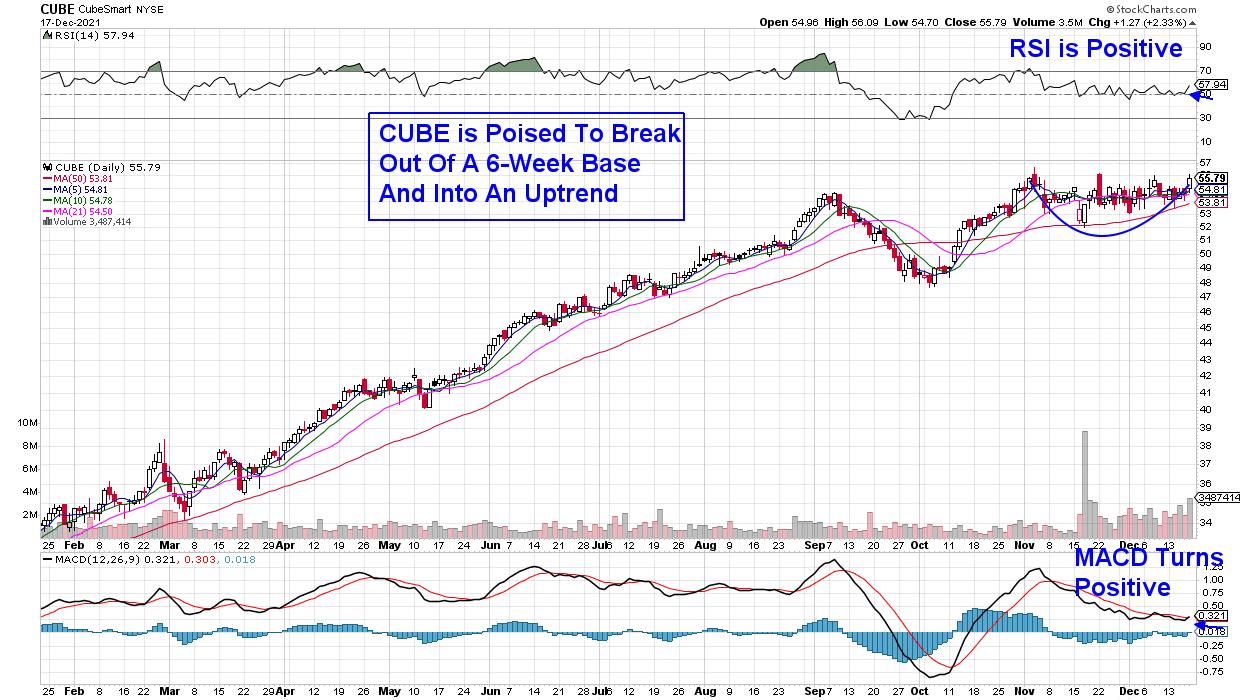

DAILY CHART OF CUBESMART (CUBE)

Cubesmart (CUBE) is a smaller self-storage operator; however, the company just announced a $1.7 Billion acquisition that will help them grow while expanding further within the Western U.S.

Currently, CUBE offers a 3.1% yield and the stock is poised to break out of a 6-week base, with its RSI in positive territory. CUBE has a MACD that just had a bullish crossover from a very low level. A base breakout at $57 would be an ideal entry point.

