I am constantly performing research, using my analytical skills to uncover the best stock market opportunities. At EarningsBeats.com, we have a proven process of identifying leading stocks in leading industries. It all starts with fundamental research, which helps us to limit the number of stocks in our trading universe and organize them into several different ChartLists. We then provide our members with several different scan syntax to identify great trading opportunities among those fundamentally-sound companies.

During this latest period of consolidation, the big picture doesn't tell us the whole story. Do you remember the big 1800 point plunge on the Dow Jones on Thursday, June 11th? Well, the recovery since then across our major indices, industry groups and individual stocks has been quite different as professionals rotate into the stocks and areas they want to own heading into next month's earnings. It's extremely important that we understand what's taking place under the surface. Before I talk about a few key recent areas of strength, let's look at the Dow Jones, S&P 500 and NASDAQ 100 on a 10-day, 15-minute chart in order to compare performance:

Can you see the difference? Without looking at this intraday chart, you might not realize that Wall Street is making a statement - one in which it clearly is favoring the higher growth NDX over its DJI and SPX counterparts.

Since the close on Wednesday, June 10th, the benchmark S&P 500 has fallen 2.90%. One of my tasks is to evaluate this period of consolidation in much the same way I did the action back in March and April and to understand the rotation that's taking place ahead of next month's earnings reports. Investment firms send their analysts out to meet with management teams, and the re-positioning of their money becomes apparent ONLY when we see where the money is going. Don't watch the lips moving on CNBC - that tells us absolutely nothing. And please don't watch Jim Cramer and Bad Money. He changes from bullish to bearish to bullish more often than a chameleon changes colors. Instead, simply watch where the money goes. That's all you need to do. From that June 10th close, I want to note the best-performing groups, analyze their technical outlook and decide which areas should perform well as we move into earnings season.

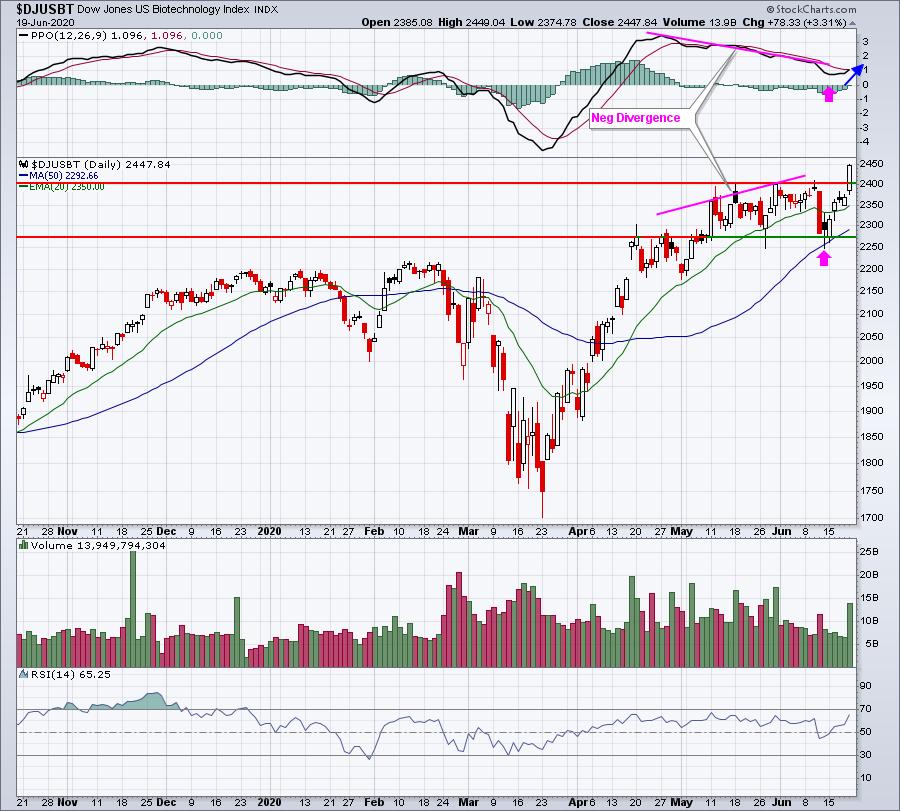

One group really stands out, and that's biotechnology ($DJUSBT). While the S&P 500 has given back almost 3% since that June 10th close, the DJUSBT just broke out on Friday to an all-time high. Clearly, Wall Street believes we're going to see robust earnings growth in the group and I definitely want exposure to stocks in this area. Check out the DJUSBT chart:

Why on earth would a group break out given the overall market performance the past 10 days? Because the leading stocks in the group are going to post quarterly earnings results that will blow away estimates. I loved biotechs when our latest portfolios were announced on May 19th. I included a biotech in each of our four portfolios and they all performed exceptionally well today.

The four biotechs that I added to our portfolios on May 19th were REGN, SGEN, VRTX and AMGN. My favorite for months has been REGN. Check out this chart:

Relative strength is awesome. When you own a stock like REGN, you own a leading stock in a leading industry. That makes it much easier to beat the benchmark S&P 500. I'm on record saying that I believe biotechnology will be the best area of the market during the balance of 2020, and possibly much longer. Friday's action certainly didn't change my mind.

During the June 10th to June 19th selloff and recovery, biotechs ranked 2nd out of 104 industry groups. On Saturday, I plan to send a report to EarningsBeats.com members, detailing the likely winners as we move towards the next earnings season. Get ready for a major upside move in these industries and the leading stocks within said industries. If you're not already an EarningsBeats.com member, I invite you to become one. Let me be your own personal research department. In the meantime, I'm begging you to stop listening to the media. CLICK HERE for a fully-refundable $7 30-day trial and make sure you receive the latest in market rotation and what that will mean as we move into summer. The stock market is going higher...... much, much higher!

Happy trading!

Tom