On Fridays, as part of my subscriber-only DecisionPoint Diamonds Report, I give readers insight on how the Sectors did for the week, what our Sector Scoreboard and daily RRG look like and, most importantly, what sector and industry group to watch going into next week.

I decided to share an excerpt from Friday's 7/23 DP Diamonds Recap. It was actually difficult to choose this week's sector to watch, as we are seeing rebounds off key levels of support and newly rising Price Momentum Oscillators (PMO). While I picked Healthcare as my "sector to watch" this week, XLP and XLU also look pretty good.

THIS WEEK's Sector Performance:

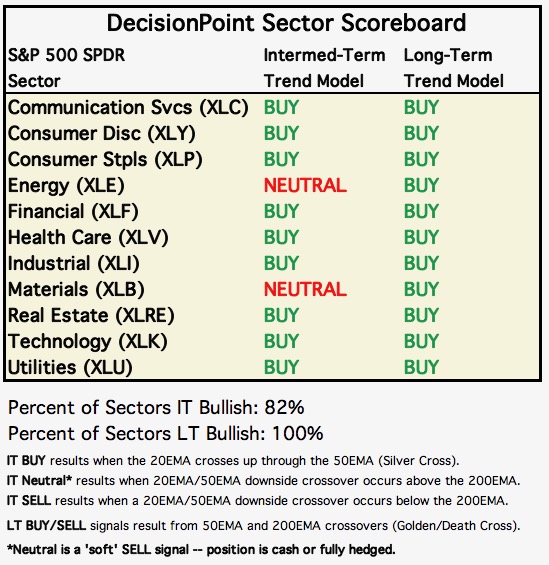

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

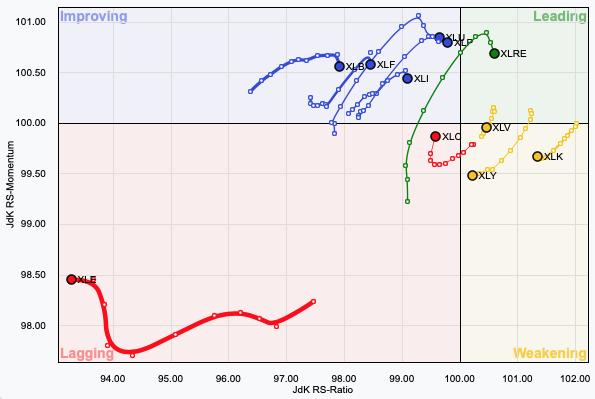

Short-Term RRG: No significant changes. I would just note that XLV, which is in Weakening, has reversed direction and is headed back to Leading. XLU and XLP are also heading toward Leading. For those in the Diamond Mine this morning, that should be no surprise, as those were short-listed for "Sector to Watch" next week.

Click here to register in advance for the recurring free DecisionPoint Trading Room! Recordings are available!

