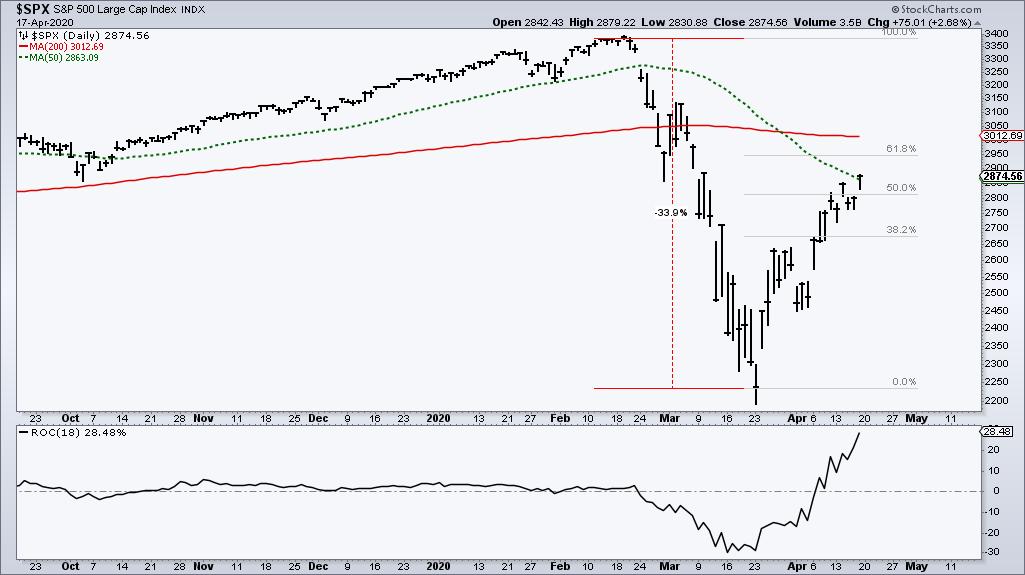

With a surge over the last 18 days, the S&P 500 reclaimed the 50-day moving average for the first time since February 21st. The move is truly remarkable, but the index remains well below the falling 200-day SMA. Moreover, a 28.5% surge in 18 days recovered just over half of the 33.9% decline. This advance is truly impressive when viewed on its own, but it still pales in comparison to the prior breakdown.

There are clearly some strong parts in the market, but there is also some serious weakness in key groups. The image below shows some 20 ETFs sorted by year-to-date performance. Six are now positive year-to-date, but only one is trading at a new high. The Biotech ETF (IBB) is the undisputed leader with a new high this week.

Elsewhere we can see strength in the Technology sector with the Nasdaq 100 ETF (QQQ), Technology SPDR (XLK), Software ETF (IGV), Cloud Computing ETF (SKYY) and Internet ETF (FDN) turning positive year to date. Despite strength in the technology sector, the Finance SPDR (XLF) and Industrials SPDR (XLI) are still down over 20% this year. Within the Finance sector, the Bank SPDR (KBE) and Regional Bank ETF (KRE) are still down over 40%.

While the surge in the S&P 500 is impressive, several key parts of the market are not keeping pace and remain in bear market mode. Technology and Healthcare can keep the market afloat, but participation from these other groups is needed to break the bear's back.

Interested in breadth charts and a focused ETF ChartList? Subscribe to TrendInvestorPro.com to get the Essential Breadth Indicator ChartList (100+ charts) and Master ETF ChartList (200 charts). The Index and Sector Breadth Models will also be updated this weekend with a video presentation.

Click here to take your analysis to the next level!

-----------------------------------

Choose a Strategy, Develop a Plan and Follow a Process

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Author, Define the Trend and Trade the Trend

Want to stay up to date with Arthur's latest market insights?

– Follow @ArthurHill on Twitter