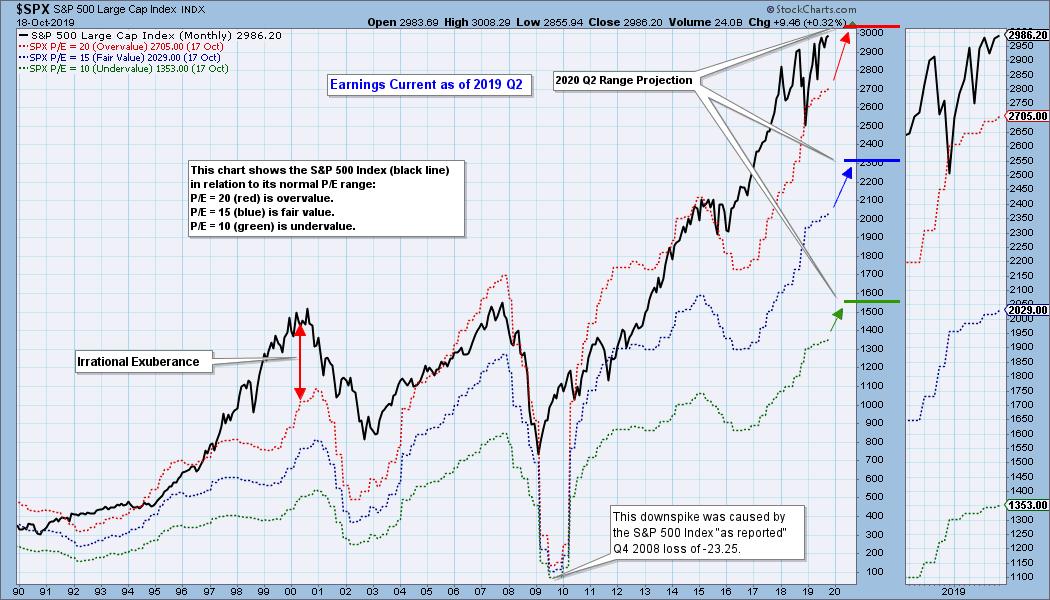

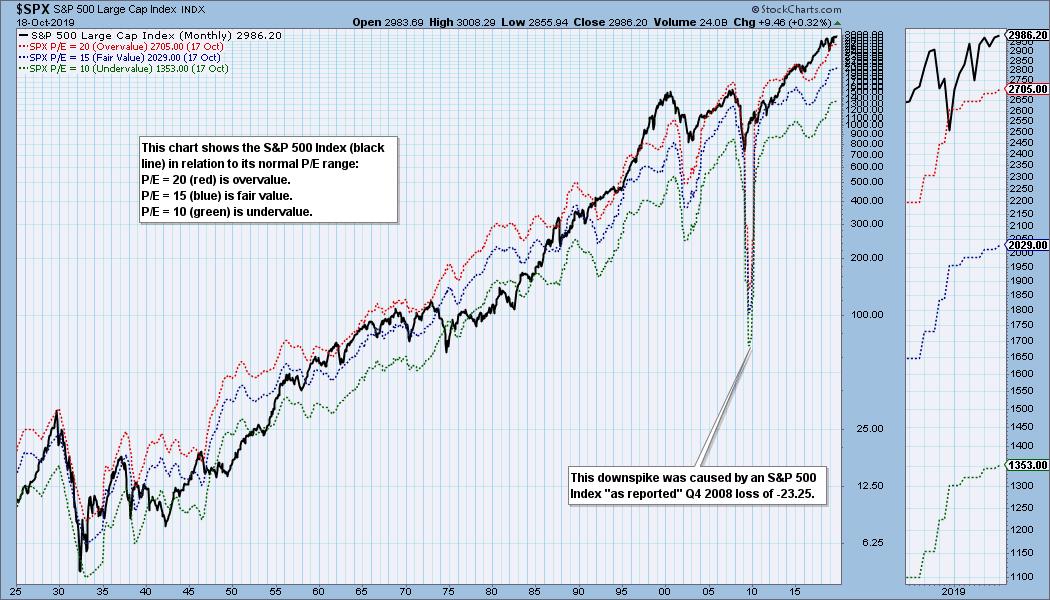

The S&P 500 earnings for 2019 Q2 were finalized a few weeks ago. The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line) or an undervalued P/E of 10 (green line). There are three hash marks on the right side of the chart, which show where the range markers are projected be at the end of 2020 Q2. Since 2016, price has been well above the traditional value range, with the exception of the late 2018 price decline (which lowered the P/E to 19). Based upon the future earnings hash marks on the right, the S&P 500 is within the normal range, but is still overvalued.

Historically, price has usually stayed below the top of the value range (red line); however, since about 1998, it has not been uncommon for price to exceed normal overvalue levels. The market hasn't been undervalued since 1984.

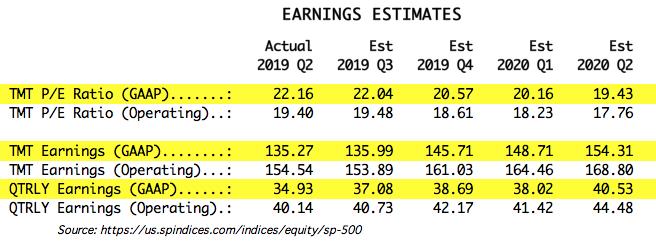

I use GAAP earnings (Generally Accepted Accounting Principals) as the reference for this article. Operating Earnings is the favorite of most of Wall Street, as it omits essential elements of real accounting to make the numbers look better. For me, a former accountant, using operating earnings is a form of cognitive dissonance.

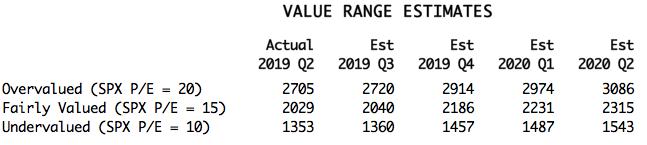

The table below shows how earnings are expected to improve going forward, but the drop in P/E shown is only possible if price doesn't rise significantly. In the best case shown (2020 Q2), the market will be slightly lower than the top of the normal value range, but this depends upon price being about the same level as it is now. Not likely.

The following table shows where the colored bands will be based upon forward earnings.

CONCLUSION: Historically, overvalued conditions leave the market vulnerable for a large correction or bear market, but P/E ratios are not a precise timing tool, just a way to see if fundamentals are favorable or not. These earnings charts are intended to provide a historical context for current earnings and to demonstrate that overvaluation is not your friend.

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)