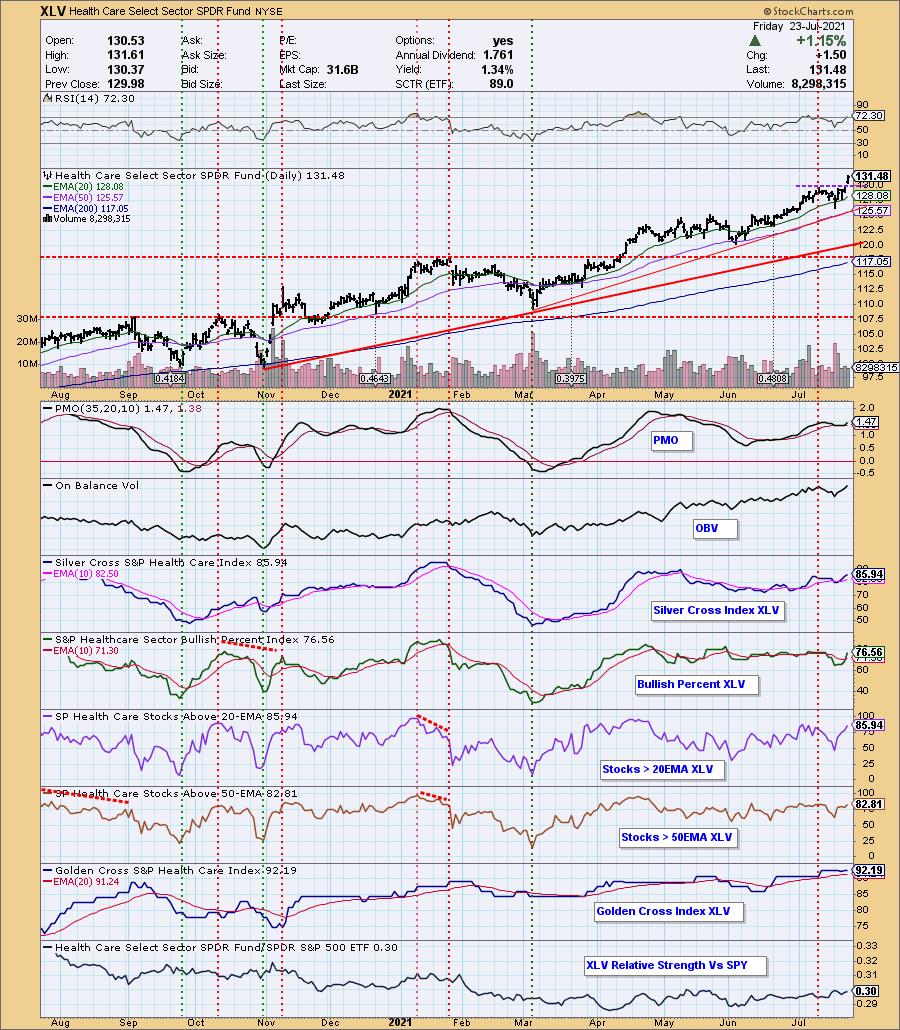

Sector to Watch: Healthcare (XLV)

The sector chart style below is available for all sectors on our website for subscribers. The "under the hood" indicators on participation make these charts a must have.

I struggled "live" in the Diamond Mine trying to find the perfect sector to watch next week. I opted to go with XLV because the only real negative on the chart was the newly overbought RSI. Today's gap up breakout also affected my decision. The configuration of the PMO, SCI and BPI, as well as strong participation numbers, sold it for me.

You'll also note that the relative strength line shows that the sector is beginning to outperform the SPX.

