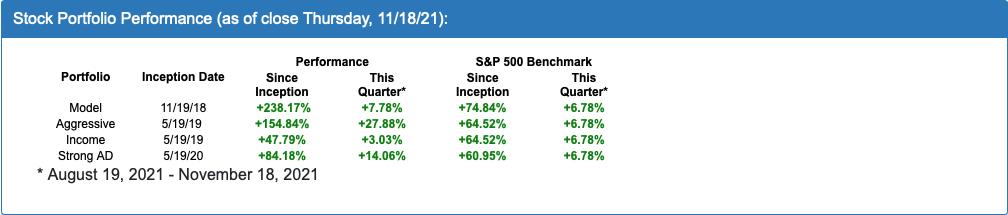

This past Thursday evening, our Chief Market Strategist Tom Bowley unveiled his "Top 10 Stock Picks" for our 4 portfolios, 40 stocks in all. These stocks are meant to be held for the subsequent 90 days, when a new batch of stocks will be unveiled and the process is repeated each quarter. The portfolios are meant for those members who are less inclined to be active traders, but are not necessarily long term buy-and-hold investors. But we also have plenty of members who like to trade individual stocks that make up the portfolios. How have the portfolios performed this past quarter and since inception? You can see for yourself in the chart below.

While our most conservative portfolio, the Income Portfolio, lagged the S&P over the same period of time, you can see that the Aggressive portfolio has crushed the S&P (a 4-bagger) and the Strong AD has outperformed the S&P by more than double. Combined, the 4 portfolios averaged over 13% for the quarter compared to the S&P of 6.78%, almost a double. How did this happen?

First, it helped that both Macy's (M) and NVIDIA (NVDA) were included in the Aggressive portfolio. For example, in the case of M, as you can see below, when the stock was added to the portfolio on August 19, it was trading at a price of $21.61. As of Thursday's close, the stock was at $37.37, resulting in a 73% gain.

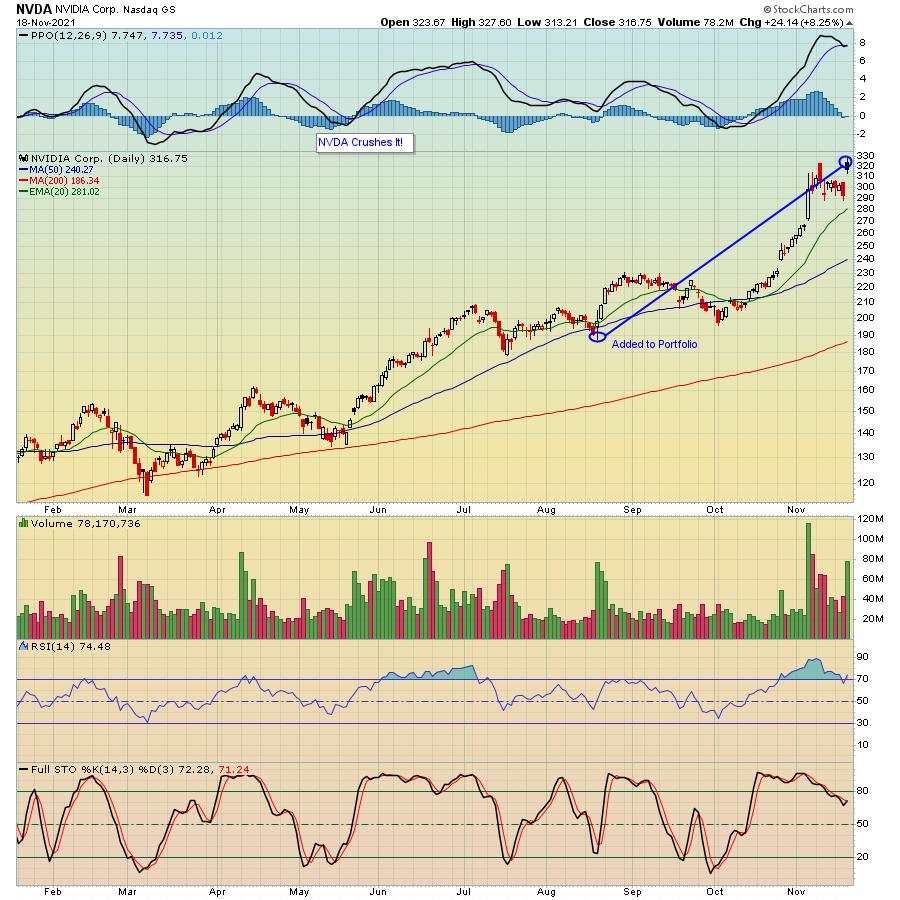

In the case of NVDA, as you can see below, when the stock was added to the portfolio on August 19, it was trading at $197.98. As of Thursday's close, the stock was at $316.75, a gain of 60%.

What we have found consistently since the Model portfolio was first introduced on 11-19-18 is that, if you have even a few strong winners, it helps to offset the laggards. For example, this past quarter, Moderna (MRNA) was one of the stocks in the Aggressive portfolio, and it lost 33% through Thursday's close. But the other stocks in the portfolio more than made up for MRNA's loss.

There are some commonalities in each of the portfolios. For example, we look for companies that are showing relative strength. With the exception of the Strong A/D portfolio, every stock has beaten Wall Street consensus estimates as to both revenues and EPS in its latest quarterly report and comes from our Strong Earnings ChartList. Next, every stock is technically sound. And every stock is held for the entire quarter; no price targets or stops. Every stock is selected the 19th of February, May, August and November. So, in the case of those stocks Tom unveiled this past Thursday, they will replace the current crop of stocks as of the close on Friday, the 19th.

In fact, if you would like to see all of the stocks that Tom just revealed, click here to sign up for a NO COST trial which will get you access to all 40 stocks. Also, feel free to sign up for our FREE newsletter, the EarningsBeats Digest by clicking here.

The primary goal of money managers is to beat the S&P. Many don't. If you can develop a formula that outpaces the S&P by a wide margin, you will be miles ahead of the pack!

At your service,

John Hopkins

EarningsBeats.com