At the time of my last ChartWatchers article two weeks ago, the 10-year treasury yield ($TNX) had just closed at 1.46% after reaching an intra-week high at 1.61%. Well, we didn't stop there. The TNX had a big day on Friday, gaining nearly 11 basis points and closing at 1.64%, our highest since we closed at 1.65% on February 5, 2020, which was just a couple weeks before the pandemic-induced U.S. equity selloff began 13 months ago. Personally, I'm of the opinion that bonds are selling and yields are rising because of a tremendous surge in economic activity later this year and simply due to normalization. Yields were artificially low due to the pandemic, and a return to the 2.00%-3.00% level is likely over the course of 2021. However, there's also a large number of stock market participants that believe inflation is on our doorstep and we need to brace for its bearish impact, especially on growth stocks.

So let's take a look at the Core Consumer Price Index ($$CCPI) and then I'll provide you my bearish and bullish interpretations of the chart.

$$CCPI:

Note that the annual rate of inflation has teetered back and forth from 0.6% to 2.9% this century. The Fed's target rate of 2.0% is marked with a horizontal line in the appropriate panel above.

Bearish Case

The 2004 to 2006 period (red-shaded area) was marked by a falling Dollar, rising commodity prices and an inflation scare that sent the Core CPI from 1.1% to 2.9%, well above the Fed's target level of 2.0%. That period of rising prices coincided with:

- a rising S&P 500

- a rising 10-year treasury yield

- a rapidly-deteriorating picture between growth and value stocks (IWF:IWD)

- underperformance by technology (XLK:$SPX)

- underperformance by consumer discretionary (XLY:$SPX)

If we look at the past month or so on the above chart, we are seeing the exact same scenario beginning to play out. The bearish argument says to get out of growth stocks, particularly technology.

Bullish Case

The Federal Reserve has a few primary functions, but the one I'll focus on right now is their responsibility to maintain price stability. They review current inflation and future inflationary pressures to help set monetary policy. Recently, Fed Chief Jay Powell has suggested that any short-term hike in inflation will be transitory (temporary) and he doesn't anticipate the need to raise rates at this time.

If you look at the above chart, particularly the area on the chart with the red circle, it shows Core CPI falling for a few months, which was the direct result of falling prices during the initial stages of the pandemic. I've included the monthly Core CPI numbers for each of the last 12 months. The numbers for March, April and May of 2020 are all negative, highlighted in red, and will be replaced in upcoming months by positive numbers. This will absolutely result in the spike of Core CPI year-over-year, which will give the bears PLENTY of ammunition to spread inflationary fears. But Fed Chief Powell's argument is that June, July and August were unusually high because of the low readings of the March through May period. By the time we get to May, the annual rate of inflation will be well above the Fed's 2% threshold, but the Fed will be expecting it to come back down when the June through August readings are replaced with much lower numbers. That's why the Fed Chief is saying that inflationary pressures will be transitory and that the Fed is willing to allow the year-over-year rate to exceed 2% without pulling the trigger on interest rates.

The other consideration here is that the U.S. Dollar ($USD) is just beginning to turn higher, following the much more rapid increase in treasury yields in the U.S. vs. Germany. I've found the difference between these two countries' yields to be a very solid indicator of future Dollar strength or weakness. If the USD continues rising, that will help to restrain inflationary pressures. Here's that $US10Y-$DET10Y chart:

The green-shaded areas show the U.S. treasury yield rising faster than Germany's, while the Dollar fell (inverse correlation). In each instance, the Dollar came roaring back (green directional lines). In the one red-shaded area, the U.S. treasury yield was falling vs. Germany's, while the Dollar kept rising. In that instance, the Dollar then suffered a steep decline (red directional line). Well, it appears to me that the Dollar is just beginning to turn higher after a green-shaded area developed as U.S. treasury yields rise more rapidly than Germany's. Should the Dollar continue strengthening in 2021, as I believe it will, that will act as a headwind for commodity prices.

My Conclusion

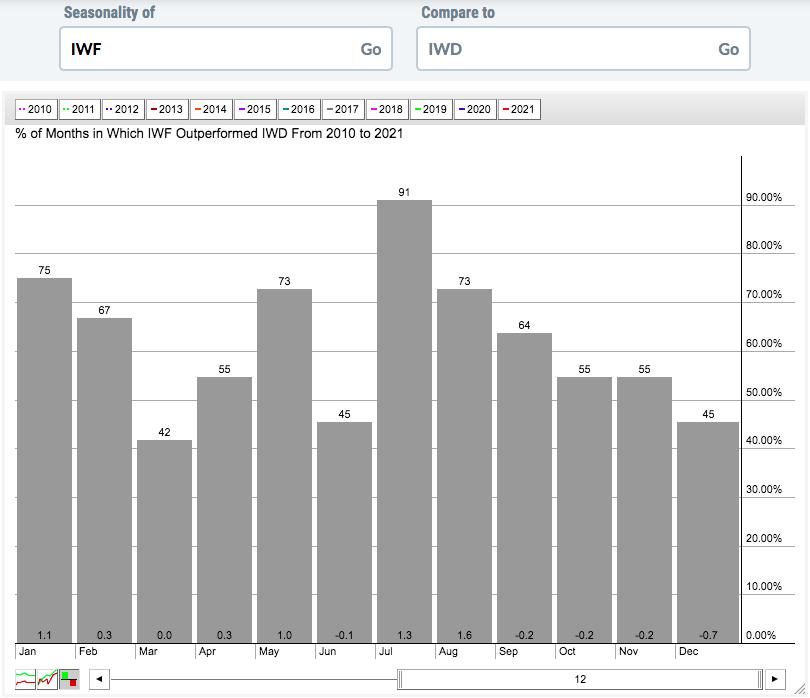

I am of the opinion that annual inflation will increase rapidly, just as it did back in 2011. This time, however, it will only take about 3 months for the annual inflation rate to hit or approach 3%. That will trigger all kinds of hyper-inflation headlines and talk, none of which will materialize. But the fears alone will result in tremendous volatility in growth stocks. I expect those stocks to do well leading up to and just beyond earnings, but in the third month of each calendar quarter, we'll need to be extremely nimble - especially if you have a short-term trading mindset. That is the history of the stock market. Here's a seasonality chart to illustrate how growth stocks perform relative to value stocks during strong stock market years (2010 through 2021):

Here's a breakdown of the average relative performance of growth vs. value by month of the calendar quarter:

- Month 1 of calendar quarter (Jan, Apr, Jul, Oct): +2.5% (7.5% outperformance annualized)

- Month 2 of calendar quarter (Feb, May, Aug, Nov): +2.7% (8.1% outperformance annualized)

- Month 3 of calendar quarter (Mar, Jun, Sep, Dec): -1.0% (4.0% underperformance annualized)

It's important to understand that growth stocks historically struggle relative to value stocks during March, June, September and December. So March 2021 is nothing new really.

I remain very bullish and fully expect that this current secular bull market will carry most equities higher throughout 2021. I can see a scenario later this year where earnings are rising rapidly among ALL areas of the market, inflation is tame, interest rates remain quite low and stock prices soar. Navigating the market for the next several months, though, will be extremely difficult due to volatility and inflation talk. It'll take a strong stomach to stick with the leading stocks in the leading industry groups. But that's exactly what we're planning to do at EarningsBeats.com.

Please CLICK HERE to subscribe to my FREE EB Digest newsletter, published 3x per week. There's no credit card required and you may unsubscribe at any time.

Happy trading!

Tom