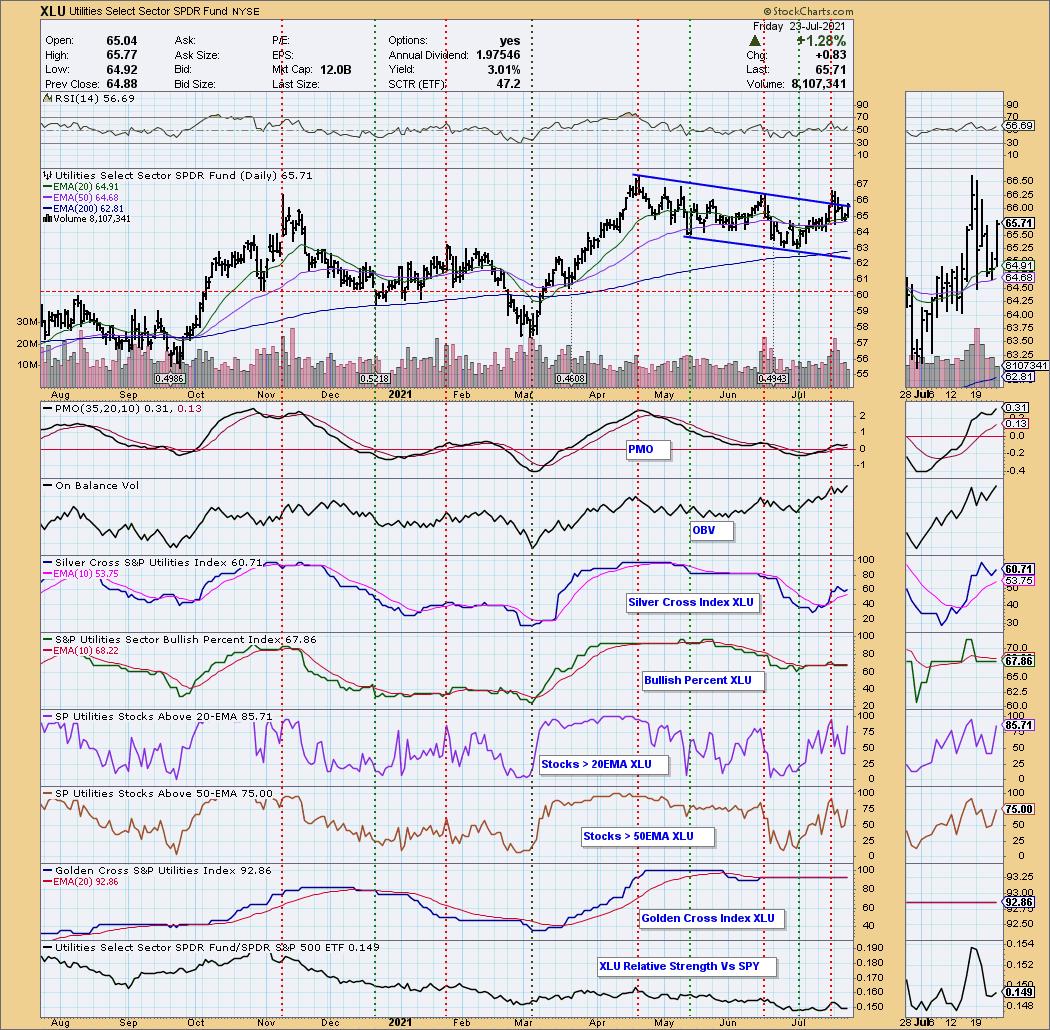

I've added the XLP and XLU sector charts below for comparison. They are also bullish.

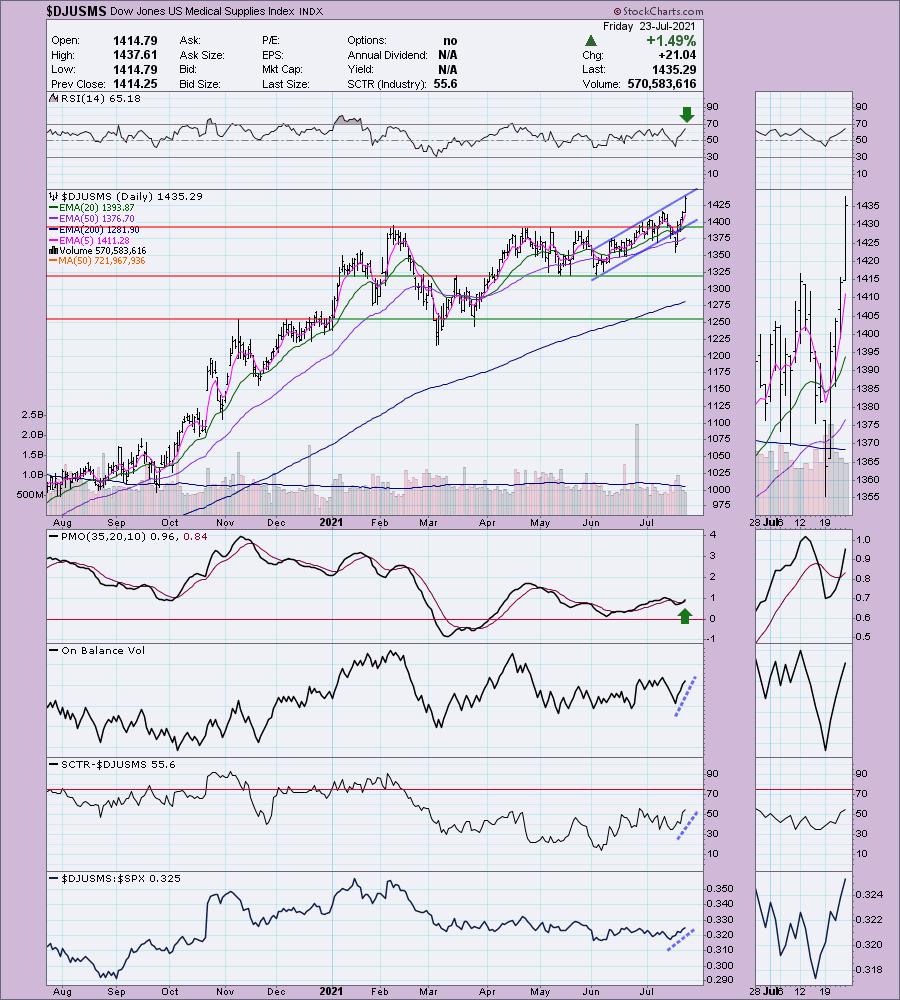

Industry Group to Watch: Medical Supplies ($DJUSMS)

After breaking down from the rising trend channel, price successfully tested the 50-EMA and recaptured the rising trend. The RSI is positive and not overbought and the PMO just gave us a crossover BUY signal. Relative performance is strong.

Conclusion: It appears that the three defensive sectors XLV, XLP and XLU all show promise for next week. Rotation is shifting toward these defensive groups, telling us that investors are already opting to play defense in anticipation of a market failure.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 35% invested right now and 65% is in "cash," meaning in money markets and readily available to trade with.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com