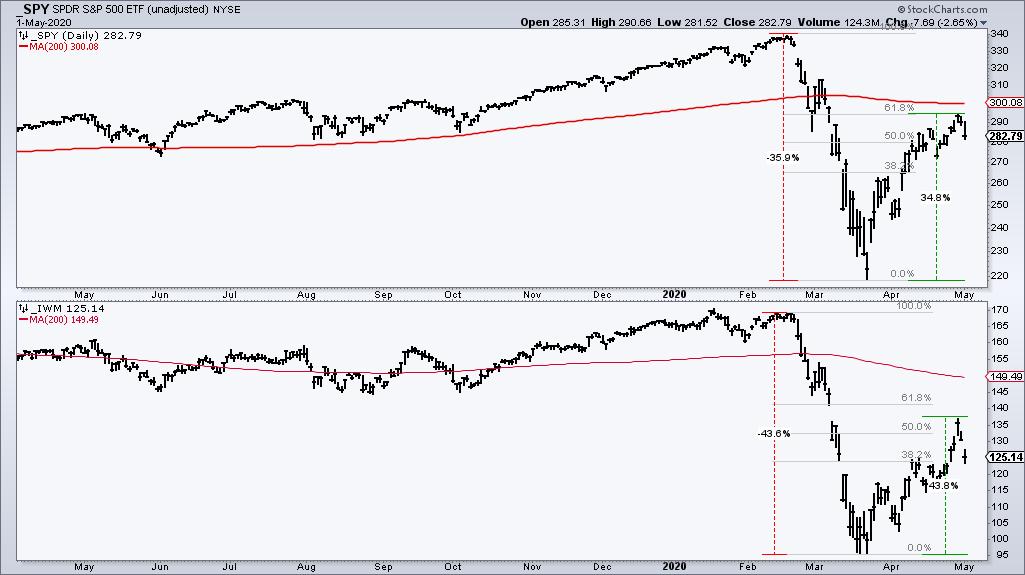

Despite a massive advance the last six weeks, the bulk of the evidence indicates that we are still in a bear market environment. The advance off the March low, while impressive on its own, still pales in comparison to the prior decline. The S&P 500 SPDR retraced around 61.8% of this decline and the Russell 2000 ETF retraced just over 50%. Such retracements are still normal for counter-trend bounces.

Consider the following. SPY, the S&P 500 EW ETF, the S&P MidCap 400 SPDR, the S&P SmallCap 600 SPDR and the Russell 2000 ETF are all below their falling 200-day SMAs. Nine of the eleven sector SPDRs are also below their 200-day SMAs. The Nasdaq 100 ETF, Technology SPDR and Healthcare SPDR are above their 200-day SMAs and leading, but they cannot do it alone. Moreover, not one index or sector recorded a 52-week high this month.

Overall, most bounces retraced a normal amount, most equity-related ETFs are still below their falling 200-day SMAs and not one index or sector ETF hit a new high. This is not the stuff of bull markets. This weekend at TrendInvestorPro.com, I covered the bear market bounces in 1981, 2001-2002 and 2008 in a video. What can we learn from these bounces and apply to the current bounce? Subscribe today for immediate access.

Click here to take your analysis to the next level!

---------------------------

Choose a Strategy, Develop a Plan and Follow a Process

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Author, Define the Trend and Trade the Trend

Want to stay up to date with Arthur's latest market insights?

– Follow @ArthurHill on Twitter