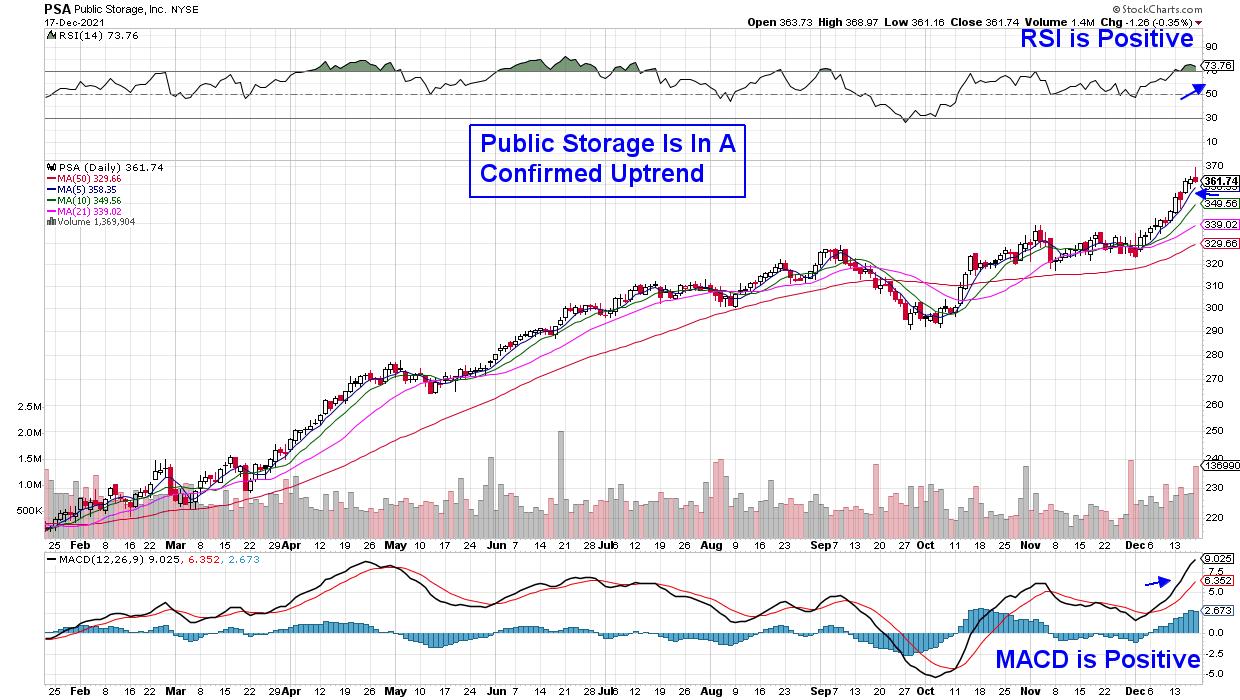

DAILY CHART OF PUBLIC STORAGE (PSA)

Public Storage (PSA) is the largest owner and operator of self-storage facilities, with operations in the U.S., Canada and Europe. The company reported quarterly results early last month that were ahead of estimates, while also raising guidance for the remainder of this year.

The 2.2-yielder is in a confirmed uptrend on its daily chart as it finds support at its upward-trending 5-day moving average. Its recent advance has put the stock into an overbought position, however, and we'd be a buyer on any pullback that would allow the MACD to reset for another leg up.

WEEKLY CHART OF CROWN CASTLE INT'L CORP. (CCI)

Last up is an infrastructure REIT focused on cell towers and fiber optic networks in the U.S. With carriers building out their 5G networks, companies such as Crown Castle (CCI) are providing new tower sites and equipment that's providing rural areas with mobile services.

Crown Castle sees a decade-long investment cycle in 5G and, because of that, the company estimates that they can grow their dividend at a 7%-8% annual rate over the long term. CCI is poised to break out of a 5-month base at $205 and, with its MACD crossing from a low level on its weekly chart, the stock is poised to trade higher.

In addition to REITs, there are other areas that are showing relative outperformance in an otherwise difficult market. This would include a select sub-industry among Technology stocks. If you'd like to uncover these select groups and the stocks I've highlighted to benefit, use this link here to gain immediate access to my latest reports.

Your 4-week trial of this twice-weekly report will also keep you up to date on whether it's safe to put new money to work while also revealing sector rotation. I hope you'll take advantage of this special offer!

On this week's episode of StockCharts TV's The MEM Edge, Mary Ellen reviews where the relative strength is in the markets and shares individual stocks that are expected to remain strong into next year.

On this week's edition of Chartwise Women, Mary Ellen and Erin Swenlin talk about their favorite chart patterns, with Mary Ellen going in-depth on Base Breakout patterns while Erin covers the Double Bottom, Ascending Triangle, Falling Wedge, Bull Flag and Triple Bottom patterns.

Warmly,

Mary Ellen McGonagle

President, MEM Investment Research